Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mason Jones earns $800.00 per week. In May he received a work related bonus of $800.00. He compared his regular weekly cheque with the

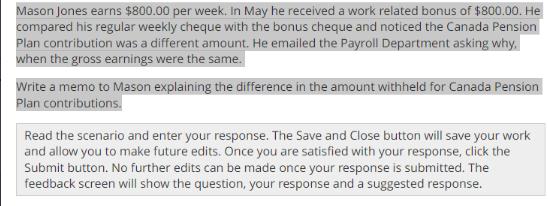

Mason Jones earns $800.00 per week. In May he received a work related bonus of $800.00. He compared his regular weekly cheque with the bonus cheque and noticed the Canada Pension Plan contribution was a different amount. He emailed the Payroll Department asking why. when the gross earnings were the same. Write a memo to Mason explaining the difference in the amount withheld for Canada Pension Plan contributions. Read the scenario and enter your response. The Save and Close button will save your work and allow you to make future edits. Once you are satisfied with your response, click the Submit button. No further edits can be made once your response is submitted. The feedback screen will show the question, your response and a suggested response.

Step by Step Solution

★★★★★

3.32 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To Mason Jones From Payroll Department Subject Canada Pension Plan Contribution Dear Mason Thank you ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started