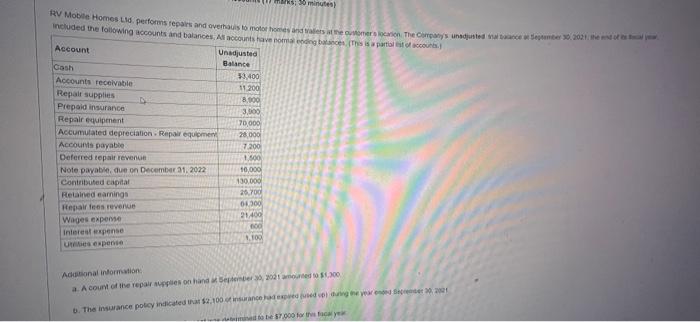

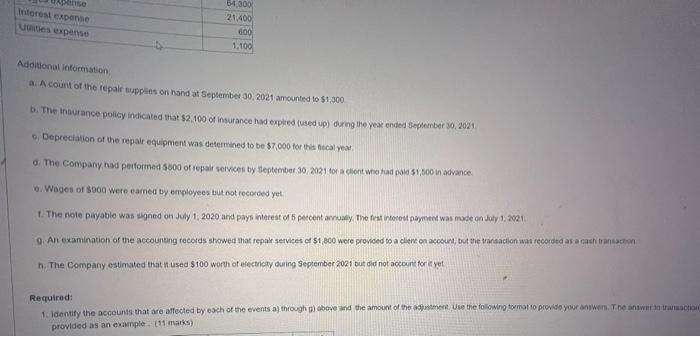

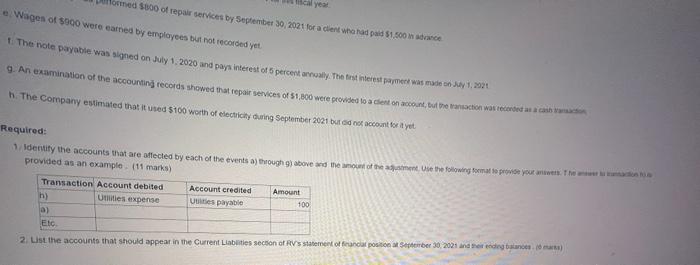

mas minutes) RV Mobile Homes Lid performs repairs and ovetouisto motor honds and as the owner on the counted Sember 2011 included the following counts and balances Accountstavenomong beses para o con Account Unadjusted Balance Cash 53.400 Accounts receivable 11.200 Repait supplies 8,000 Prepaid insurance 3,500 Repair equipment 70,000 Accumulated depreciation. Repair equipment 28.000 Accounts payable 7.200 Deferred tepair revenue 1.500 10,000 Note payable on December 21, 2012 Contributed capital 130,000 26.700 Retained earnings Repair les revenue 21,400 Wages expense interest expense Us expense 60300 1.100 Additional information A count of the repair ies on hand September 2001 amoo 300 The insurance policy indicated at $2.100 intrance the to be 57.000 for they Interest expense des expense 64.300 21.400 600 1.100 Additional information a. A count of the repair supplies on hand at September 30, 2021 amounted to $1,300 b. The insurance policy indicated that $2,100 of insurance had expued (used up) auring the year ended September 30, 2021 Depreciation of the repair equipment was determined to be $7,000 for this scal year a. The company had performed 5000 of repair services by September 30, 2021 for a client who had paid $1,500 in advance. o. Wages of 5000 were eamed by employees but not recorded yet 1. The note payable was signed on July 1, 2020 and pays interest of 5 percentually. The first interest payment was made on July 1, 2021 0 An examination of the accounting records showed that repair services of $1,800 were provided to a client on account, but the transaction was recorded as a cash transaction n. The Company estimated that used $100 worth of electrichy during September 2021 but did not account for a yet Required: 1. Identify the accounts that are affected by each of the events a) through above and the amount of the wint. Use the following format to provide your answer. The answer provided as an example (11 marks) med $800 of repair services by September 30, 2021 for a client who had paid $1.500 de year Wages of $900 were earned by employees but not recorded yet. 1. The note payable was signed on July 1, 2020 and pay interest of 5 percent arvonly. The tre terest payment was made a 1,2024 9. An examination of the accounting records showed that repair services of $1,800 were provided to a dient on account, but the variation was recorded as cash.com 1. The Company estimated that it used 5100 worth of electricity during September 2010 occoart for a yet Required: 1. Identify the accounts that are affected by each of the events as though above and the amount of the sent. Use the following format to prove your uniwer. The provided as an example (11 mark) Transaction Account debited Account credited Amount h) Uues expense Utes payable 100 a) Etc 2021 anderende balances) 2 List the accounts that should appear in the Current Liabilities section of RV's statement of financial position September