Martin Office Supplies paid a $2 dividend last year. The dividend is expected to grow at a constant rate of 5 percent over the

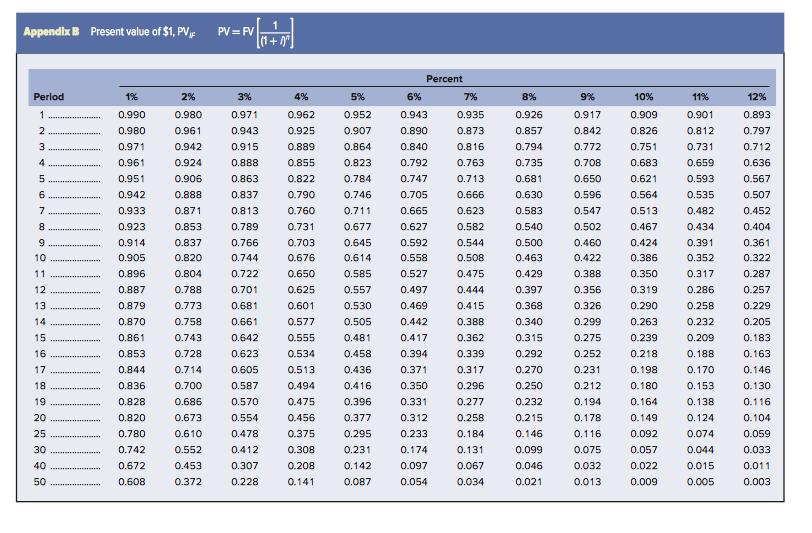

Martin Office Supplies paid a $2 dividend last year. The dividend is expected to grow at a constant rate of 5 percent over the next four years. The required rate of return is 12 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Answer is complete and correct. Anticipated Value D1 2.10 D2 $ 2.21 D3 $ 2.32 D4 2.43 e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Current value f. Use the formula given below to show that it will provide approximately the same answer as part e. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) PO D1 Ke - g Current value g. If current EPS were equal to $4.65 and the P/E ratio is 11% higher than the industry average of 6, what would the stock price be? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock price h. By what dollar amount is the stock price in part g different from the stock price in part f? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Amount i. With regard to the stock price in part f, indicate which direction it would move if: (1) D1 increases (2) Ke increases (3) g increases Appendix B Present value of $1, PV, 1 PV=FV [(1+1"] Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183. 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003

Step by Step Solution

There are 3 Steps involved in it

Step: 1

e Compute the current value of the stock To compute the current value of the stock we need to calculate the present value of the anticipated dividends ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards