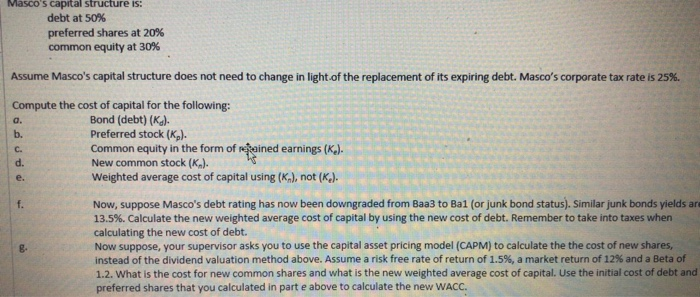

Masco's capital structure is: debt at 50% preferred shares at 20% common equity at 30% a. b. Assume Masco's capital structure does not need to change in light of the replacement of its expiring debt. Masco's corporate tax rate is 25%. Compute the cost of capital for the following: Bond (debt) (d). Preferred stock (Kn). Common equity in the form of retained earnings (Ke). New common stock (Kn). Weighted average cost of capital using (K), not (K.). Now, suppose Masco's debt rating has now been downgraded from Baa3 to Bal (or junk bond status). Similar junk bonds yields are 13.5%. Calculate the new weighted average cost of capital by using the new cost of debt. Remember to take into taxes when calculating the new cost of debt. Now suppose, your supervisor asks you to use the capital asset pricing model (CAPM) to calculate the the cost of new shares, instead of the dividend valuation method above. Assume a risk free rate of return of 1.5%, a market return of 12% and a Beta of 1.2. What is the cost for new common shares and what is the new weighted average cost of capital. Use the initial cost of debt and preferred shares that you calculated in part e above to calculate the new WACC. d. e. f. 8 Masco's capital structure is: debt at 50% preferred shares at 20% common equity at 30% a. b. Assume Masco's capital structure does not need to change in light of the replacement of its expiring debt. Masco's corporate tax rate is 25%. Compute the cost of capital for the following: Bond (debt) (d). Preferred stock (Kn). Common equity in the form of retained earnings (Ke). New common stock (Kn). Weighted average cost of capital using (K), not (K.). Now, suppose Masco's debt rating has now been downgraded from Baa3 to Bal (or junk bond status). Similar junk bonds yields are 13.5%. Calculate the new weighted average cost of capital by using the new cost of debt. Remember to take into taxes when calculating the new cost of debt. Now suppose, your supervisor asks you to use the capital asset pricing model (CAPM) to calculate the the cost of new shares, instead of the dividend valuation method above. Assume a risk free rate of return of 1.5%, a market return of 12% and a Beta of 1.2. What is the cost for new common shares and what is the new weighted average cost of capital. Use the initial cost of debt and preferred shares that you calculated in part e above to calculate the new WACC. d. e. f. 8