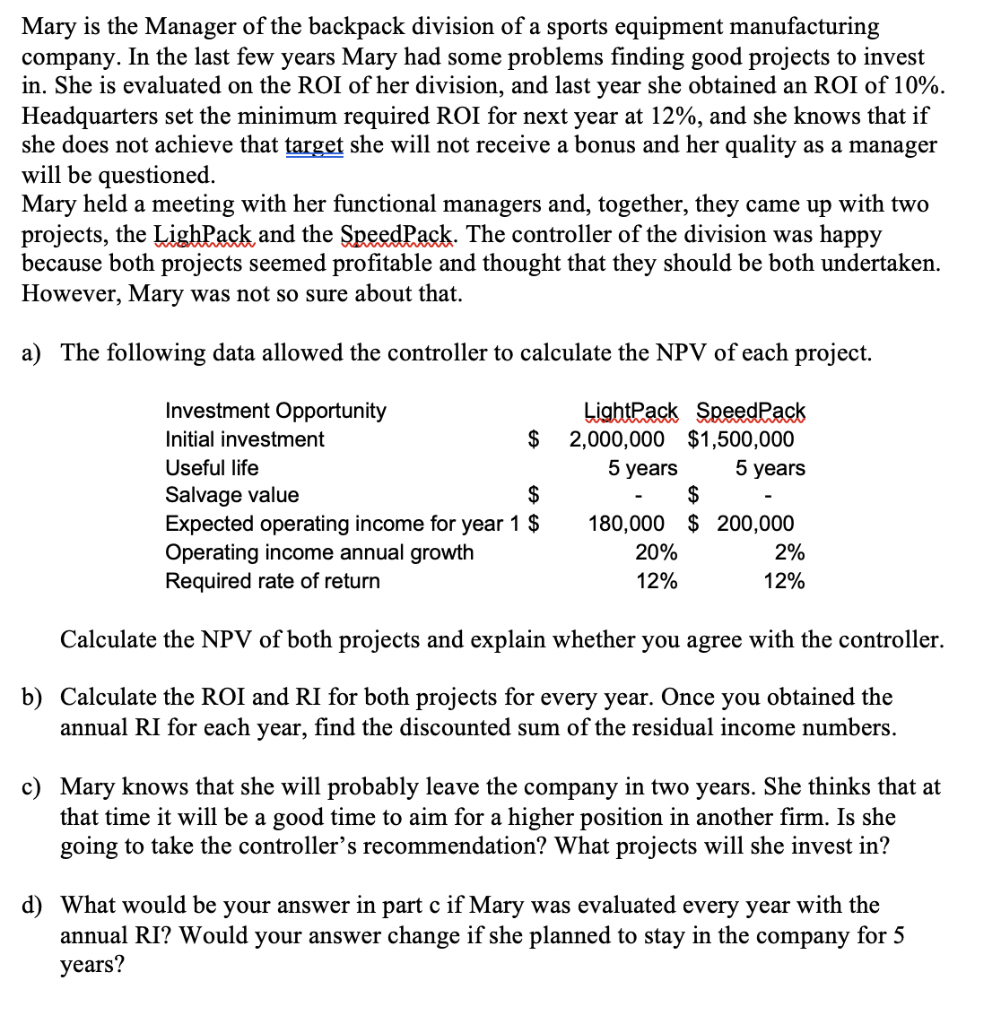

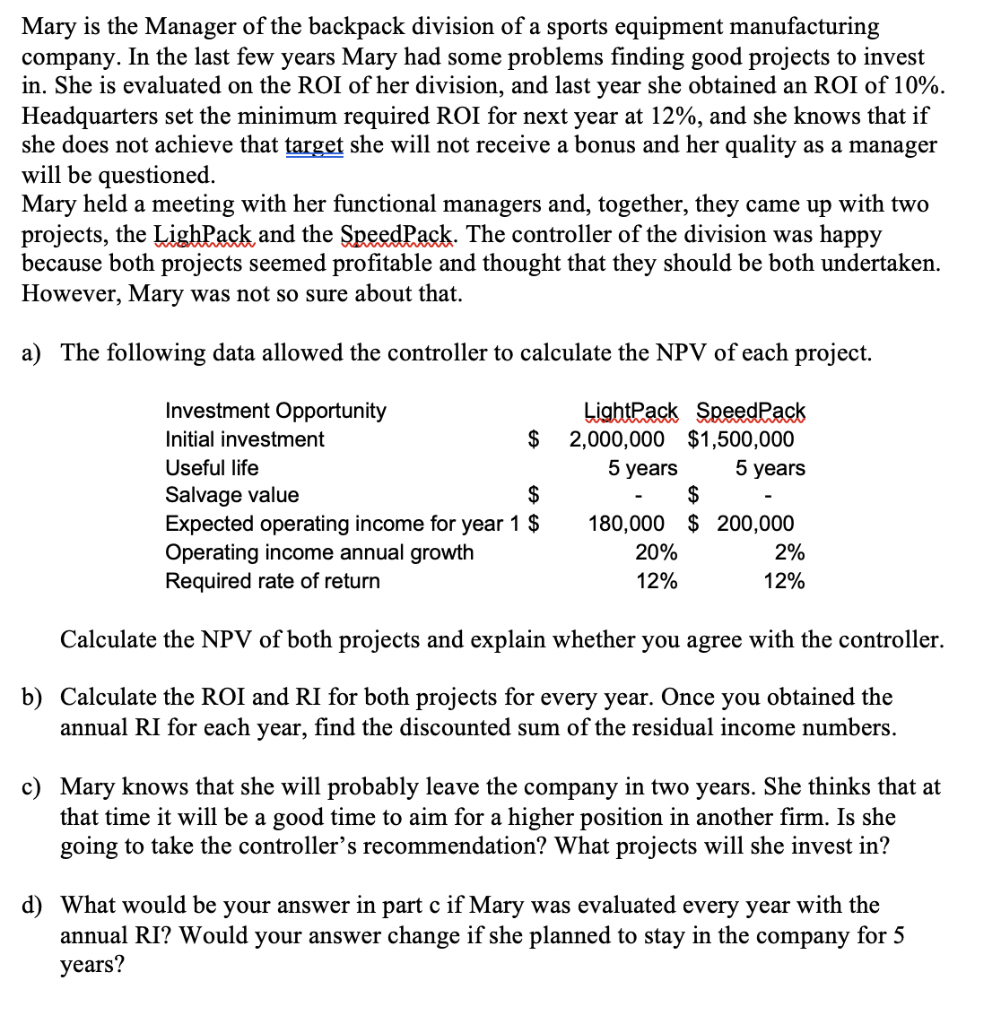

Mary is the Manager of the backpack division of a sports equipment manufacturing company. In the last few years Mary had some problems finding good projects to invest in. She is evaluated on the ROI of her division, and last year she obtained an ROI of 10%. Headquarters set the minimum required ROI for next year at 12%, and she knows that if she does not achieve that target she will not receive a bonus and her quality as a manager will be questioned. Mary held a meeting with her functional managers and, together, they came up with two projects, the LighPack and the SpeedPack. The controller of the division was happy because both projects seemed profitable and thought that they should be both undertaken. However, Mary was not so sure about that. a) The following data allowed the controller to calculate the NPV of each project. Investment Opportunity Initial investment $ Useful life Salvage value $ Expected operating income for year 1 $ Operating income annual growth Required rate of return LightPack SpeedPack 2,000,000 $1,500,000 5 years 5 years $ 180,000 $ 200,000 20% 2% 12% 12% Calculate the NPV of both projects and explain whether you agree with the controller. b) Calculate the ROI and RI for both projects for every year. Once you obtained the annual RI for each year, find the discounted sum of the residual income numbers. c) Mary knows that she will probably leave the company in two years. She thinks that at that time it will be a good time to aim for a higher position in another firm. Is she going to take the controller's recommendation? What projects will she invest in? d) What would be your answer in part c if Mary was evaluated every year with the annual RI? Would your answer change if she