Question

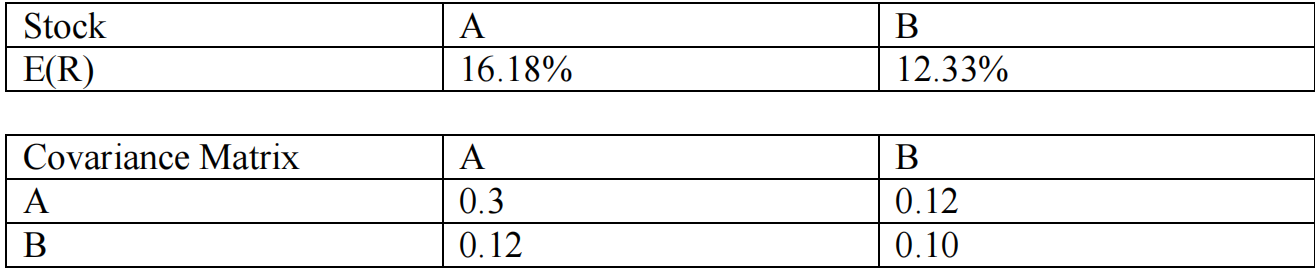

Mary is holding a portfolio that contains 33% of Stock A and 67% of Stock B. The expected annual returns of Stock A and Stock

Mary is holding a portfolio that contains 33% of Stock A and 67% of Stock B. The expected

annual returns of Stock A and Stock B, and their covariance matrix are given below:

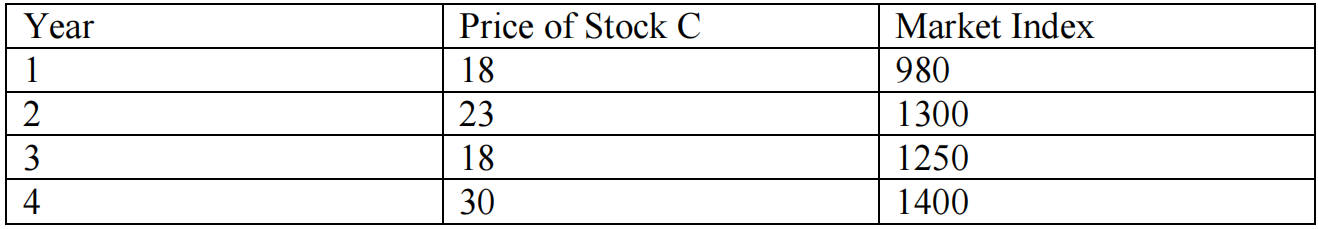

Mary is considering adding Stock C into her portfolio. Suppose that only yearly stock price

data is available. Stock Cs prices over the past 4 years are given below, along with the

index values of a market index over the past 4 years. The beta of Stock A with respect to

this market index is 1.4 and the beta of Stock B with respect to this market index is 0.85.

Required:

a) What is the correlation coefficient between Stock A and Stock B?

b) If Mary borrows an amount of 50% of her own money at 5% and forms a portfolio

of 30% of Stock A, 30% of Stock B, and 40% of Stock C, what is the expected

return from the new portfolio?

A B Stock E(R) 16.18% 12.33% Covariance Matrix A B A 0.3 0.12 0.12 0.10 B Year 1 2 Price of Stock C 18 23 18 30 Market Index 980 1300 1250 1400 3 4 A B Stock E(R) 16.18% 12.33% Covariance Matrix A B A 0.3 0.12 0.12 0.10 B Year 1 2 Price of Stock C 18 23 18 30 Market Index 980 1300 1250 1400 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started