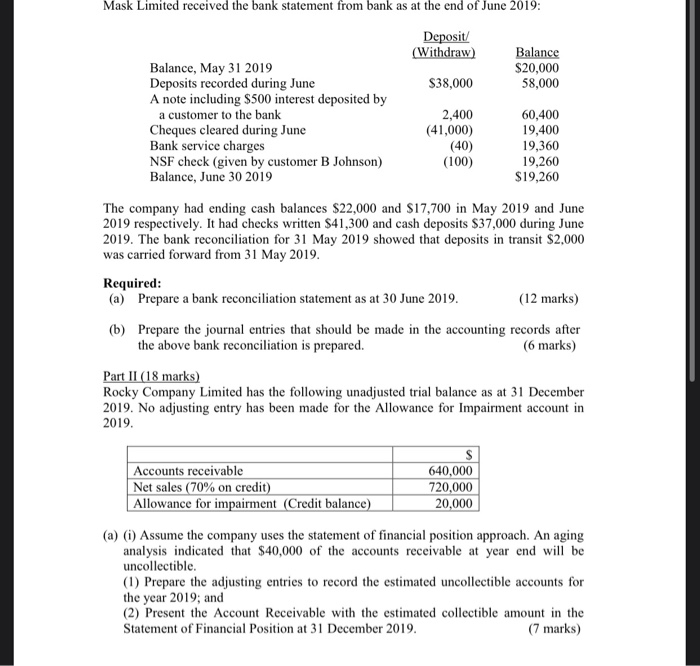

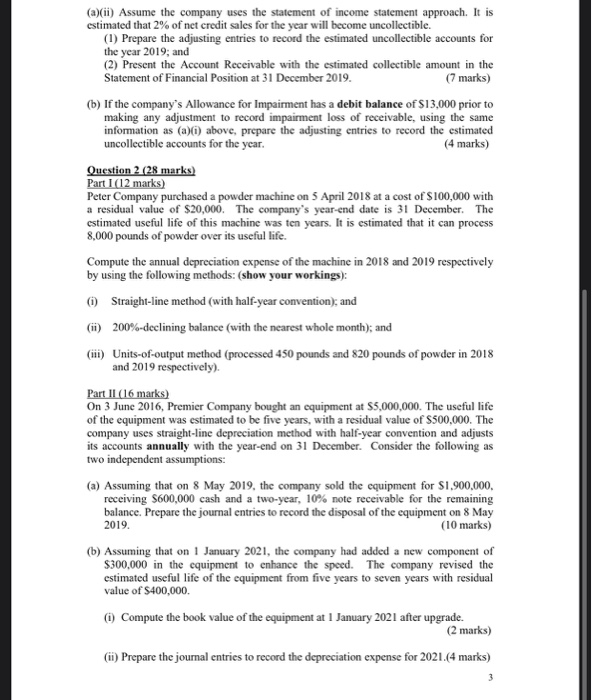

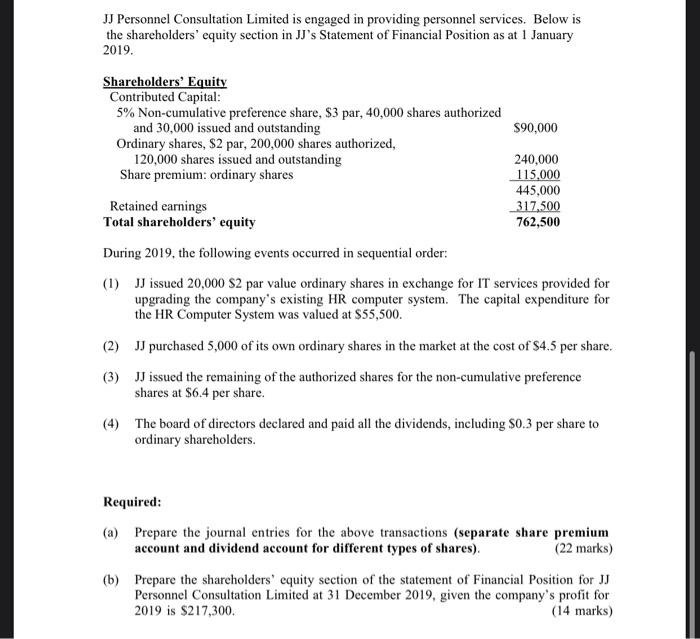

Mask Limited received the bank statement from bank as at the end of June 2019: Deposit/ (Withdraw) Balance $20,000 58,000 $38,000 Balance, May 31 2019 Deposits recorded during June A note including $500 interest deposited by a customer to the bank Cheques cleared during June Bank service charges NSF check (given by customer B Johnson) Balance, June 30 2019 2,400 (41,000) (40) (100) 60,400 19,400 19,360 19,260 $19,260 The company had ending cash balances $22,000 and $17,700 in May 2019 and June 2019 respectively. It had checks written $41,300 and cash deposits $37,000 during June 2019. The bank reconciliation for 31 May 2019 showed that deposits in transit $2,000 was carried forward from 31 May 2019. Required: (a) Prepare a bank reconciliation statement as at 30 June 2019. (12 marks) (b) Prepare the journal entries that should be made in the accounting records after the above bank reconciliation is prepared. (6 marks) Part II (18 marks) Rocky Company Limited has the following unadjusted trial balance as at 31 December 2019. No adjusting entry has been made for the Allowance for Impairment account in 2019. S Accounts receivable Net sales (70% on credit) Allowance for impairment (Credit balance) 640,000 720,000 20,000 (a) (i) Assume the company uses the statement of financial position approach. An aging analysis indicated that $40,000 of the accounts receivable at year end will be uncollectible. (1) Prepare the adjusting entries to record the estimated uncollectible accounts for the year 2019, and (2) Present the Account Receivable with the estimated collectible amount in the Statement of Financial Position at 31 December 2019. (7 marks) (a)(ii) Assume the company uses the statement of income statement approach. It is estimated that 2% of net credit sales for the year will become uncollectible. (1) Prepare the adjusting entries to record the estimated uncollectible accounts for the year 2019; and (2) Present the Account Receivable with the estimated collectible amount in the Statement of Financial Position at 31 December 2019. (7 marks) (b) If the company's Allowance for Impairment has a debit balance of $13,000 prior to making any adjustment to record impairment loss of receivable, using the same information as (a)n) above, prepare the adjusting entries to record the estimated uncollectible accounts for the year. (4 marks) Question 2 (28 marks) Part 1(12 marks) Peter Company purchased a powder machine on 5 April 2018 at a cost of $100,000 with a residual value of $20,000. The company's year-end date is 31 December. The estimated useful life of this machine was ten years. It is estimated that it can process 8,000 pounds of powder over its useful life. Compute the annual depreciation expense of the machine in 2018 and 