planned to stay in the company for 5 years? Mary is the Manager of the backpack division of a sports equipment manufacturing company. In the last few years Mary had some problems finding good projects to invest in. She is evaluated on the ROI of her division, and last year she obtained an ROI of 10%. Headquarters set the minimum required ROI for next year at 12%, and she knows that if she does not achieve that target she will not receive a bonus and her quality as a manager will be questioned. Mary held a meeting with her functional managers and, together, they came up with two projects, the LighPack and the SpeedPack. The controller of the division was happy because both projects seemed profitable and thought that they should be both undertaken. However, Mary was not so sure about that. a) The following data allowed the controller to calculate the NPV of each project. Investment Opportunity Initial investment $ Useful life Salvage value $ Expected operating income for year 1 $ Operating income annual growth Required rate of return LightPack SpeedPack 2,000,000 $1,500,000 5 years 5 years $ 180,000 $ 200,000 20% 2% 12% 12% Calculate the NPV of both projects and explain whether you agree with the controller. b) Calculate the ROI and RI for both projects for every year. Once you obtained the annual RI for each year, find the discounted sum of the residual income numbers. c) Mary knows that she will probably leave the company in two years. She thinks that at that time it will be a good time to aim for a higher position in another firm. Is she going to take the controller's recommendation? What projects will she invest in? d) What would be your answer in part c if Mary was evaluated every year with the annual RI? Would your answer change if she planned to stay in the company for 5 years