Question

Martinez is looking at the positions of the four stocks (a, b, c, and d in blue) that he is considering on the Security Market

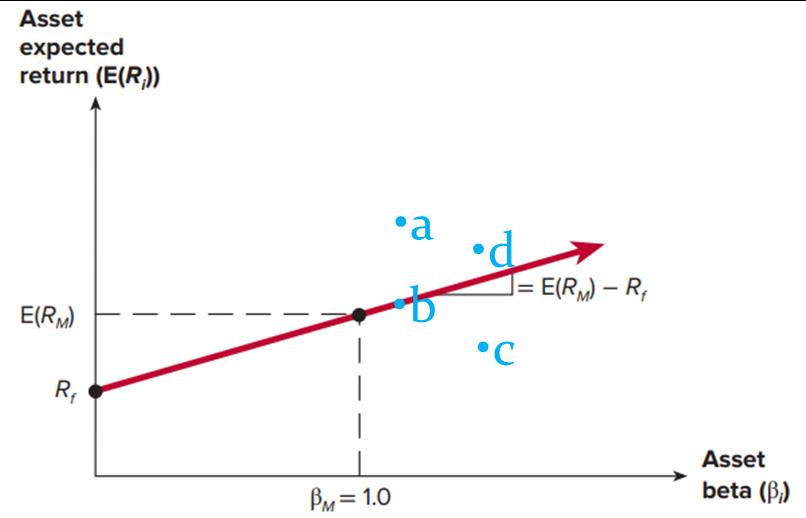

Martinez is looking at the positions of the four stocks (a, b, c, and d in blue) that he is considering on the Security Market Line (SML) as below. When he is a risk-averse and highly rational investor, which stock is he supposed to purchase among the four stocks?

Asset expected return (E(R;)) E(RM) R PM=1.0 a d C E(RM) - R Asset beta (B)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Martinez as a riskaverse and highly rational investor should ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of quality control and improvement

Authors: amitava mitra

3rd edition

470226536, 978-1-11849164, 978-0470226537

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App