Answered step by step

Verified Expert Solution

Question

1 Approved Answer

out of all of this what goes on the tax return and where does it go? Mary is a licensed attorney who works part time

out of all of this what goes on the tax return and where does it go?

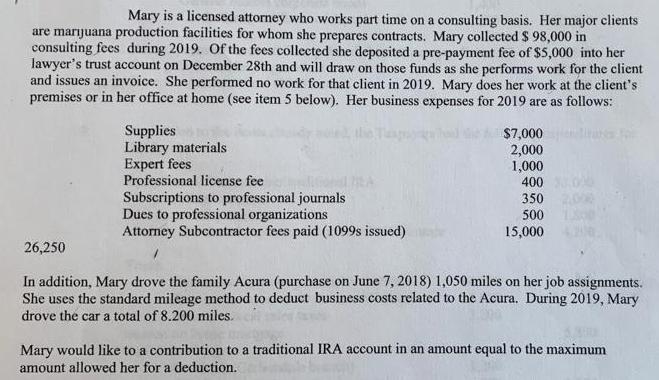

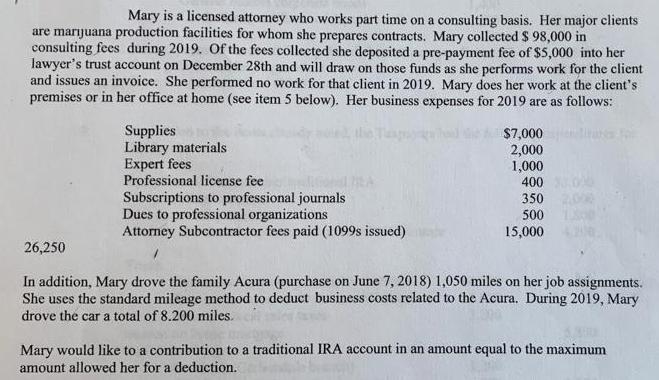

Mary is a licensed attorney who works part time on a consulting basis. Her major clients are marijuana production facilities for whom she prepares contracts. Mary collected $ 98,000 in consulting fees during 2019. Of the fees collected she deposited a pre-payment fee of $5,000 into her lawyer's trust account on December 28th and will draw on those funds as she performs work for the client and issues an invoice. She performed no work for that client in 2019. Mary does her work at the client's premises or in her office at home (see item 5 below). Her business expenses for 2019 are as follows: 26,250 Supplies Library materials Expert fees Professional license fee Subscriptions to professional journals Dues to professional organizations Attorney Subcontractor fees paid (1099s issued) $7,000 2,000 1,000 400 350 500 15,000 In addition, Mary drove the family Acura (purchase on June 7, 2018) 1,050 miles on her job assignments. She uses the standard mileage method to deduct business costs related to the Acura. During 2019, Mary drove the car a total of 8.200 miles. Mary would like to a contribution to a traditional IRA account in an amount equal to the maximum amount allowed her for a deduction.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Out What goe of all of there On the tax return and whoe does it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started