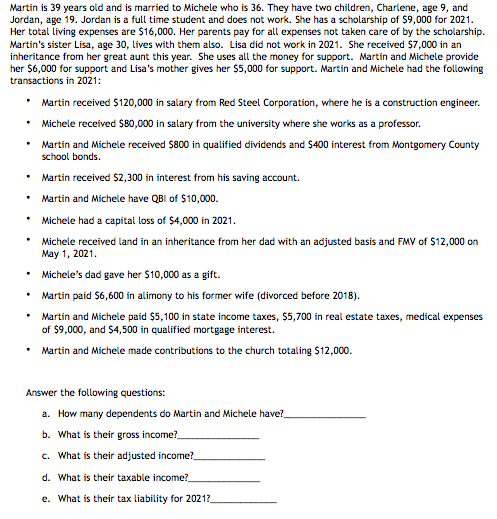

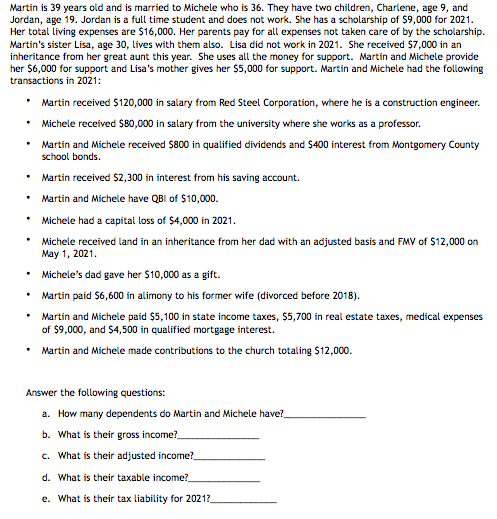

Martin is 39 years old and is married to Michele who is 36. They have two children, Charlene, age 9, and Jordan, age 19. Jordan is a full time student and does not work. She has a scholarship of $9,000 for 2021. Her total living expenses are $16,000. Her parents pay for all expenses not taken care of by the scholarship. Martin's sister Lisa, age 30, lives with them also. Lisa did not work in 2021. She received $7,000 in an inheritance from her great aunt this year. She uses all the money for support. Martin and Michele provide her $6,000 for support and Lisa's mother gives her $5,000 for support. Martin and Michele had the following transactions in 2021: Martin received $120,000 in salary from Red Steel Corporation, where he is a construction engineer. Michele received $80,000 in salary from the university where she works as a professor. Martin and Michele received $800 in qualified dividends and $400 interest from Montgomery County school bonds. Martin received $2,300 in interest from his saving account. Martin and Michele have QBI of $10,000. Michele had a capital loss of $4,000 in 2021. Michele received land in an inheritance from her dad with an adjusted basis and FMV of $12,000 on May 1, 2021. Michele's dad gave her $10,000 as a gift. Martin paid $6,600 in alimony to his former wife (divorced before 2018). Martin and Michele paid $5,100 in state income taxes, 55,700 in real estate taxes, medical expenses of $9,000, and $4,500 in qualified mortgage interest. Martin and Michele made contributions to the church totaling $12,000. Answer the following questions: a. How many dependents do Martin and Michele have? b. What is their gross income? c. What is their adjusted income? d. What is their taxable income? e. What is their tax liability for 20212 Martin is 39 years old and is married to Michele who is 36. They have two children, Charlene, age 9, and Jordan, age 19. Jordan is a full time student and does not work. She has a scholarship of $9,000 for 2021. Her total living expenses are $16,000. Her parents pay for all expenses not taken care of by the scholarship. Martin's sister Lisa, age 30, lives with them also. Lisa did not work in 2021. She received $7,000 in an inheritance from her great aunt this year. She uses all the money for support. Martin and Michele provide her $6,000 for support and Lisa's mother gives her $5,000 for support. Martin and Michele had the following transactions in 2021: Martin received $120,000 in salary from Red Steel Corporation, where he is a construction engineer. Michele received $80,000 in salary from the university where she works as a professor. Martin and Michele received $800 in qualified dividends and $400 interest from Montgomery County school bonds. Martin received $2,300 in interest from his saving account. Martin and Michele have QBI of $10,000. Michele had a capital loss of $4,000 in 2021. Michele received land in an inheritance from her dad with an adjusted basis and FMV of $12,000 on May 1, 2021. Michele's dad gave her $10,000 as a gift. Martin paid $6,600 in alimony to his former wife (divorced before 2018). Martin and Michele paid $5,100 in state income taxes, 55,700 in real estate taxes, medical expenses of $9,000, and $4,500 in qualified mortgage interest. Martin and Michele made contributions to the church totaling $12,000. Answer the following questions: a. How many dependents do Martin and Michele have? b. What is their gross income? c. What is their adjusted income? d. What is their taxable income? e. What is their tax liability for 20212