Question

Marvin Flatbush began his consulting business as a proprietary company on 1 July 2017. He has provided you with the following information for the first

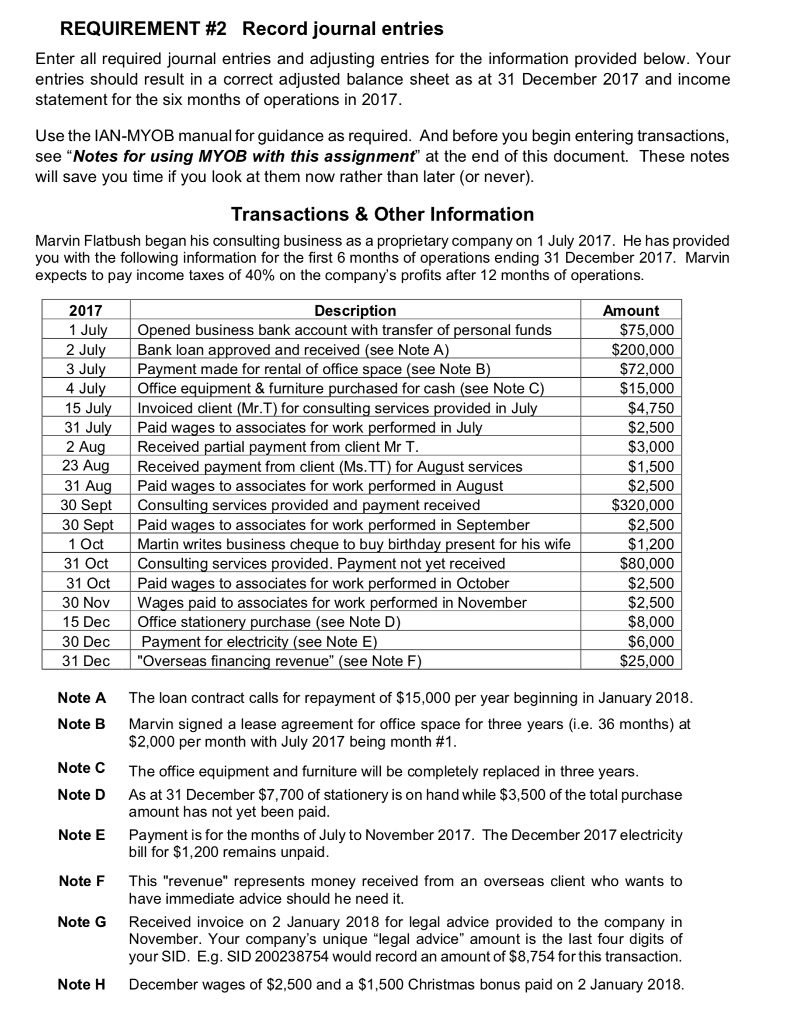

Marvin Flatbush began his consulting business as a proprietary company on 1 July 2017. He has provided you with the following information for the first 6 months of operations ending 31 December 2017. Marvin expects to pay income taxes of 40% on the companys profits after 12 months of operations.

Marvin Flatbush began his consulting business as a proprietary company on 1 July 2017. He has provided you with the following information for the first 6 months of operations ending 31 December 2017. Marvin expects to pay income taxes of 40% on the companys profits after 12 months of operations.

Required

Balance sheet as at 31 December 2017 (MYOB Standard Balance Sheet)

Income statement for the 6 months ended 31 Dec 2017 (MYOB Profit & Loss [Accrual])

Statement of cash flow for the 6 months ended 31 Dec 2017 (see Ch.10 MYOB manual)

General journal showing all journal entries (see Transaction Journals)

General ledger for the 6 months ended 31 Dec 2017 (MYOB General Ledger [Detail])

REQUIREMENT #2 Record Journal entries Enter all required journal entries and adjusting entries for the information provided below. Your entries should result in a correct adjusted balance sheet as at 31 December 2017 and income statement for the six months of operations in 2017 Use the IAN-MYOB manual for guidance as required. And before you begin entering transactions see "Notes for using MYOB with this assignmen" at the end of this document. These note:s will save you time if you look at them now rather than later (or never) Transactions & Other Information Marvin Flatbush began his consulting business as a proprietary company on 1 July 2017. He has provided you with the following information for the first 6 months of operations ending 31 December 2017. Marvin expects to pay income taxes of 40% on the company's profits after 12 months of operations. 2017 1 Jul 2 Jul 3 Jul 4 Jul 15 Jul 31 Jul 2 Au 23 Au 31 Au 30 Sept Consulting services provided and payment received 30 Se Description Amount Opened business bank account with transfer of personal funds Bank loan approved and received (see Note A Payment made for rental of office space (see Note B Office equipment & furniture purchased for cash (see Note C Invoiced client (Mr.T) for consulting services provided in Jul Paid wages to associates for work performed in Ju Received partial payment from client Mr T Received payment from client (Ms.TT) for August services Paid wages to associates for work performed in August S75,000 200,00 $72,000 $15,000 $4,750 $2,500 $3,000 $1,500 $2,500 $320,000 2,500 $1,200 $80,000 $2,500 $2,500 $8,000 6,000 25.000 Paid wages to associates for work performed in September 1 Oct Martin writes business cheque to buy birthday present for his wife 31 Oct Consulting services provided. Payment not vet received 31 Oct Paid wages to associates for work performed in October 30 NovWages paid to associates for work performed in November 15 Dec Office stationery purchase (see Note D 30 Dec Payment for electricity (see Note E 31 Dec "Overseas financing revenue" (see Note F Note A The loan contract calls for repayment of $15,000 per year beginning in January 2018 Note B Marvin signed a lease agreement for office space for three years (i.e. 36 months) at $2,000 per month with July 2017 being month #1 The office equipment and furniture will be completely replaced in three years As at 31 December $7,700 of stationery is on hand while $3,500 of the total purchase amount has not yet been paid Note C Note D Note E Payment is for the months of July to November 2017. The December 2017 electricity Note FThis "revenue" represents money received from an overseas client who wants to Note GReceived invoice on 2 January 2018 for legal advice provided to the company in bill for $1,200 remains unpaid have immediate advice should he need it. November. Your company's unique "legal advice" amount is the last four digits of your SID. E.g. SID 200238754 would record an amount of $8,754 for this transaction Note H December wages of $2,500 and a $1,500 Christmas bonus paid on 2 January 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started