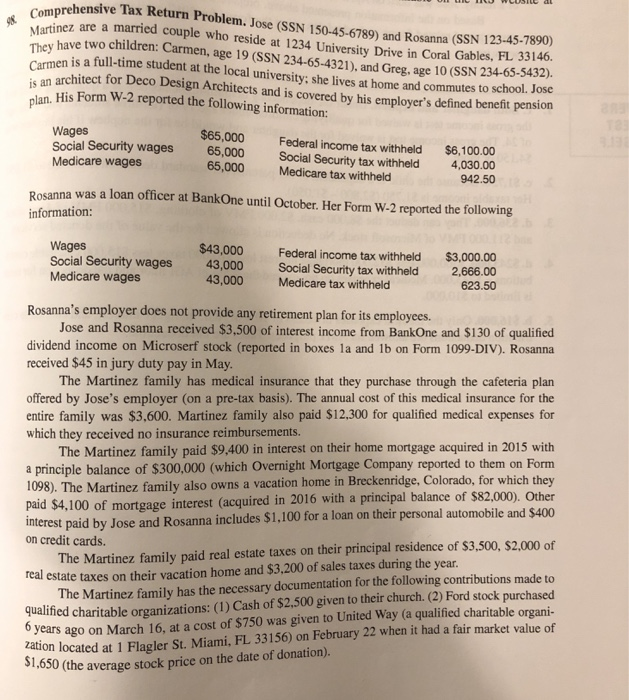

Martinez re a married couple who reside at 1234 University Drive in Coral Gables. mprehensive Tax Return Problem. Jose (SSN 150-45-6789) and Rosanna (SSN 123.45-7 have two children: Carmen, age 19 (SSN 234-65-4321), and Greg, age 10 (SSN 234-65-5432) SSN 123-45-7890) They en is a full-time student at the local university: she lives at home and commutes to sc Carm architect for Deco Design Architects and is covered by his em s an His Form W-2 reported the following information: hool. Jose ployer's defined benefit pension Wages Federal income tax withheld Social Security tax withheld Social Security wages65,000 $6,100.00 4,030.00 942.50 Medicare wages 65,000Medicare tax withheld Rosanna was a loan officer at BankOne until October. Her Form W-2 reported the following information Wages $43,000 43,000 Federal income tax withheld Social Security tax withheld $3,000.00 2,666.00 623.50 Social Security wages Medicare wages 43,000 Medicare tax withheld Rosanna's employer does not provide any retirement plan fo r its employces. Jose and Rosanna received $3,500 of interest income from BankOne and $130 of qualified dividend income on Microserf stock (reported in boxes la and 1b on Form 1099-DIV). Rosanna received $45 in jury duty pay in May The Martinez family has medical insurance that they purchase through the cafeteria plan offered by Jose's employer (on a pre-tax basis). The annual cost of this medical insurance for the entire family was $3,600. Martinez family also paid $12,300 for qualified medical expenses for which they received no insurance reimbursement The Martinez family paid $9,400 in interest on their home mortgage acquired in 2015 with a principle balance of $300,000 (which Overnight Mortgage Company reported to them on Form 1098). The Martinez family also owns paid $4,100 of mortgage interest (acquired in 2016 with a principal balance of $82,000), Other interest paid by Jose and Rosanna includes $1,100 for a loan on their personal automobile and $400 a vacation home in Breckenridge, Colorado, for which they on credit cards. The Martinez family paid real estate taxes on their principal residence of $3,500, s2,000 of real estate taxes on their vacation home and $3,200 of sales taxes during the year qualified charitable organizations: (1) Cash of $2.500 given to their church. (2) Ford stock purchased 6 years ago on March 16, at a cost of $750 was given to United Way (a qualified charitable organi- zation located at 1 Flagler St. Miami, FL 33156) on February 22 when it had a fair market value of .650 (the average stock price on the date of donation The Martinez family has the necessary documentation for the following contributions made to Martinez re a married couple who reside at 1234 University Drive in Coral Gables. mprehensive Tax Return Problem. Jose (SSN 150-45-6789) and Rosanna (SSN 123.45-7 have two children: Carmen, age 19 (SSN 234-65-4321), and Greg, age 10 (SSN 234-65-5432) SSN 123-45-7890) They en is a full-time student at the local university: she lives at home and commutes to sc Carm architect for Deco Design Architects and is covered by his em s an His Form W-2 reported the following information: hool. Jose ployer's defined benefit pension Wages Federal income tax withheld Social Security tax withheld Social Security wages65,000 $6,100.00 4,030.00 942.50 Medicare wages 65,000Medicare tax withheld Rosanna was a loan officer at BankOne until October. Her Form W-2 reported the following information Wages $43,000 43,000 Federal income tax withheld Social Security tax withheld $3,000.00 2,666.00 623.50 Social Security wages Medicare wages 43,000 Medicare tax withheld Rosanna's employer does not provide any retirement plan fo r its employces. Jose and Rosanna received $3,500 of interest income from BankOne and $130 of qualified dividend income on Microserf stock (reported in boxes la and 1b on Form 1099-DIV). Rosanna received $45 in jury duty pay in May The Martinez family has medical insurance that they purchase through the cafeteria plan offered by Jose's employer (on a pre-tax basis). The annual cost of this medical insurance for the entire family was $3,600. Martinez family also paid $12,300 for qualified medical expenses for which they received no insurance reimbursement The Martinez family paid $9,400 in interest on their home mortgage acquired in 2015 with a principle balance of $300,000 (which Overnight Mortgage Company reported to them on Form 1098). The Martinez family also owns paid $4,100 of mortgage interest (acquired in 2016 with a principal balance of $82,000), Other interest paid by Jose and Rosanna includes $1,100 for a loan on their personal automobile and $400 a vacation home in Breckenridge, Colorado, for which they on credit cards. The Martinez family paid real estate taxes on their principal residence of $3,500, s2,000 of real estate taxes on their vacation home and $3,200 of sales taxes during the year qualified charitable organizations: (1) Cash of $2.500 given to their church. (2) Ford stock purchased 6 years ago on March 16, at a cost of $750 was given to United Way (a qualified charitable organi- zation located at 1 Flagler St. Miami, FL 33156) on February 22 when it had a fair market value of .650 (the average stock price on the date of donation The Martinez family has the necessary documentation for the following contributions made to