Answered step by step

Verified Expert Solution

Question

1 Approved Answer

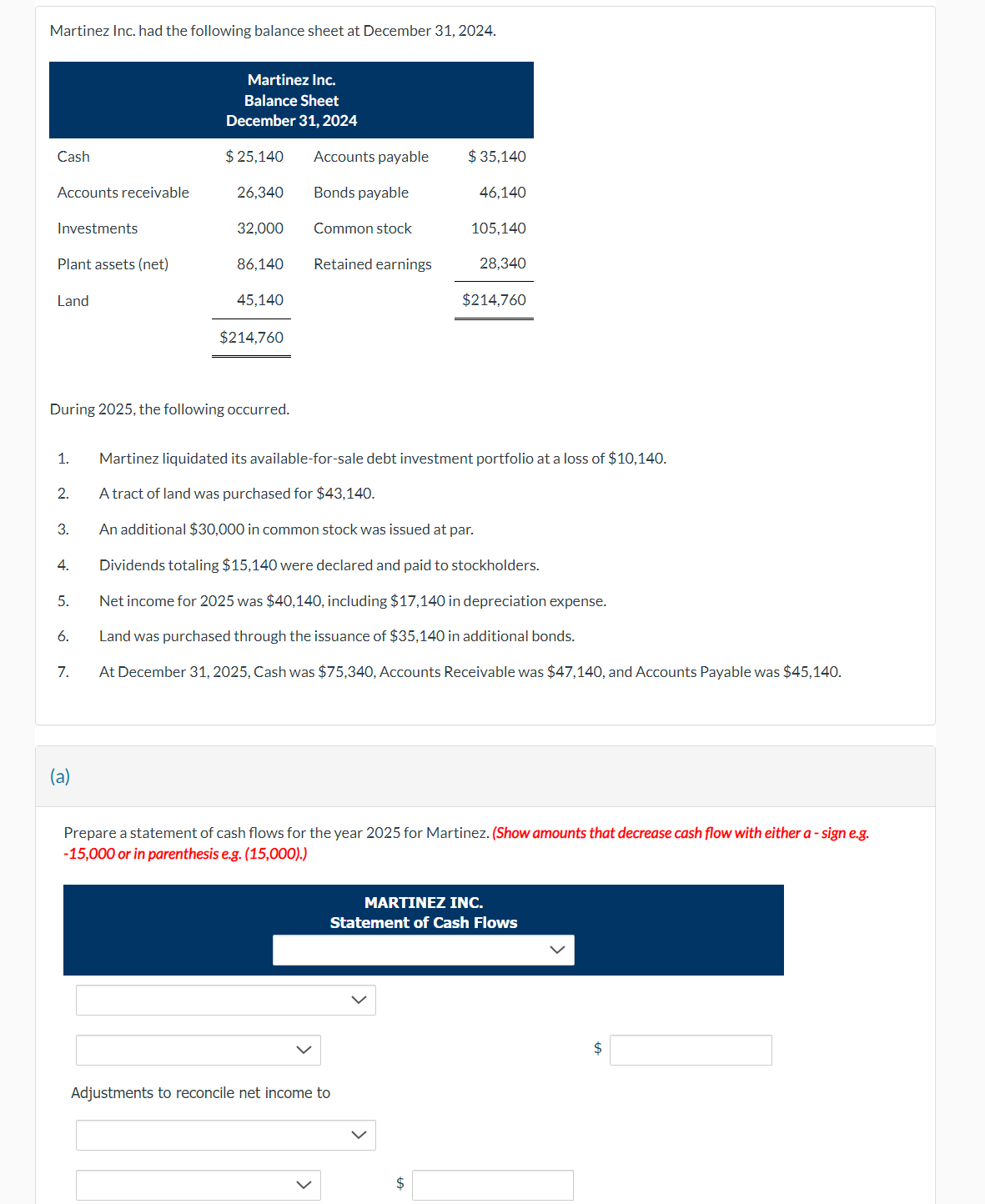

Martinez Inc. had the following balance sheet at December 3 1 , 2 0 2 4 . During 2 0 2 5 , the following

Martinez Inc. had the following balance sheet at December

During the following occurred.

Martinez liquidated its availableforsale debt investment portfolio at a loss of $

A tract of land was purchased for $

An additional $ in common stock was issued at par.

Dividends totaling $ were declared and paid to stockholders.

Net income for was $ including $ in depreciation expense.

Land was purchased through the issuance of $ in additional bonds.

At December Cash was $ Accounts Receivable was $ and Accounts Payable was $

a

Prepare a statement of cash flows for the year for Martinez. Show amounts that decrease cash flow with either sign eg

or in parenthesis eg

MARTINEZ INC.

Statement of Cash Flows

Adjustments to reconcile net income to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started