Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charan died on 31 December 2021. At the date of his death, he owned the following assets: 1. A main residence valued at 425,000

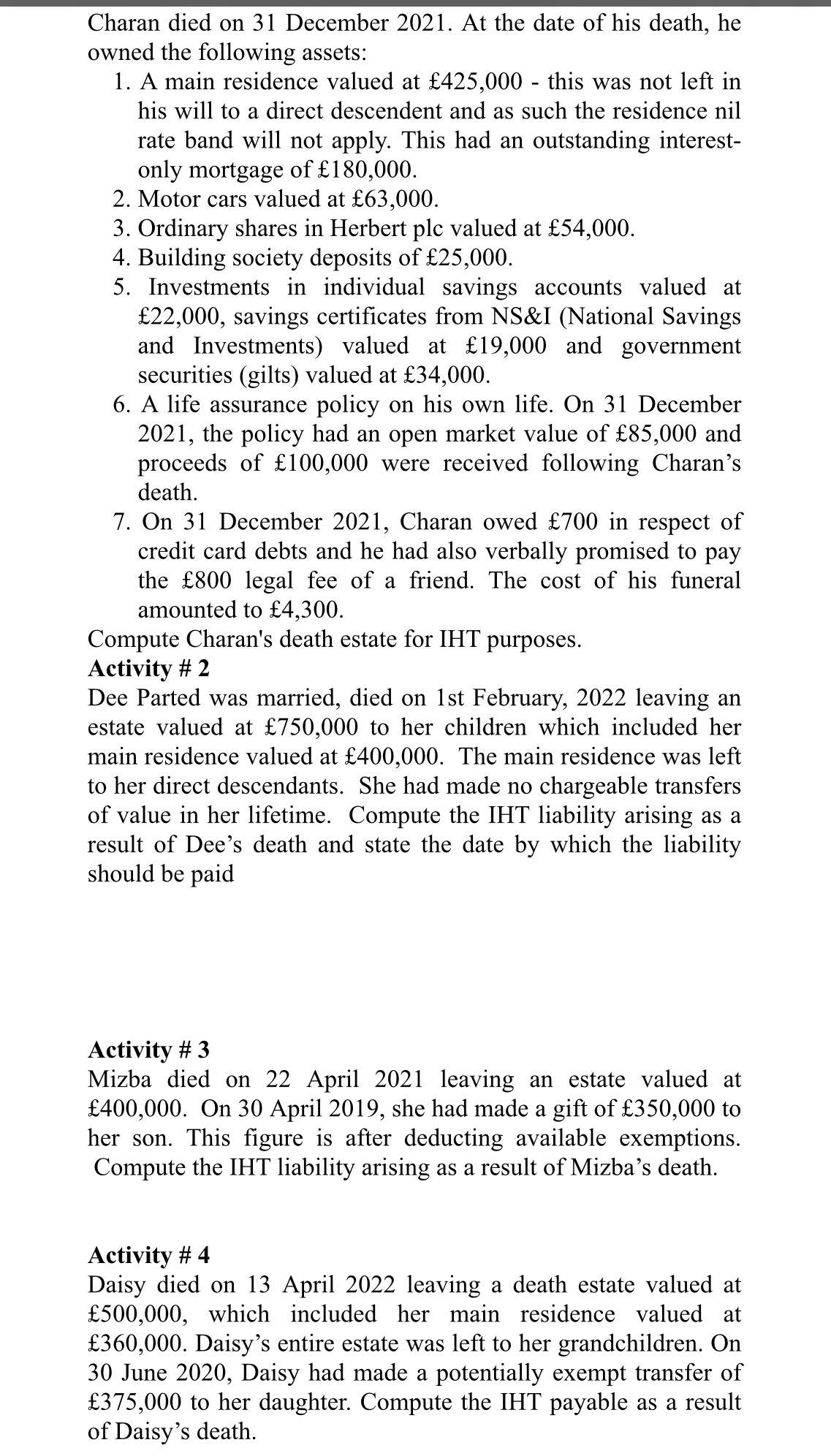

Charan died on 31 December 2021. At the date of his death, he owned the following assets: 1. A main residence valued at 425,000 - this was not left in his will to a direct descendent and as such the residence nil rate band will not apply. This had an outstanding interest- only mortgage of 180,000. 2. Motor cars valued at 63,000. 3. Ordinary shares in Herbert plc valued at 54,000. 4. Building society deposits of 25,000. 5. Investments in individual savings accounts valued at 22,000, savings certificates from NS&I (National Savings and Investments) valued at 19,000 and government securities (gilts) valued at 34,000. 6. A life assurance policy on his own life. On 31 December 2021, the policy had an open market value of 85,000 and proceeds of 100,000 were received following Charan's death. 7. On 31 December 2021, Charan owed 700 in respect of credit card debts and he had also verbally promised to pay the 800 legal fee of a friend. The cost of his funeral amounted to 4,300. Compute Charan's death estate for IHT purposes. Activity # 2 Dee Parted was married, died on 1st February, 2022 leaving an estate valued at 750,000 to her children which included her main residence valued at 400,000. The main residence was left to her direct descendants. She had made no chargeable transfers of value in her lifetime. Compute the IHT liability arising as a result of Dee's death and state the date by which the liability should be paid Activity # 3 Mizba died on 22 April 2021 leaving an estate valued at 400,000. On 30 April 2019, she had made a gift of 350,000 to her son. This figure is after deducting available exemptions. Compute the IHT liability arising as a result of Mizba's death. Activity # 4 Daisy died on 13 April 2022 leaving a death estate valued at 500,000, which included her main residence valued at 360,000. Daisy's entire estate was left to her grandchildren. On 30 June 2020, Daisy had made a potentially exempt transfer of 375,000 to her daughter. Compute the IHT payable as a result of Daisy's death.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Activity 1 Charans death estate consists of the following assets Main residence valued at 425000 with an outstanding interestonly mortgage of 180000 Motor cars valued at 63000 Ordinary shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started