Answered step by step

Verified Expert Solution

Question

1 Approved Answer

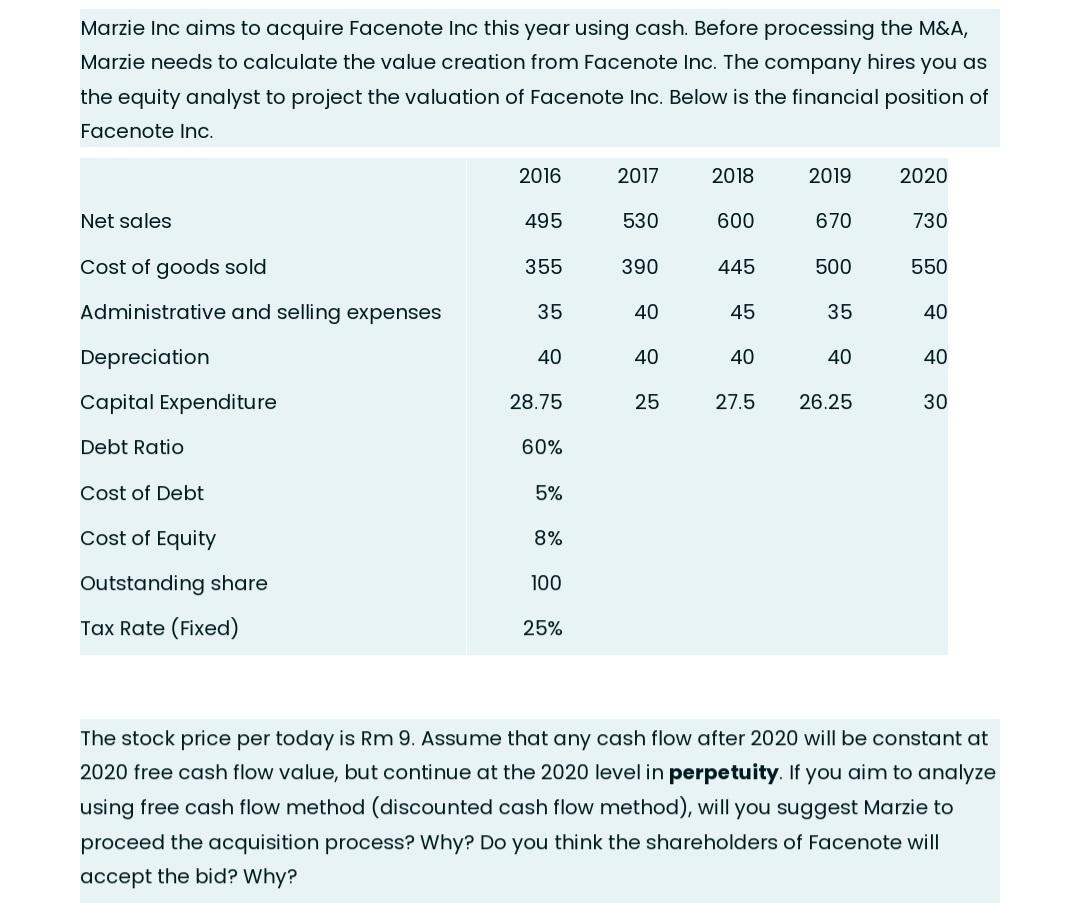

Marzie Inc aims to acquire Facenote Inc this year using cash. Before processing the M&A, Marzie needs to calculate the value creation from Facenote

Marzie Inc aims to acquire Facenote Inc this year using cash. Before processing the M&A, Marzie needs to calculate the value creation from Facenote Inc. The company hires you as the equity analyst to project the valuation of Facenote Inc. Below is the financial position of Facenote Inc. Net sales Cost of goods sold Administrative and selling expenses Depreciation Capital Expenditure Debt Ratio Cost of Debt Cost of Equity Outstanding share Tax Rate (Fixed) 2016 495 355 35 40 28.75 60% 5% 8% 100 25% 2017 530 390 40 40 25 2018 600 445 45 40 2019 670 500 35 40 27.5 26.25 2020 730 550 40 40 30 The stock price per today is Rm 9. Assume that any cash flow after 2020 will be constant at 2020 free cash flow value, but continue at the 2020 level in perpetuity. If you aim to analyze using free cash flow method (discounted cash flow method), will you suggest Marzie to proceed the acquisition process? Why? Do you think the shareholders of Facenote will accept the bid? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether Marzie Inc should proceed with the acquisition of Facenote Inc using the discounted cash flow DCF method we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started