Answered step by step

Verified Expert Solution

Question

1 Approved Answer

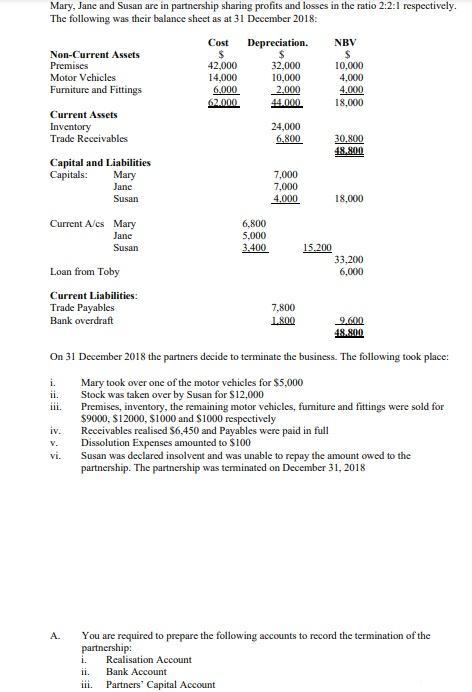

Mary, Jane and Susan are in partnership sharing profits and losses in the ratio 2:2:1 respectively. The following was their balance sheet as at

Mary, Jane and Susan are in partnership sharing profits and losses in the ratio 2:2:1 respectively. The following was their balance sheet as at 31 December 2018: Cost Depreciation. 24 32,000 10,000 2.000 44.000 NBV 24 10,000 4,000 4.000 18,000 Non-Current Assets Premises 42,000 14,000 6.000 62.000 Motor Vehicles Furmiture and Fittings Current Assets Inventory Trade Receivables 24,000 6.800 30.800 48.800 Capital and Liabilities Capitals: Mary 7,000 Jane 7,000 Susan 4.000 18,000 Current A/es Mary 6,800 5,000 3.400 Jane Susan 15.200 33,200 6,000 Loan from Toby Current Liabilities: Trade Payables Bank overdraft 7,800 1800 9.600 48.800 On 31 December 2018 the partners decide to terminate the business. The following took place: Mary took over one of the motor vehicles for $5,000 Stock was taken over by Susan for S12,000 Premises, inventory, the remaining motor vehicles, fumiture and fittings were sold for $9000, $12000, S1000 and S1000 respectively i. ii. iii. iv. Receivables realised $6,450 and Payables were paid in full Dissolution Expenses amounted to $100 Susan was declared insolvent and was unable to repay the amount owed to the partnership. The partnership was teminated on December 31, 2018 v. vi. You are required to prepare the following accounts to record the termination of the partnership: i. A. Realisation Account ii. Bank Account iii. Partners' Capital Account

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Reriaatta arcouAt Pailleuralt y TIade payatio To Piemised To M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started