Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marvin Moving has begun to prepare his 2020 tax return and has already computed the following amounts correctly: Income from Employment Income from Business

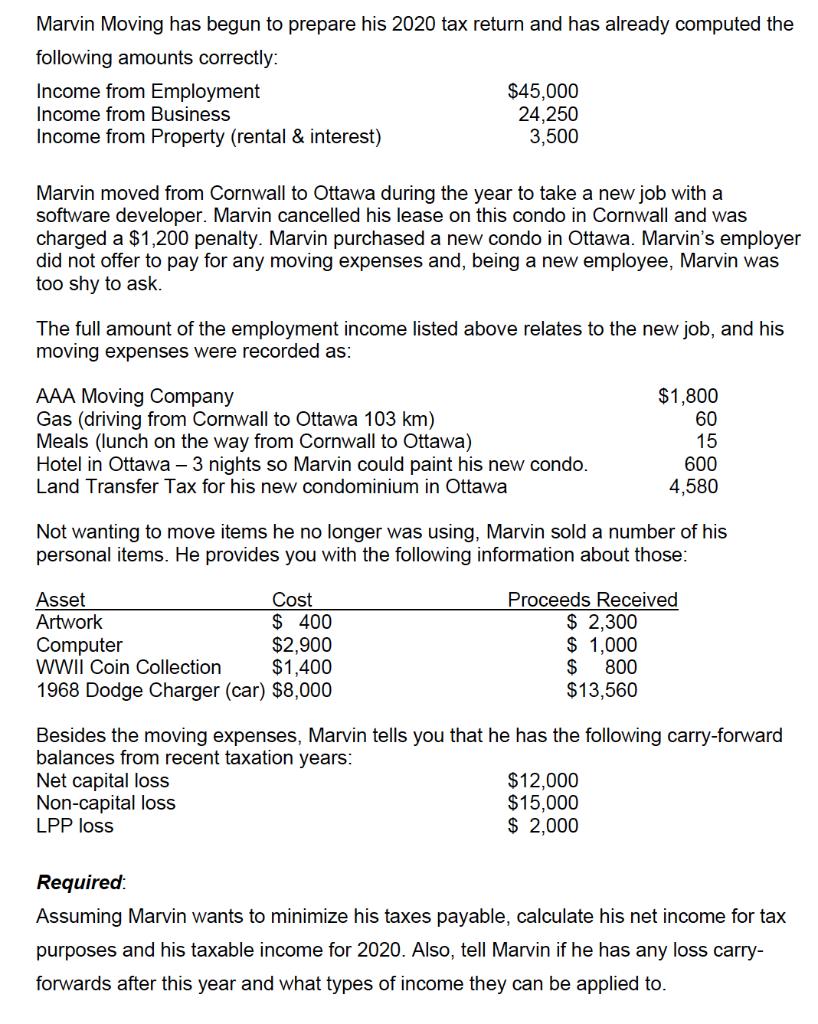

Marvin Moving has begun to prepare his 2020 tax return and has already computed the following amounts correctly: Income from Employment Income from Business Income from Property (rental & interest) Marvin moved from Cornwall to Ottawa during the year to take a new job with a software developer. Marvin cancelled his lease on this condo in Cornwall and was charged a $1,200 penalty. Marvin purchased a new condo in Ottawa. Marvin's employer did not offer to pay for any moving expenses and, being a new employee, Marvin was too shy to ask. The full amount of the employment income listed above relates to the new job, and his moving expenses were recorded as: AAA Moving Company Gas (driving from Cornwall to Ottawa 103 km) Meals (lunch on the way from Cornwall to Ottawa) $45,000 24,250 3,500 Hotel in Ottawa - 3 nights so Marvin could paint his new condo. Land Transfer Tax for his new condominium in Ottawa Cost $ 400 $2,900 WWII Coin Collection $1,400 1968 Dodge Charger (car) $8,000 Not wanting to move items he no longer was using, Marvin sold a number of his personal items. He provides you with the following information about those: Asset Artwork Computer Net capital loss Non-capital loss LPP loss $1,800 60 15 600 4,580 Proceeds Received $ 2,300 $1,000 $ 800 $13,560 Besides the moving expenses, Marvin tells you that he has the following carry-forward balances from recent taxation years: $12,000 $15,000 $ 2,000 Required: Assuming Marvin wants to minimize his taxes payable, calculate his net income for tax purposes and his taxable income for 2020. Also, tell Marvin if he has any loss carry- forwards after this year and what types of income they can be applied to.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Net income for tax purposes 45000 24250 3500 1800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started