Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MARY Coyle CFA has the following information on two stocks. return Forecast Standard beta deviation Stock X 14% 36% 0.8 Stock Y 17% 25%

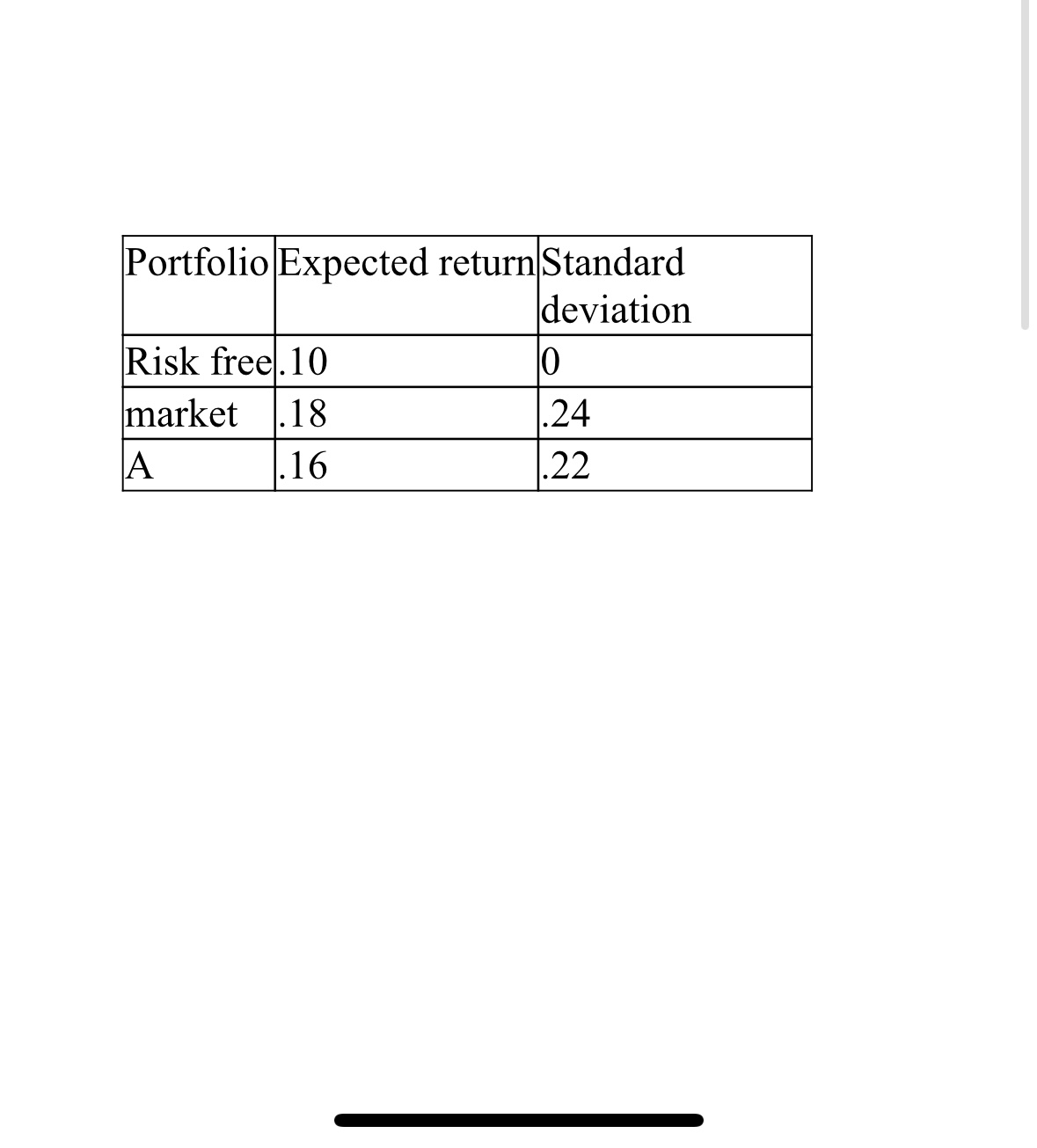

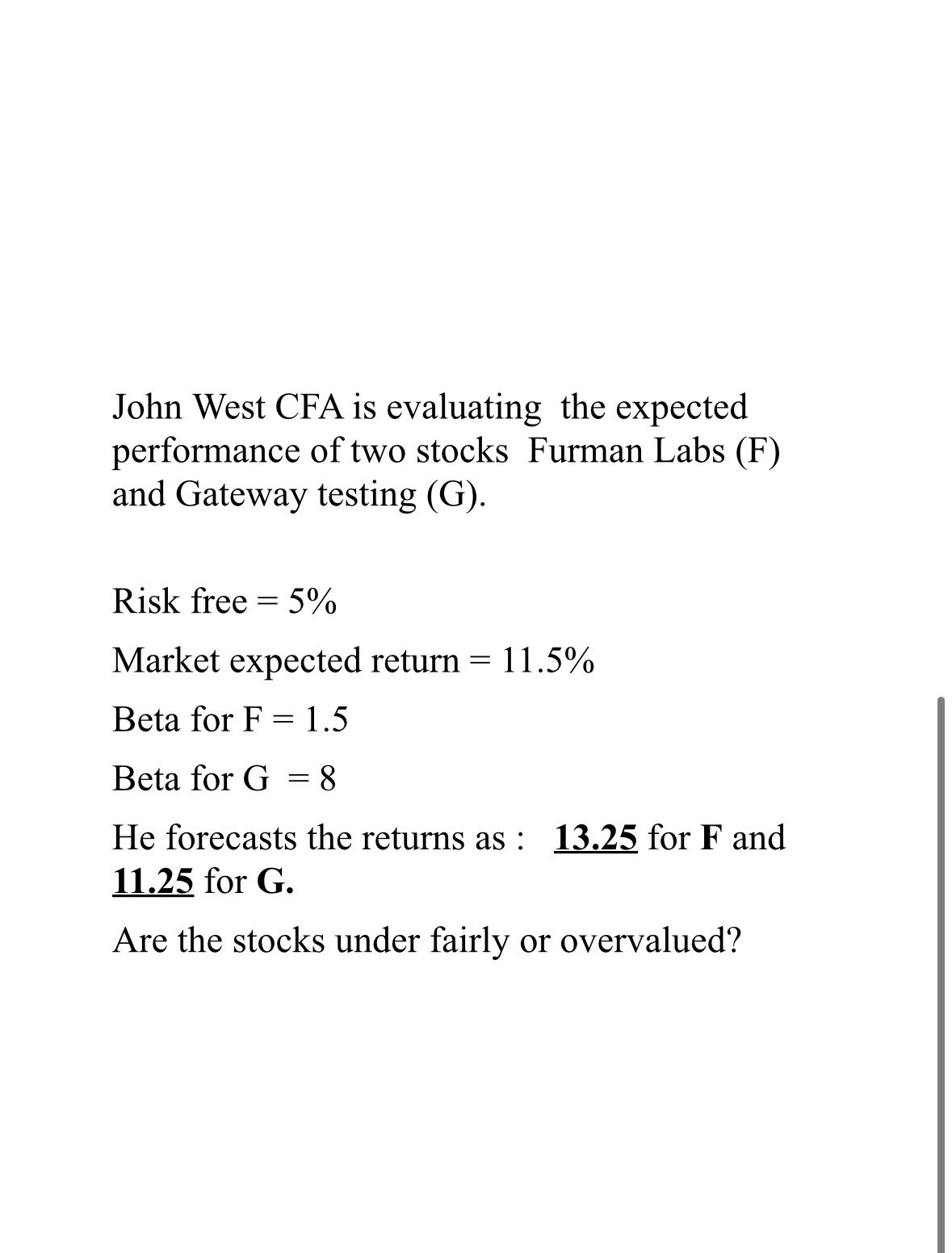

MARY Coyle CFA has the following information on two stocks. return Forecast Standard beta deviation Stock X 14% 36% 0.8 Stock Y 17% 25% 1.5 Market 14% 15% 1.0 Risk free 5% Calculate the alpha for each stock. Which stock is best for an investor who wants to add it to an already diversified equity portfolio? Why?? Portfolio Expected return Standard deviation Risk free.10 0 market 18 .24 A .16 .22 Are the following scenarios valid? Why or why not? Portfolio Expected Beta return A 20 1.4. B .25 1.2 Portfolio Expected return Standard Deviation A 30 35 B 40 25 Portfolio Expected return Beta Risk free.10 10 market A .18 .16 I 1.5 Portfolio Expected return Beta Risk free.10 market .18 A 16 10 .9 John West CFA is evaluating the expected performance of two stocks Furman Labs (F) and Gateway testing (G). Risk free 5% = Market expected return = 11.5% Beta for F = 1.5 Beta for G = 8 He forecasts the returns as: 13.25 for F and 11.25 for G. Are the stocks under fairly or overvalued?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started