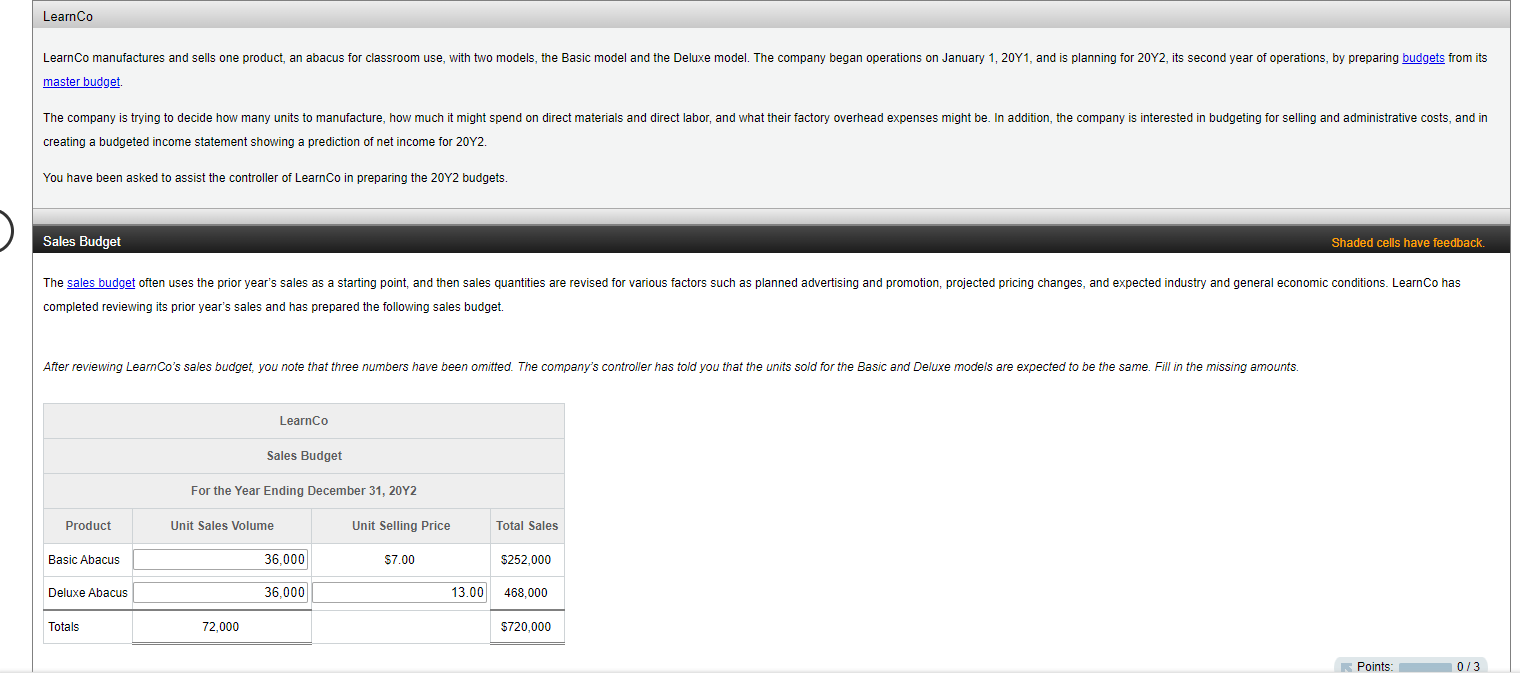

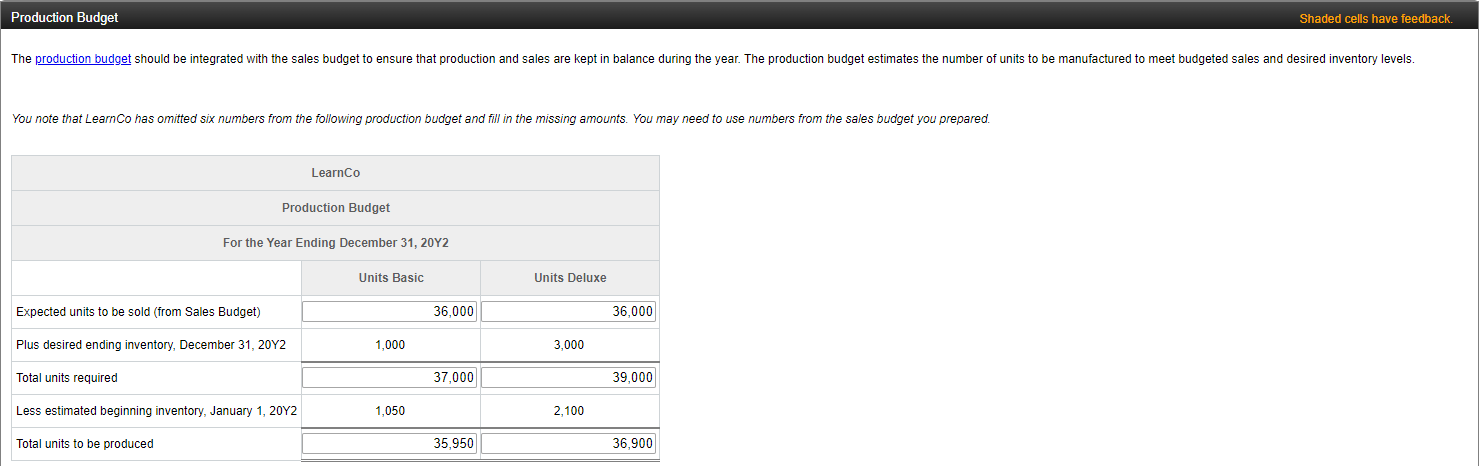

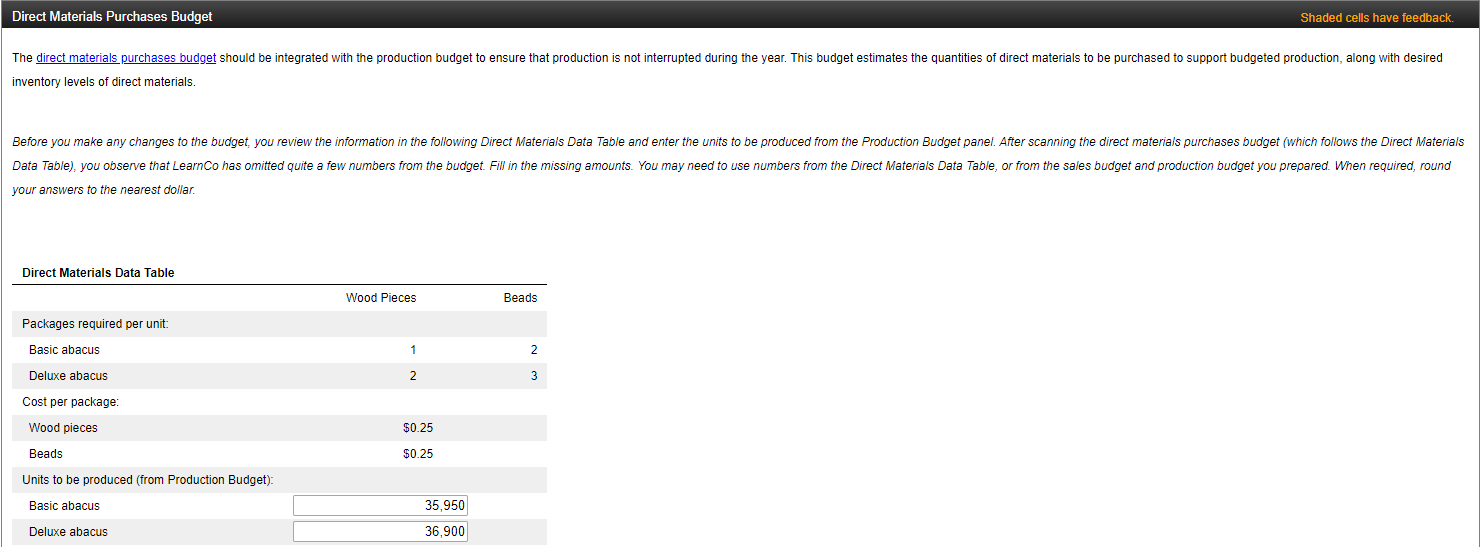

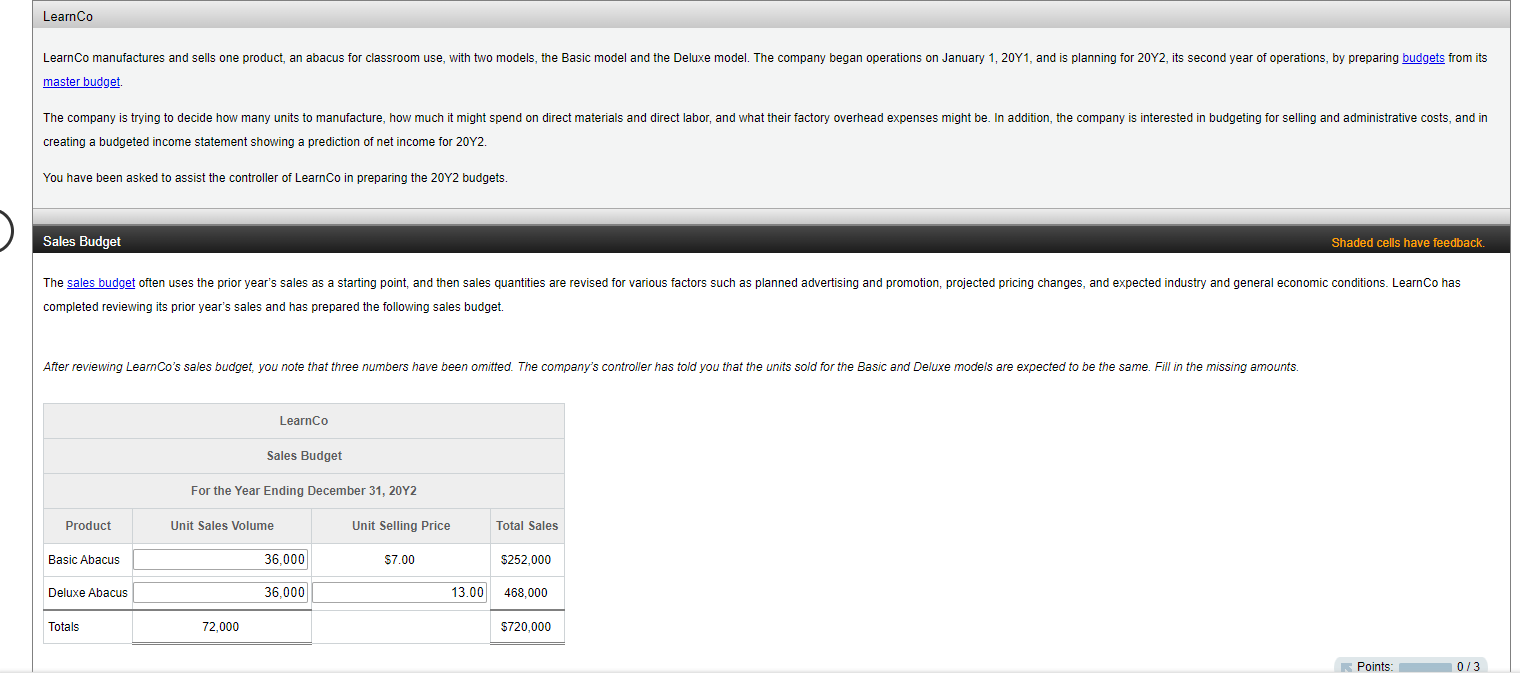

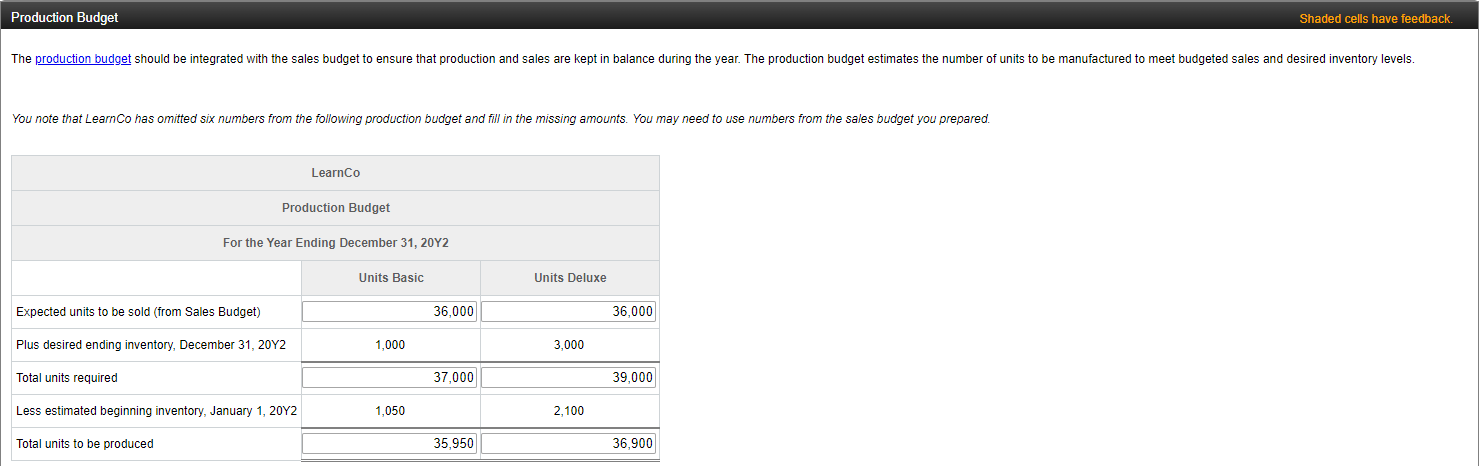

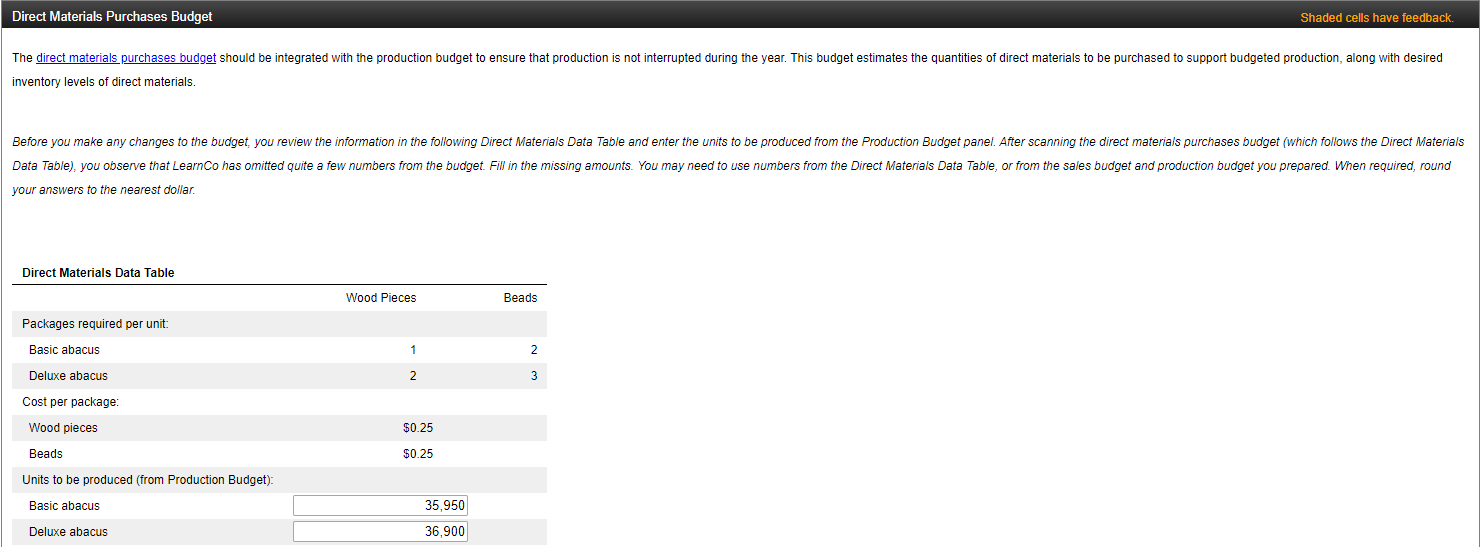

master budget. creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget Shaded cells have feedback. completed reviewing its prior year's sales and has prepared the following sales budget. You note that LearnCo has omitted six numbers from the following production budget and fill in the missing amounts. You may need to use numbers from the sales budget you prepared. inventory levels of direct materials. your answers to the nearest dollar. Direct labor needs from the direct labor cost budget should be coordinated between the production and personnel departments so that there will be enough labor available for production. When required, round your answers to the nearest dollar. costs so that department managers may monitor and evaluate costs during the year. For simplicity, LearnCo has not separated costs in this manner. After reviewing the following factory overhead cost budget, you note that Learnco has completed the budget with the exception of one amount. Fill in the missing amount. Complete