Question

. Calculate the degree of operating leverage for the firm. (2 marks). Please round your final answer to 2 decimals. b. Calculate the degree of

. Calculate the degree of operating leverage for the firm. (2 marks). Please round your final answer to 2 decimals.

. Calculate the degree of operating leverage for the firm. (2 marks). Please round your final answer to 2 decimals.

b. Calculate the degree of financial leverage for the firm. (2 marks). Please round your final answer to 2 decimals.

c. Calculate the degree of combined leverage for the firm. (2 marks). Please round your final answer to 2 decimals.

d. If the company can increase their sales by 25%, what percentage increase in EBIT would you expect to observe? (2 marks)

e. If the company can increase their sales by 25%, what percentage increase in EPS would you expect to observe? (2 marks)

f. If the sales increase by 25%, what will the new EPS be? (2 marks)

g. If the company's sales decrease by 25%, what will the new EPS be? (2 marks)

h. If EBIT increases by 5%, what will the new EPS be? (2 marks)

i. If the company were to reduce its reliance on debt financing such that interest expense were

cut in half, how would this affect your answer to part (d)? (ii) part (e)? (4 marks)

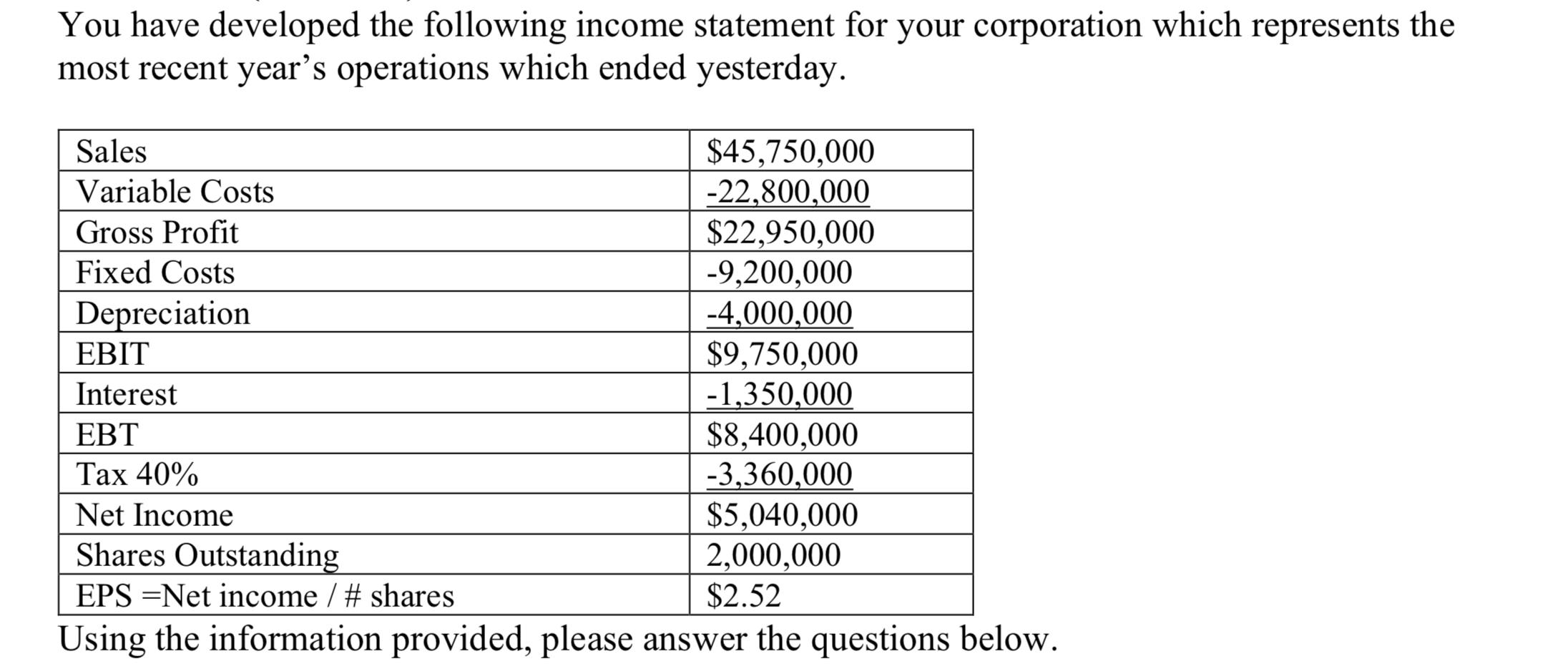

You have developed the following income statement for your corporation which represents the most recent year's operations which ended yesterday. Sales Variable Costs Gross Profit Fixed Costs Depreciation EBIT Interest EBT $45,750,000 -22,800,000 $22,950,000 -9,200,000 -4,000,000 $9,750,000 -1,350,000 $8,400,000 -3,360,000 $5,040,000 2,000,000 $2.52 Tax 40% Net Income Shares Outstanding EPS Net income / # shares Using the information provided, please answer the questions below.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

It seems like youre looking for a retirement plan for Mary and Stuart Lets break down their financia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started