Question

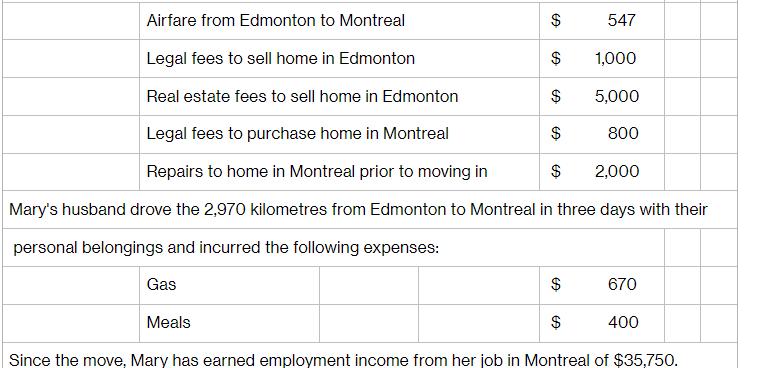

Mary Shelton has been transferred by her employer from Edmonton, AB to Montreal, QC. In the course of her move, she incurred the following expenses:

Mary Shelton has been transferred by her employer from Edmonton, AB to Montreal, QC. In the course of her move, she incurred the following expenses:

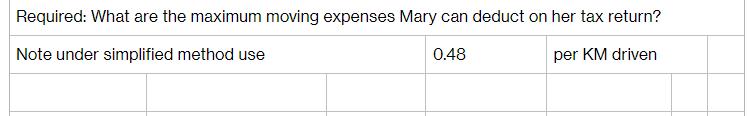

Airfare from Edmonton to Montreal $ Legal fees to sell home in Edmonton $ Real estate fees to sell home in Edmonton $ 5,000 Legal fees to purchase home in Montreal $ 800 $ 2,000 Repairs to home in Montreal prior to moving in Mary's husband drove the 2,970 kilometres from Edmonton to Montreal in three days with their personal belongings and incurred the following expenses: 547 Gas Meals 1,000 $ $ Since the move, Mary has earned employment income from her job in Montreal of $35,750. 670 400

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the deductible moving expenses for Mary using the given infor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Canadian Income Taxation Planning And Decision Making

Authors: Joan Kitunen, William Buckwold

17th Edition 2014-2015 Version

1259094332, 978-1259094330

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App