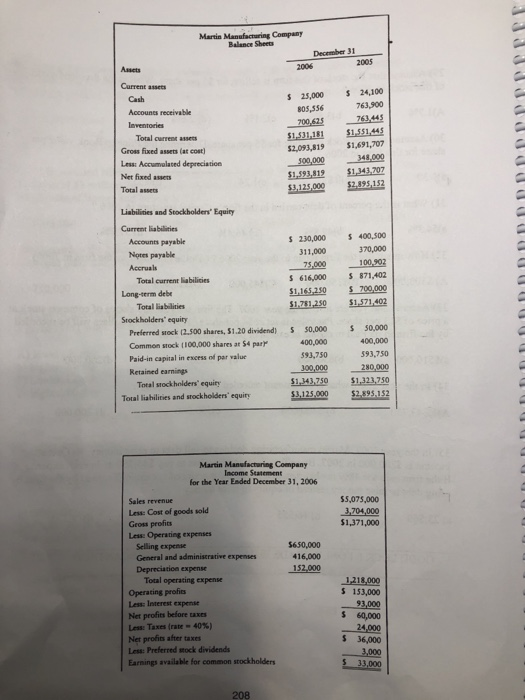

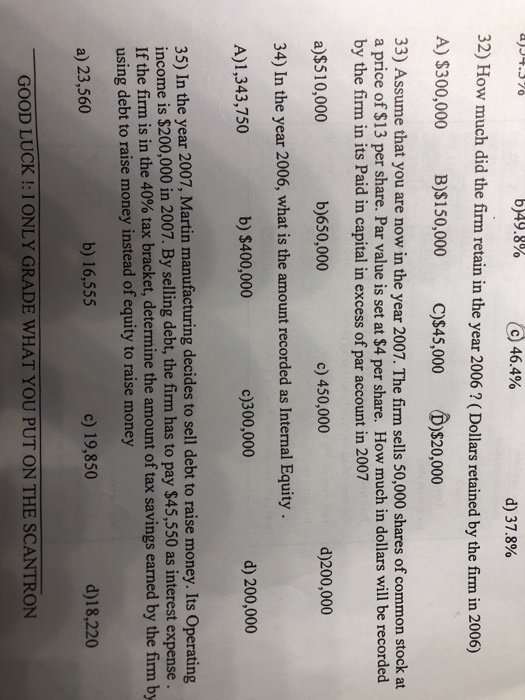

Martin Manufacturing Company Balance Sheets December 31 2005 Assets 2006 $ 24,100 763,900 761,445 Current assets Cash Accounts receivable Inventories Total current as Gross fixed assets (at cost) Less: Accumulated depreciation Net fixed asses Total sets $ 25,000 BOS,556 700,625 $1,531,181 $2,093,819 300.000 $1.592.819 53.125.000 $1,551,445 $1,691,707 348.000 $1,343,707 $2.195.152 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 230,000 Nors payable 311,000 Accruals 75,000 Total current liabilities $ 616,000 Long-term debe 51,165,250 Total liabilities 51.781,250 Stockholders' equity Preferred stock (2.500 shares, 51.20 dividend) 5 50,000 Common stock (100,000 shares at S4 pary 400,000 Paid-in capital in excess of par value 593.750 Retained earnings 300,000 Total stockholders' equiry $1,343,750 Total liabilities and stockholders' equiry $3,125.000 $ 400,500 370,000 100,902 S 871,402 $ 700,000 $1,571 402 $ 50,000 400,000 593,750 280,000 $1,123.750 $2.895,152 Martin Manufacturing Company Income Statement for the Year Ended December 31, 2006 55,075,000 3,704,000 $1,371,000 $650,000 416,000 152.000 Sales revenue Lew Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Le Taxes (rate -40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 1,218,000 $ 153,000 93,000 $ 60,000 24,000 $ 36,000 3,000 5 33.000 208 a)14.370 b)49.8% 46.4% d) 37.8% 32) How much did the firm retain in the year 2006 ? ( Dollars retained by the firm in 2006) A) $300,000 B)$150,000 C)$45,000 $20,000 33) Assume that you are now in the year 2007. The firm sells 50,000 shares of common stock at a price of $13 per share. Par value is set at $4 per share. How much in dollars will be recorded by the firm in its Paid in capital in excess of par account in 2007 a)$510,000 b)650,000 c) 450,000 d)200,000 34) In the year 2006, what is the amount recorded as Internal Equity. A)1,343,750 b) $400,000 c)300,000 d) 200,000 35) In the year 2007, Martin manufacturing decides to sell debt to raise money. Its Operating income is $200,000 in 2007. By selling debt, the firm has to pay $45,550 as interest expense. If the firm is in the 40% tax bracket, determine the amount of tax savings earned by the firm by using debt to raise money instead of equity to raise money a) 23,560 b) 16,555 c) 19,850 d)18,220 GOOD LUCK !: I ONLY GRADE WHAT YOU PUT ON THE SCANTRON