Answered step by step

Verified Expert Solution

Question

1 Approved Answer

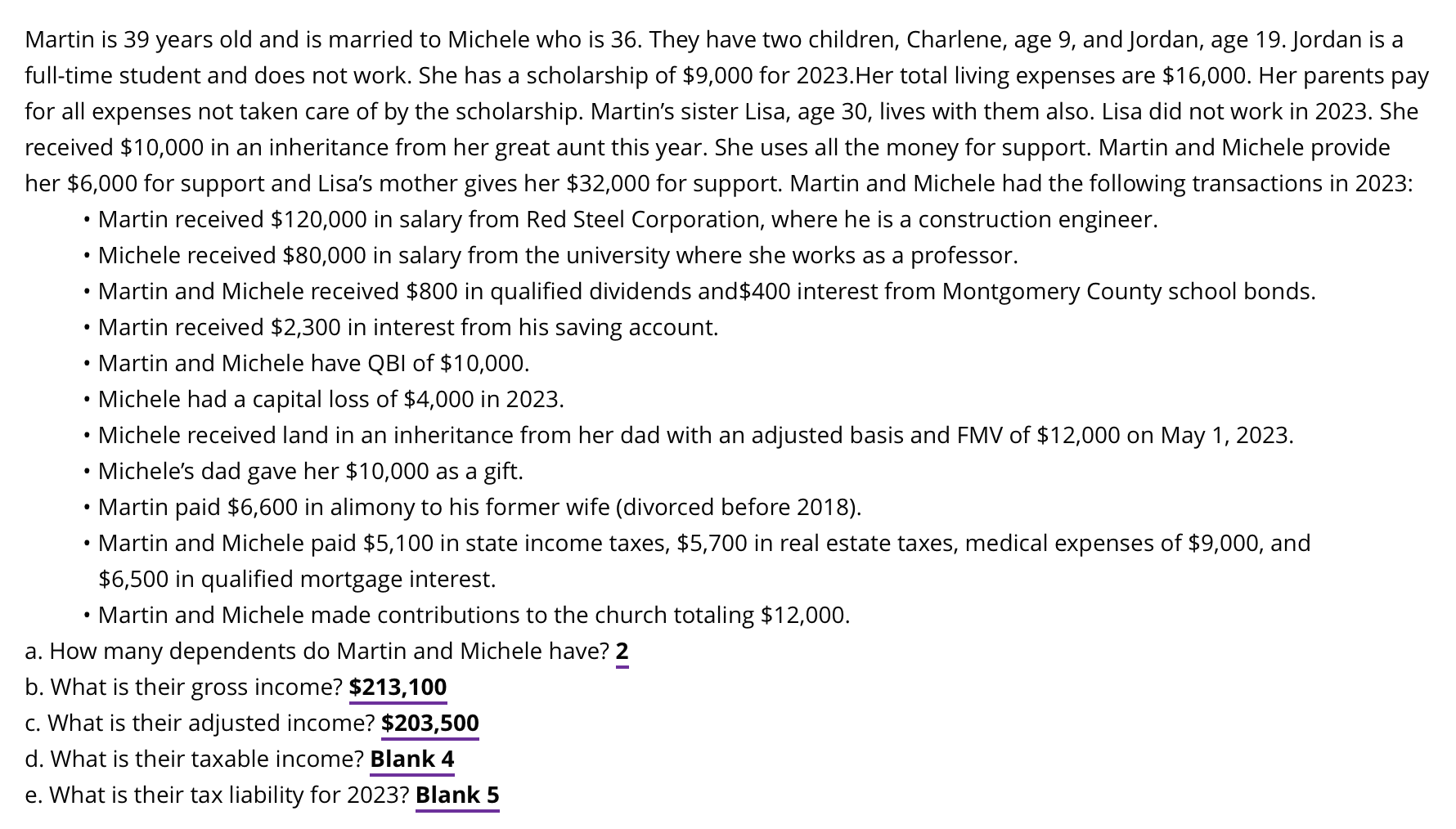

Martin is 3 9 years old and is married to Michele who is 3 6 . They have two children, Charlene, age 9 , and

Martin is years old and is married to Michele who is They have two children, Charlene, age and Jordan, age Jordan is a

fulltime student and does not work. She has a scholarship of $ for Her total living expenses are $ Her parents pay

for all expenses not taken care of by the scholarship. Martin's sister Lisa, age lives with them also. Lisa did not work in She

received $ in an inheritance from her great aunt this year. She uses all the money for support. Martin and Michele provide

her $ for support and Lisa's mother gives her $ for support. Martin and Michele had the following transactions in :

Martin received $ in salary from Red Steel Corporation, where he is a construction engineer.

Michele received $ in salary from the university where she works as a professor.

Martin and Michele received $ in qualified dividends and $ interest from Montgomery County school bonds.

Martin received $ in interest from his saving account.

Martin and Michele have QBI of $

Michele had a capital loss of $ in

Michele received land in an inheritance from her dad with an adjusted basis and FMV of $ on May

Michele's dad gave her $ as a gift.

Martin paid $ in alimony to his former wife divorced before

Martin and Michele paid $ in state income taxes, $ in real estate taxes, medical expenses of $ and

$ in qualified mortgage interest.

Martin and Michele made contributions to the church totaling $

a How many dependents do Martin and Michele have?

b What is their gross income? $

c What is their adjusted income? $

d What is their taxable income?

e What is their tax liability for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started