Answered step by step

Verified Expert Solution

Question

1 Approved Answer

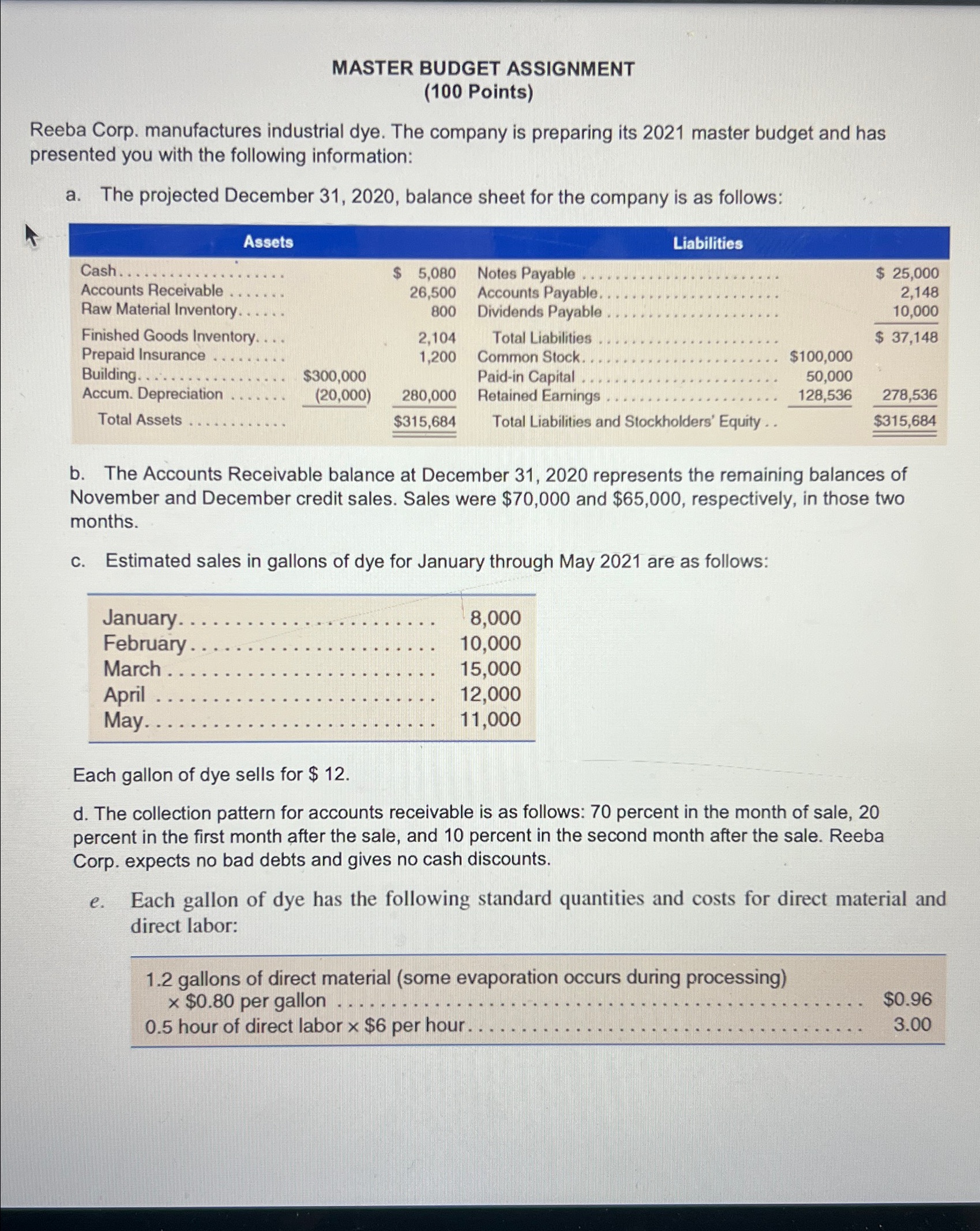

MASTER BUDGET ASSIGNMENT ( 1 0 0 Points ) Reeba Corp. manufactures industrial dye. The company is preparing its 2 0 2 1 master budget

MASTER BUDGET ASSIGNMENT

Points

Reeba Corp. manufactures industrial dye. The company is preparing its master budget and has

presented you with the following information:

a The projected December balance sheet for the company is as follows:

b The Accounts Receivable balance at December represents the remaining balances of

November and December credit sales. Sales were $ and $ respectively, in those two

months.

c Estimated sales in gallons of dye for January through May are as follows:

Each gallon of dye sells for $

d The collection pattern for accounts receivable is as follows: percent in the month of sale,

percent in the first month after the sale, and percent in the second month after the sale. Reeba

Corp. expects no bad debts and gives no cash discounts.

e Each gallon of dye has the following standard quantities and costs for direct material and

direct labor:

gallons of direct material some evaporation occurs during processingVariable overhead VOH is applied to the product on a machinehour basis. Processing one gallon of dye takes five hours of machine time. The variable overhead rate is $ per machine hour; VOH consists entirely of utility costs. Total annual fixed overhead is $; it is applied at $ per gallon based on an expected annual capacity of gallons. Fixed overhead per year is composed of the following costs:

Salanes.

Utilities

Insurancefactory Depreciationfactory.

Fixed overhead is incurred evenly throughout the year.

There is no beginning Work in Process Inventory. All work in process is completed in the period in which it is started. Raw Material Inventory at the beginning of the year consists of gallons of direct material at a standard cost of $ per gallon. There are gallons of dye in Finished Goods Inventory at the beginning of the year carried at a standard cost of $ per gallon: direct material, $; direct labor, $; variable overhead, $; and fixed overhead, $

h

Accounts Payable relates solely to raw material and is paid percent in the month of purchase and percent in the month after purchase. No discounts are received for prompt payment.

i The dividend will be paid in January

j A new piece of equipment costing $ will be purchased on March Payment of percent will be made in March and percent in April. The equipment has a useful life of three years, will have no salvage value, and will be placed into service on March

k

The note payable has a percent interest rate; interest is paid at the end of each month. The principal of the note is repaid as cash is available to do so

Kalogridis Corp.s management has set a minimum cash balance at $ Investments and borrowings are made in even $ amounts. Interest on any borrowings is expected to be percent per year, and investments will earn percent per year.

m

The ending Finished Goods Inventory should include percent of the next month's sales. This situation will not be true at the beginning of due to a miscalculation in sales for December. The ending inventory of raw materials also should be percent of the next month's needs.

n

Selling and administrative costs per month are as follows: salaries, $; rent, $; and utilities, $ These costs are paid in cash as they are incurred.

The company's tax rate is percent. Round to the nearest dollar.

Required:

a Calculate a sales budget for the first quarter monthly and in total

b Calculate an accounts receivable collections for the first quarter monthly and in total

C

Calculate a Purchases budget the first quarter monthly and in total d

Create a cash receipts budget the first quarter monthly and in total

e

Create a cash disbursements budget the first quarter monthly and in total

f Create an overall cash budge the first quarter monthly and in total

g Create a budgeted income statement. One for the quarter

h Balance Sheet Bonus Points at end of quarter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started