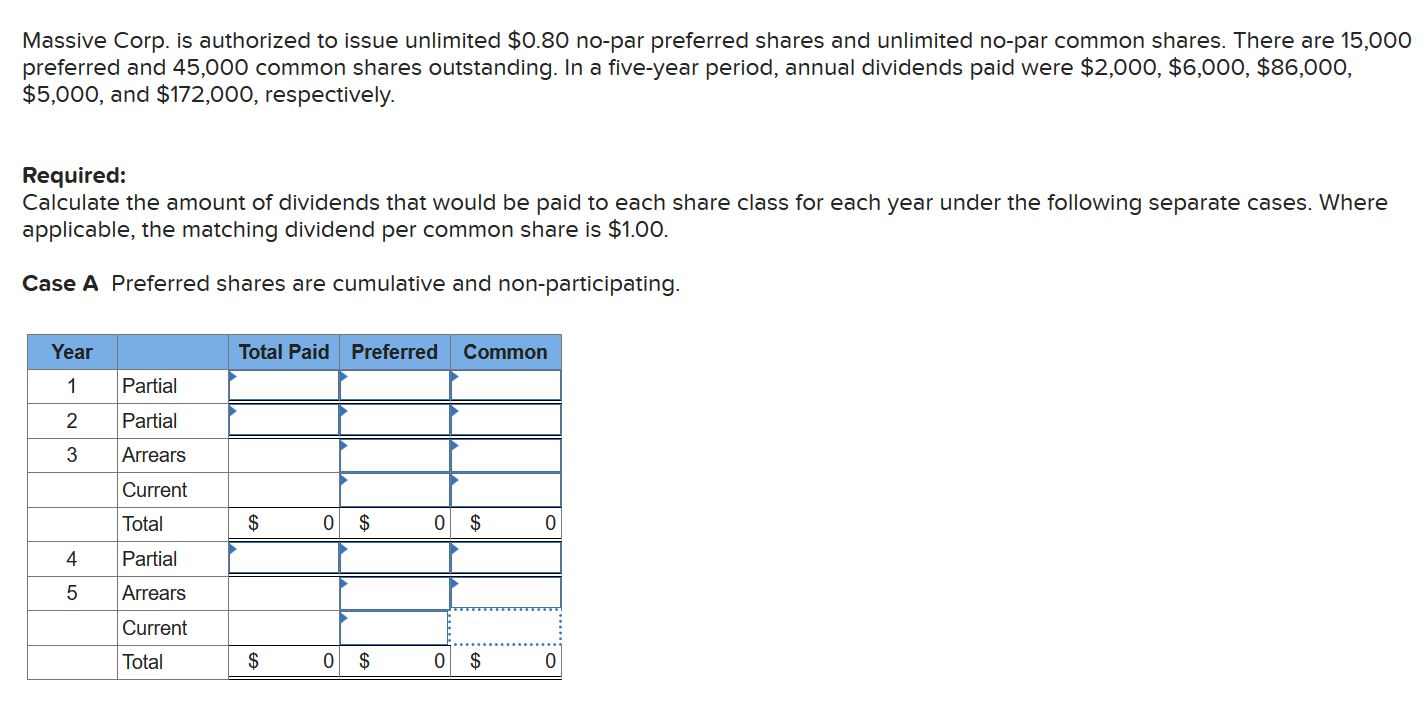

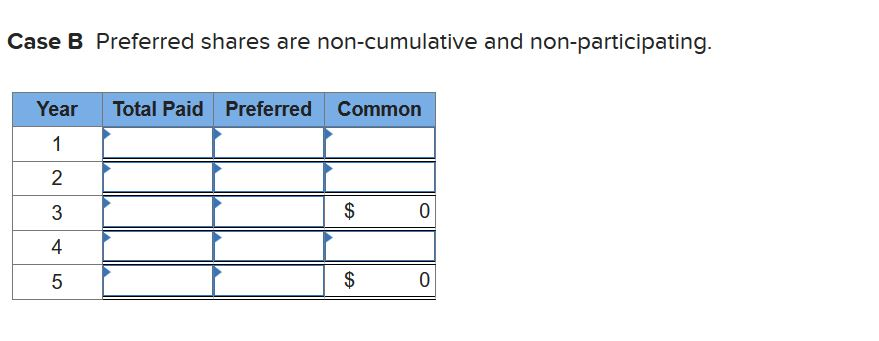

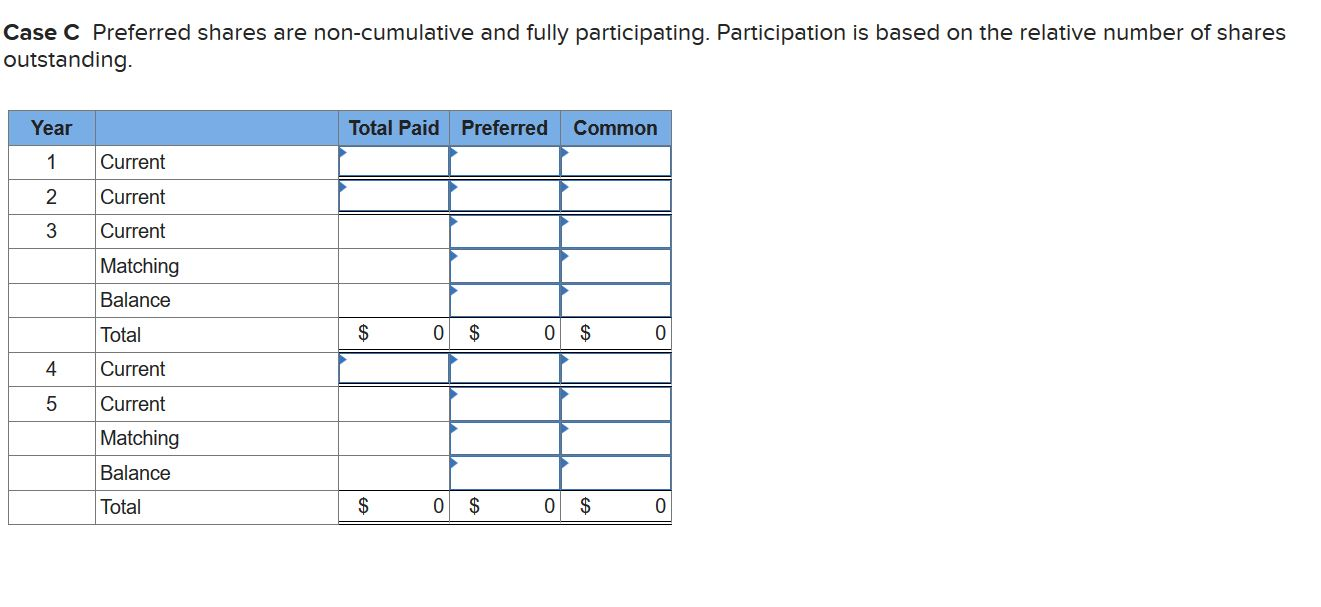

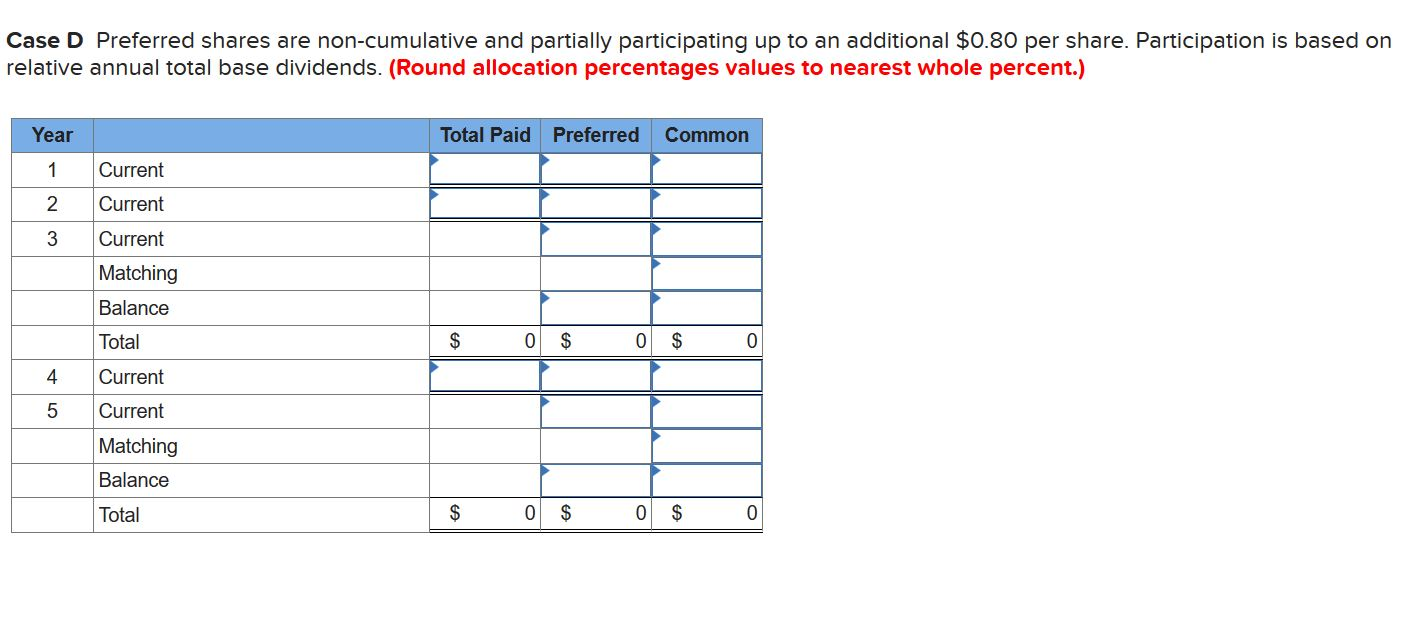

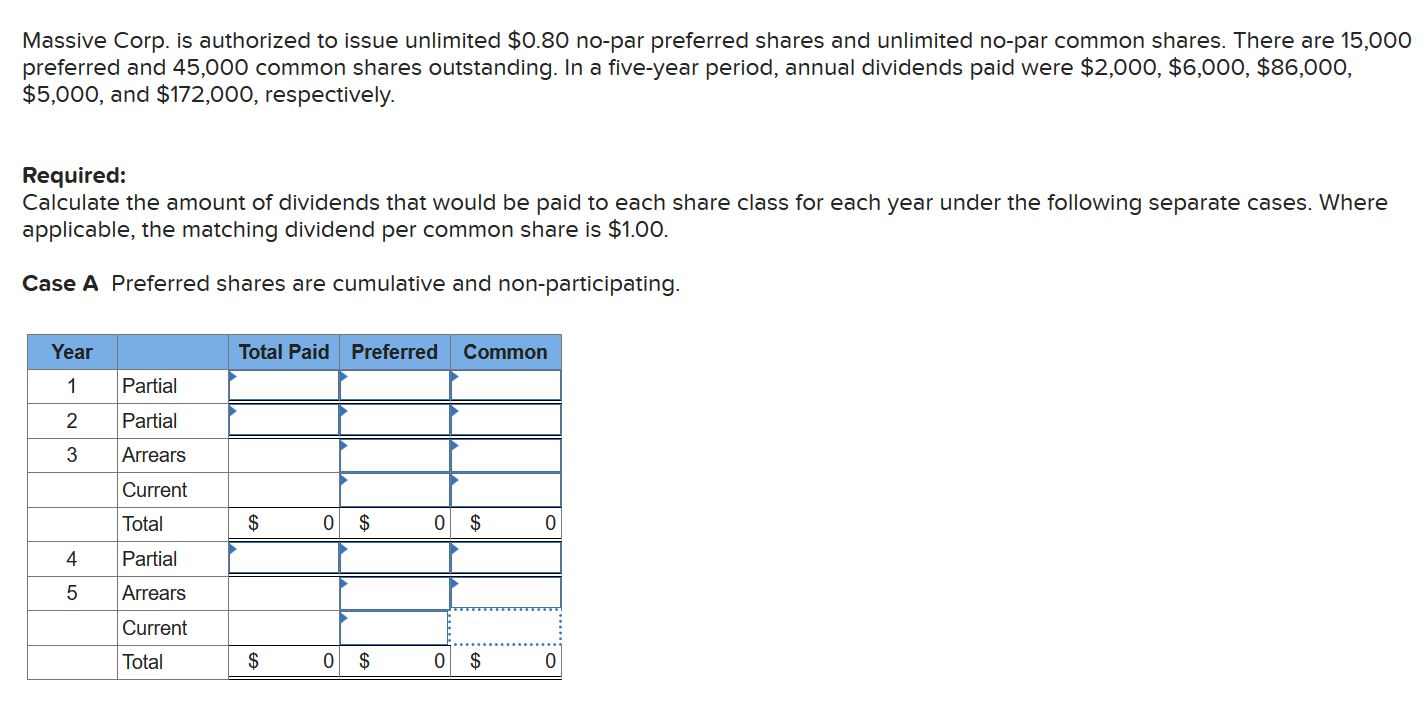

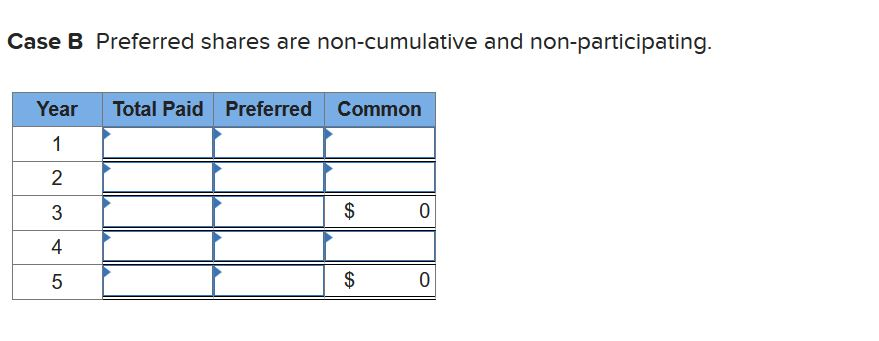

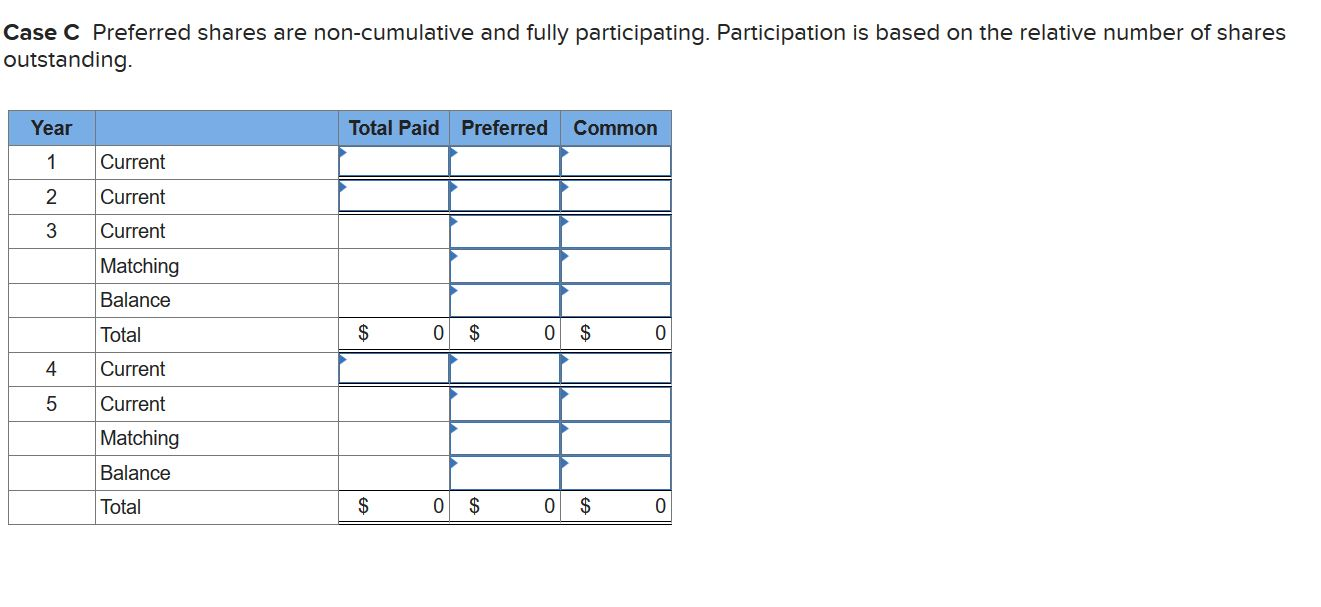

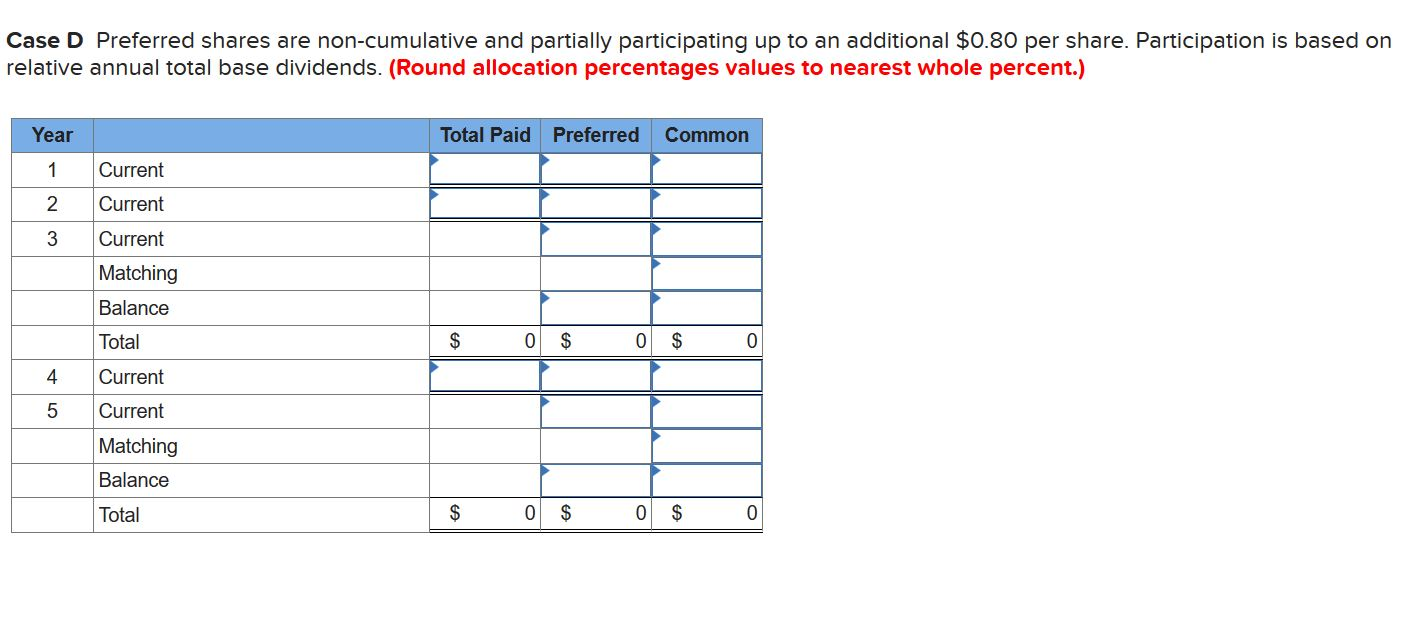

Massive Corp. is authorized to issue unlimited $0.80 no-par preferred shares and unlimited no-par common shares. There are 15,000 preferred and 45,000 common shares outstanding. In a five-year period, annual dividends paid were $2,000, $6,000, $86,000, $5,000, and $172,000, respectively. Required: Calculate