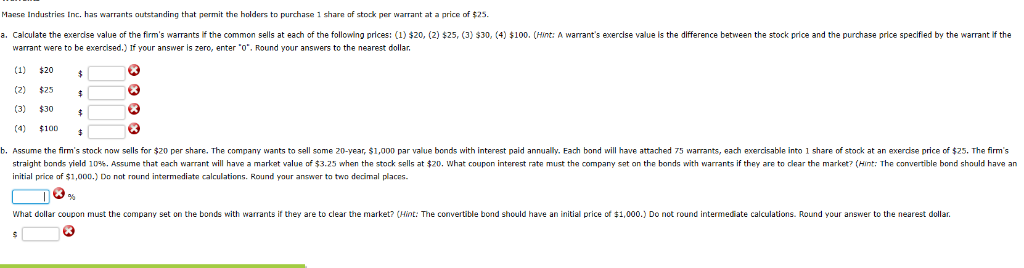

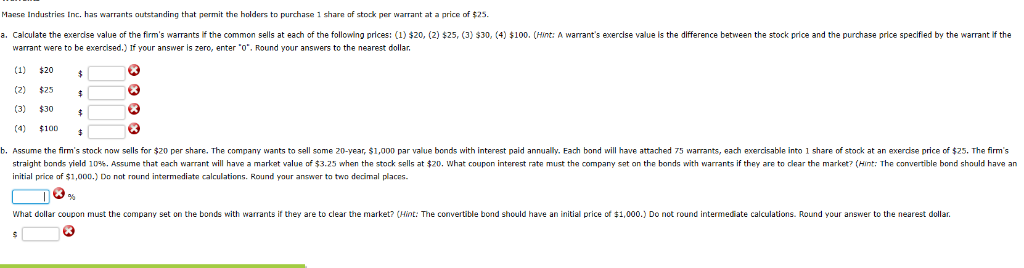

Mase Industrics Inc. has warrants autstanding that permit the holders to purchase 1 share af stock per warrant at a price of $25 a. Calculate the exerdise value of the firm's warrants ifthe common sells at each of the following prices: (1)$20, (2) $25, (3) $30, (4) $100. (Hint: A warrant's exerclse value is the difference between the stock price and the purchase price specif ed by the warrant if the warrant were to be exercised.) If your answer is zero, enter .0". Round your answers to the nearest dollar. (2) $25 (3) $30 4 $100 at an exerdise price of Hint: The convertible bond should have an b. Assume the firm's stock now sells for20 per share. The company wants to sell some 20-year, $1,000 par alue bonds with interest paid annual y Each bond will have attached 75 war ants, each exercisable into 1 share of stock at an exer se price of $25. The firms ave a matat straight bonds eld 10% Assume that each warrant ill have a market value of $3.25 when the stock sells at 2 initial price of $1,000.) , not round intermediate calculations. Round your answer to two decimal places what coupon interest rate must the company set on the bonds with warrants ear the market? they are to L 10% What dollar coupon must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) Do not round intermediate calculations. Round your answer to the nearest dollar. 3 Mase Industrics Inc. has warrants autstanding that permit the holders to purchase 1 share af stock per warrant at a price of $25 a. Calculate the exerdise value of the firm's warrants ifthe common sells at each of the following prices: (1)$20, (2) $25, (3) $30, (4) $100. (Hint: A warrant's exerclse value is the difference between the stock price and the purchase price specif ed by the warrant if the warrant were to be exercised.) If your answer is zero, enter .0". Round your answers to the nearest dollar. (2) $25 (3) $30 4 $100 at an exerdise price of Hint: The convertible bond should have an b. Assume the firm's stock now sells for20 per share. The company wants to sell some 20-year, $1,000 par alue bonds with interest paid annual y Each bond will have attached 75 war ants, each exercisable into 1 share of stock at an exer se price of $25. The firms ave a matat straight bonds eld 10% Assume that each warrant ill have a market value of $3.25 when the stock sells at 2 initial price of $1,000.) , not round intermediate calculations. Round your answer to two decimal places what coupon interest rate must the company set on the bonds with warrants ear the market? they are to L 10% What dollar coupon must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) Do not round intermediate calculations. Round your answer to the nearest dollar. 3