the preparation of the cost of goods sold budget for LearnCo, using information that follows provided by the controller, and using the previous budgets you have prepared. Selling/Admin. Expenses Budget in the budgeted income statement. Budgeted Income Statement \begin{tabular}{lr} \multicolumn{2}{l}{ Budgeted Income Statement Data Table } \\ \hline Interest revenue for the year & $2,000 \\ Interest expense for the year & $1,500 \\ LearnCo's income tax rate & 40% \end{tabular} Budgeting affects the planning, directing, and controlling functions of management. LearnCo wishes to determine the sensitivity of some of its budget values to changes in the economy. LearnCo will still have positive income before income tax if it sells zero Deluxe Abacus units in 20Y2. If LearnCo sells zero Deluxe Abacus units in 20Y2, it will break even (i.e., the company will have zero income before income tax). LearnCo will have a net loss before income tax if it sells zero Deluxe Abacus units in 20Y2. Feedback Check My Work Consider the change in Deluxe abacus sales and its effect on the Sales Budget, then follow that change through the budget chain to the Budgeted Income Statement. 2. LeamCo's vendor for bead packages is expected to double its price per package of beads. If this occurs, what will be the effect on LearnCo's income before income tax? LearnCo will still have positive income before income tax if the price for bead packages doubles. LearnCo will have a loss before income tax if the price for bead packages doubles. If the price for bead packages doubles, LearnCo will break even (i.e., the company will have zero income before income tax). LearnCo will have a loss before income tax if Gluing labor costs increase to $15.00 per hour. If Gluing labor costs increase to $15.00 per hour, LearnCo will break even (i.e., the company will have zero income before income tax). LearnCo vill still have positive income before income tax if Gluing labor costs increase to $15.00 per hour. Feedback Check My Work master budget. creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget Shaded cells have feedback. completed reviewing its prior year's sales and has prepared the following sales budget. You note that LearnCo has omitted six numbers from the following production budget and fill in the missing amounts. You may need to use numbers from the sales budget you prepared. inventory levels of direct materials. your answers to the nearest dollar. Direct labor needs from the direct labor cost budget should