the amount of dividends that would be paid to each share class for each year under the following separate cases. Where applicable, the matching dividend per common share is $1.00. Case A Preferred shares are cumulative and non-participating. Year Total Paid Preferred Common 2 Partial Partial Arrears Current Total Partial $ 0 $ 0 $ 0 4 Arrears Current Total $ 0 $ 0 $ Case B Preferred shares are non-cumulative and non-participating. Year Total Paid Preferred Common Case C Preferred shares are non-cumulative and fully participating. Participation is based on the relative number of shares outstanding. Year Total Paid Preferred Common WN - 2 Current Current Current Matching Balance Total Current Current Matching Balance Total $ 0 $ 0 $ $ 0 $ 0 $ Case D Preferred shares are non-cumulative and partially participating up to an additional $0.80 per share. Participation is based on relative annual total base dividends. (Round allocation percentages values to nearest whole percent.) Year Total Paid Preferred Common 2 3 Current Current Current Matching Balance Total Current Current Matching Balance 0 $ 0 $ Total $ 0 $ 0 $ 0 Massive Corp. is authorized to issue unlimited $0.80 no-par preferred shares and unlimited no-par common shares. There are 15,000 preferred and 45,000 common shares outstanding. In a five-year period, annual dividends paid were $2,000, $6,000, $86,000, $5,000, and $172,000, respectively. Required: Calculate the amount of dividends that would be paid to each share class for each year under the following separate cases. Where applicable, the matching dividend per common share is $1.00. Case A Preferred shares are cumulative and non-participating. Year Total Paid Preferred Common 2 Partial Partial Arrears Current Total Partial $ 0 $ 0 $ 0 4 Arrears Current Total $ 0 $ 0 $ Case B Preferred shares are non-cumulative and non-participating. Year Total Paid Preferred Common Case C Preferred shares are non-cumulative and fully participating. Participation is based on the relative number of shares outstanding. Year Total Paid Preferred Common WN - 2 Current Current Current Matching Balance Total Current Current Matching Balance Total $ 0 $ 0 $ $ 0 $ 0 $ Case D Preferred shares are non-cumulative and partially participating up to an additional $0.80 per share. Participation is based on relative annual total base dividends. (Round allocation percentages values to nearest whole percent.) Year Total Paid Preferred Common 2 3 Current Current Current Matching Balance Total Current Current Matching Balance 0 $ 0 $ Total $ 0 $ 0 $ 0