Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mason PLC is a successful company which is embarking on an expansionary phase. It wishes to undertake a major new project which require an

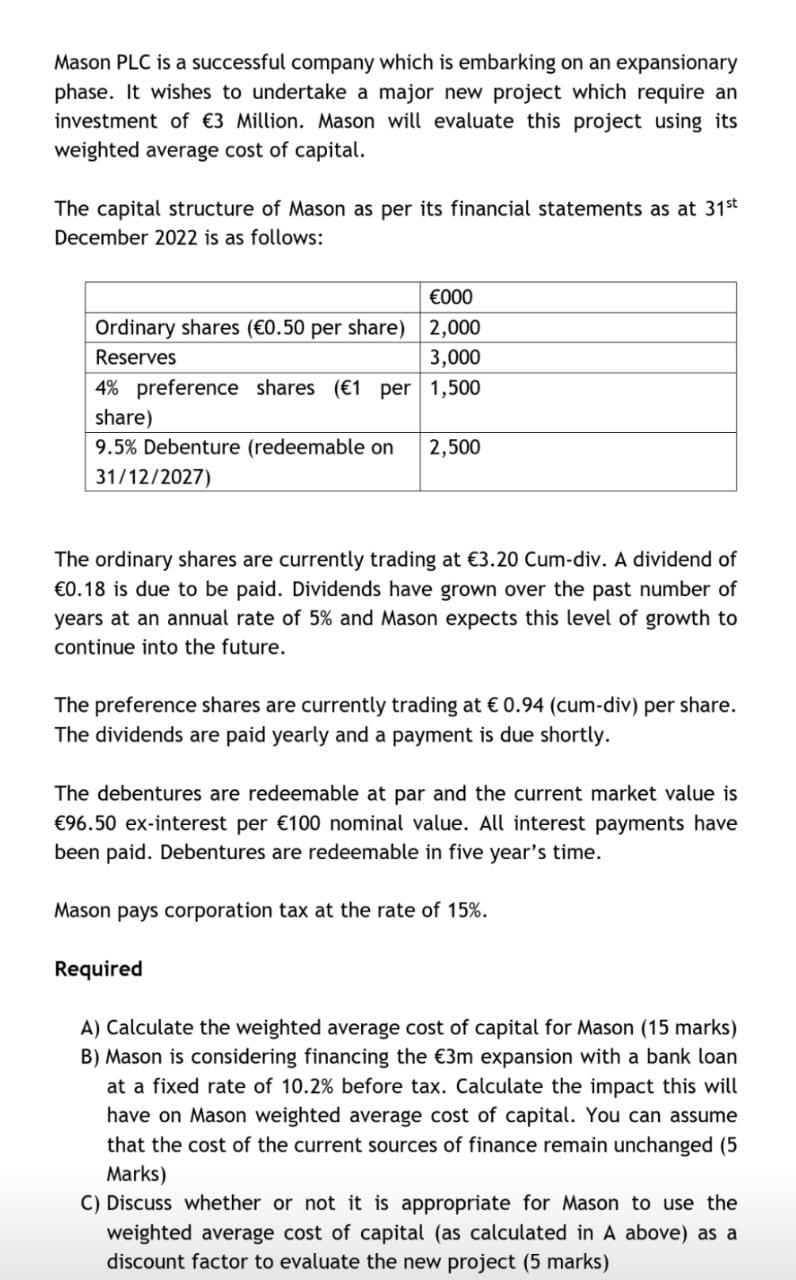

Mason PLC is a successful company which is embarking on an expansionary phase. It wishes to undertake a major new project which require an investment of 3 Million. Mason will evaluate this project using its weighted average cost of capital. The capital structure of Mason as per its financial statements as at 31st December 2022 is as follows: 000 Ordinary shares (0.50 per share) 2,000 Reserves 3,000 4% preference shares (1 per 1,500 share) 9.5% Debenture (redeemable on 31/12/2027) 2,500 The ordinary shares are currently trading at 3.20 Cum-div. A dividend of 0.18 is due to be paid. Dividends have grown over the past number of years at an annual rate of 5% and Mason expects this level of growth to continue into the future. The preference shares are currently trading at 0.94 (cum-div) per share. The dividends are paid yearly and a payment is due shortly. The debentures are redeemable at par and the current market value is 96.50 ex-interest per 100 nominal value. All interest payments have been paid. Debentures are redeemable in five year's time. Mason pays corporation tax at the rate of 15%. Required A) Calculate the weighted average cost of capital for Mason (15 marks) B) Mason is considering financing the 3m expansion with a bank loan at a fixed rate of 10.2% before tax. Calculate the impact this will have on Mason weighted average cost of capital. You can assume that the cost of the current sources of finance remain unchanged (5 Marks) C) Discuss whether or not it is appropriate for Mason to use the weighted average cost of capital (as calculated in A above) as a discount factor to evaluate the new project (5 marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A Calculate the weighted average cost of capital WACC for Mason Cost of Ordinary Shares Ke The cost of ordinary shares also known as the cost of equit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started