be coordinated between the production and personnel departments so that there will be enough labor available for production. When required, round your answers to the nearest dollar. costs so that department managers may monitor and evaluate costs during the year. For simplicity, LearnCo has not separated costs in this manner. After reviewing the following factory overhead cost budget, you note that Learnco has completed the budget with the exception of one amount. Fill in the missing amount. Complete the preparation of the cost of goods sold budget for LearnCo, using information that follows provided by the controller, and using the previous budgets you have prepared. Selling/Admin. Expenses Budget in the budgeted income statement. Budgeted Income Statement \begin{tabular}{lr} \multicolumn{2}{l}{ Budgeted Income Statement Data Table } \\ \hline Interest revenue for the year & $2,000 \\ Interest expense for the year & $1,500 \\ LearnCo's income tax rate & 40% \end{tabular} Budgeting affects the planning, directing, and controlling functions of management. LearnCo wishes to determine the sensitivity of some of its budget values to changes in the economy. LearnCo will still have positive income before income tax if it sells zero Deluxe Abacus units in 20Y2. If LearnCo sells zero Deluxe Abacus units in 20Y2, it will break even (i.e., the company will have zero income before income tax). LearnCo will have a net loss before income tax if it sells zero Deluxe Abacus units in 20Y2. Feedback Check My Work Consider the change in Deluxe abacus sales and its effect on the Sales Budget, then follow that change through the budget chain to the Budgeted Income Statement. 2. LeamCo's vendor for bead packages is expected to double its price per package of beads. If this occurs, what will be the effect on LearnCo's income before income tax? LearnCo will still have positive income before income tax if the price for bead packages doubles. LearnCo will have a loss before income tax if the price for bead packages doubles. If the price for bead packages doubles, LearnCo will break even (i.e., the company will have zero income before income tax). LearnCo will have a loss before income tax if Gluing labor costs increase to $15.00 per hour. If Gluing labor costs increase to $15.00 per hour, LearnCo will break even (i.e., the company will have zero income before income tax). LearnCo vill still have positive income before income tax if Gluing labor costs increase to $15.00 per hour. Feedback Check My Work