Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marvel Media, LLC, has three members: WLKT Partners, Madison Sanders, and Observer Newspaper, LLC. On January 1, 2012, the three members had equity of

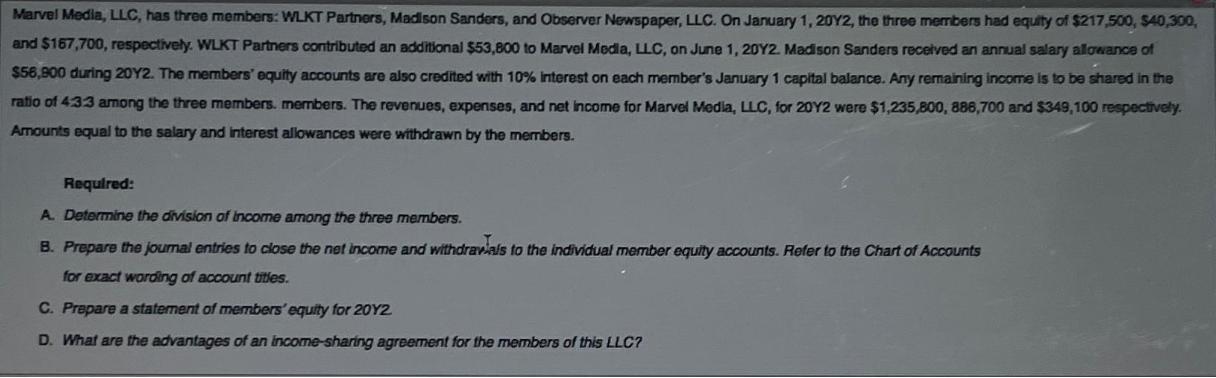

Marvel Media, LLC, has three members: WLKT Partners, Madison Sanders, and Observer Newspaper, LLC. On January 1, 2012, the three members had equity of $217,500, $40,300, and $167,700, respectively. WLKT Partners contributed an additional $53,800 to Marvel Media, LLC, on June 1, 20Y2. Madison Sanders received an annual salary allowance of $56,900 during 2012. The members' equity accounts are also credited with 10% interest on each member's January 1 capital balance. Any remaining income is to be shared in the ratio of 4:33 among the three members. members. The revenues, expenses, and net income for Marvel Media, LLC, for 20Y2 were $1,235,800, 886,700 and $349,100 respectively. Amounts equal to the salary and interest allowances were withdrawn by the members. Required: A. Determine the division of income among the three members. B. Prepare the journal entries to close the net income and withdrawals to the individual member equity accounts. Refer to the Chart of Accounts for exact wording of account titles. C. Prepare a statement of members' equity for 2012 D. What are the advantages of an income-sharing agreement for the members of this LLC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Division of Income among the three members To determine the division of income among the three members we need to calculate the income allocated to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started