2019 respectively by using the following methods: (show your workings): (1) Straight-line method (with half-year convention), and (ii) 200%-declining balance (with the nearest whole month); and (iii) Units-of-output method (processed 450 pounds and 820 pounds of powder in 2018 and 2019 respectively). Part II (16 marks) On 3 June 2016, Premier Company bought an equipment at $5,000,000. The useful life of the equipment was estimated to be five years, with a residual value of $500,000. The company uses straight-line depreciation method with half-year convention and adjusts its accounts annually with the year-end on 31 December. Consider the following as two independent assumptions: (a) Assuming that on 8 May 2019, the company sold the equipment for $1.900.000, receiving S600,000 cash and a two-year, 10% note receivable for the remaining balance. Prepare the journal entries to record the disposal of the equipment on 8 May 2019. (10 marks) (b) Assuming that on 1 January 2021, the company had added a new component of $300,000 in the equipment to enhance the speed. The company revised the estimated useful life of the equipment from five years to seven years with residual value of $400,000 (1) Compute the book value of the equipment at 1 January 2021 after upgrade. (2 marks) (11) Prepare the journal entries to record the depreciation expense for 2021.(4 marks) JJ Personnel Consultation Limited is engaged in providing personnel services. Below is the shareholders' equity section in JJ's Statement of Financial Position as at 1 January 2019. Shareholders' Equity Contributed Capital: 5% Non-cumulative preference share, $3 par, 40,000 shares authorized and 30,000 issued and outstanding Ordinary shares, $2 par, 200,000 shares authorized, 120,000 shares issued and outstanding Share premium: ordinary shares $90,000 240,000 115,000 445,000 317.500 762,500 Retained earnings Total shareholders' equity During 2019, the following events occurred in sequential order: (1) JJ issued 20,000 S2 par value ordinary shares in exchange for IT services provided for upgrading the company's existing HR computer system. The capital expenditure for the HR Computer System was valued at $55,500. (2) JJ purchased 5,000 of its own ordinary shares in the market at the cost of $4.5 per share. (3) JJ issued the remaining of the authorized shares for the non-cumulative preference shares at $6.4 per share. (4) The board of directors declared and paid all the dividends, including $0.3 per share to ordinary shareholders. Required: (a) Prepare the journal entries for the above transactions (separate share premium account and dividend account for different types of shares) (22 marks) (b) Prepare the shareholders' equity section of the statement of Financial Position for JJ Personnel Consultation Limited at 31 December 2019, given the company's profit for 2019 is $217,300. (14 marks)