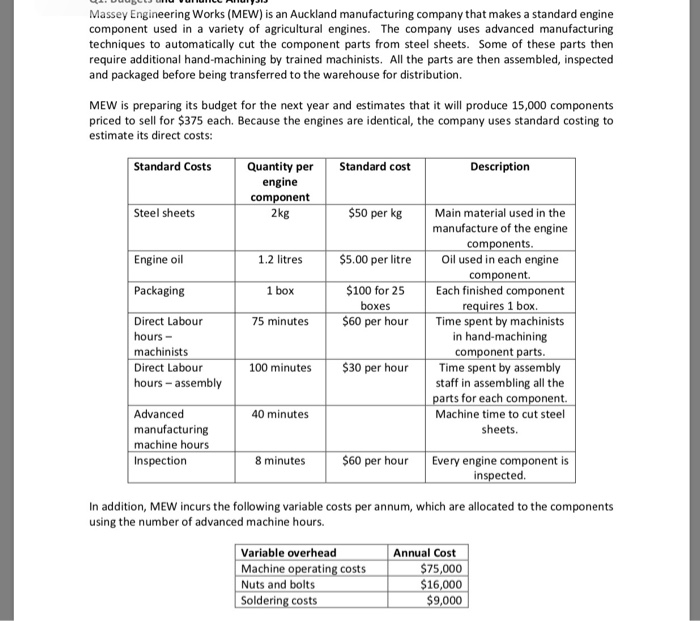

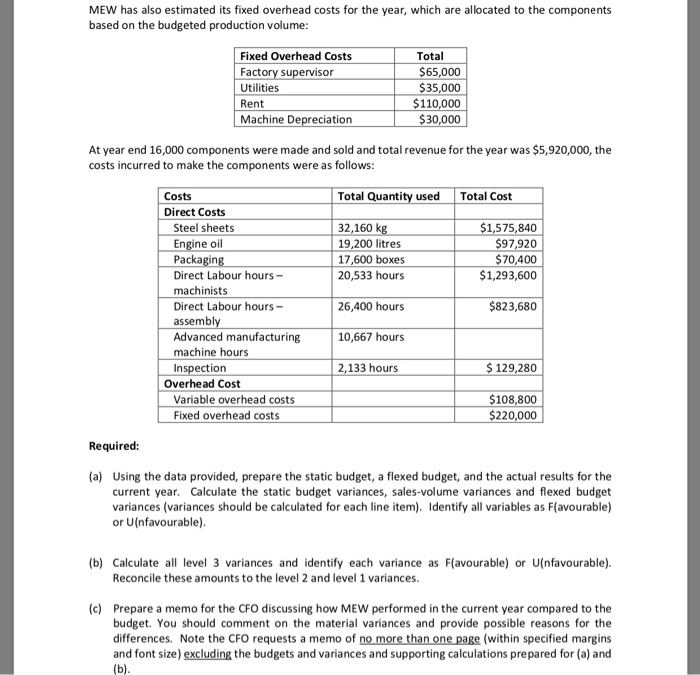

Massey Engineering Works (MEW) is an Auckland manufacturing company that makes a standard engine component used in a variety of agricultural engines. The company uses advanced manufacturing techniques to automatically cut the component parts from steel sheets. Some of these parts then require additional hand-machining by trained machinists. All the parts are then assembled, inspected and packaged before being transferred to the warehouse for distribution. MEW is preparing its budget for the next year and estimates that it will produce 15,000 components priced to sell for $375 each. Because the engines are identical, the company uses standard costing to estimate its direct costs: Standard Costs Quantity per Standard cost Description engine component Steel sheets $50 per kg Main material used in the manufacture of the engine components 5.00 per ltre Oil used in each engine 100 for 25 Each finished component 75 minutes $60 per hour Time spent by machinists Engine oil 1.2 litres component. Packaging 1 box requires 1 box boxes Direct Labour hours- machinists Direct Labour hours- assembly in hand-machining ponent 100 minutes 30 per hour Time spent by assembly staff in assembling all the arts for each component. Machine time to cut steel sheets Advanced manufacturing machine hours Inspection 40 minutes $60 per hour Every engine component is 8 minutes inspected In addition, MEW incurs the following variable costs per annum, which are allocated to the components using the number of advanced machine hours. Variable overhead Annual Cost Machine operating costs Nuts and bolts Soldering costs 75,000 16,000 9,000 MEW has also estimated its fixed overhead costs for the year, which are allocated to the components based on the budgeted production volume Total Fixed Overhead Costs Factory su Utilities Rent Machine Depreciation 65 sor $35 110,000 30,000 At year end 16,000 components were made and sold and total revenue for the year was $5,920,000, the costs incurred to make the components were as follows Costs Direct Costs Total Quantity used Total Cost Steel sheets Engine oil Packagin Direct Labour hours- machinists Direct Labour hours- assembl Advanced manufacturing machine hours Inspection 1,575,840 97,920 $70,400 $1,293,600 32,160 k 19,200 litres 17,600 boxes 20,533 hours 823,680 26,400 hours 10,667 hours 129,280 133 hours Overhead Cost Variable overhead costs Fixed overhead costs 108,800 220,000 Required: (a) Using the data provided, prepare the static budget, a flexed budget, and the actual results for the current year. Calculate the static budget variances, sales-volume variances and flexed budget variances (variances should be calculated for each line item). Identify all variables as F(avourable) or U(nfavourable) (b) Calculate all level 3 variances and identify each variance as F(avourable) or U(nfavourable). Reconcile these amounts to the level 2 and level 1 variances (c) Prepare a memo for the CFO discussing how MEW performed in the current year compared to the budget. You should comment on the material variances and provide possible reasons for the differences. Note the CFO requests a memo of no more than one page (within specified margins and font size) excluding the budgets and variances and supporting calculations prepared for (a) and