Master Budget Project

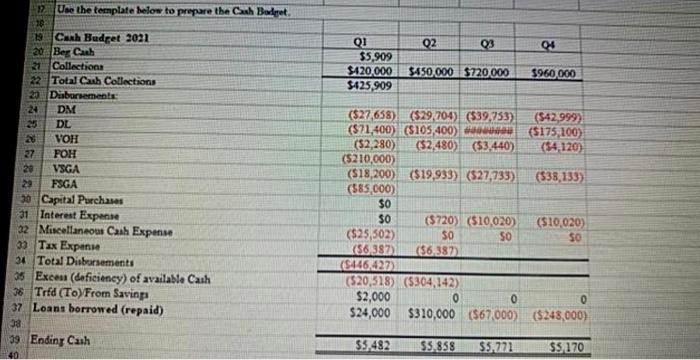

Can someone help me filling the 3rd picture

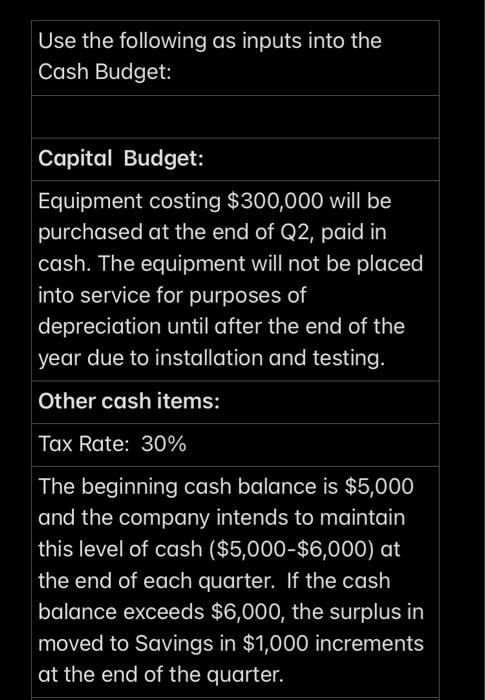

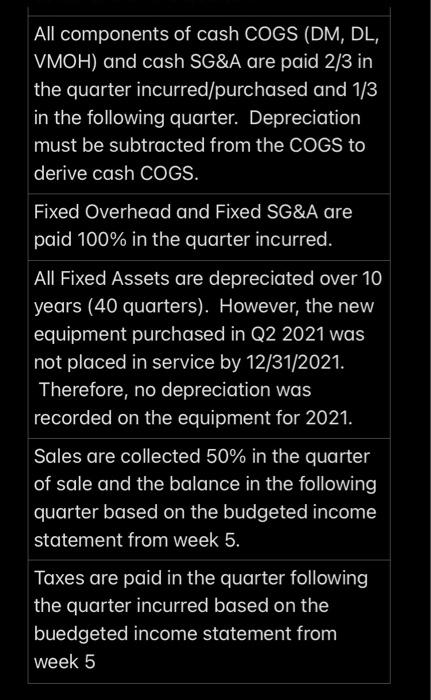

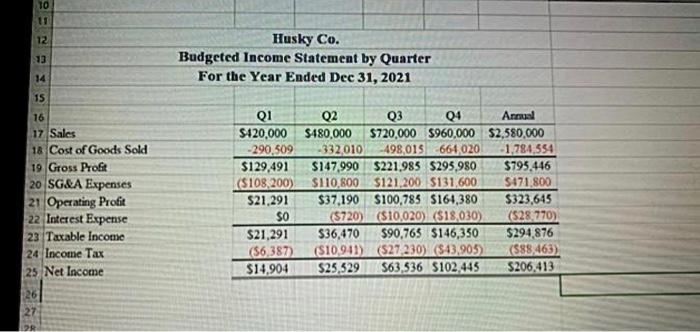

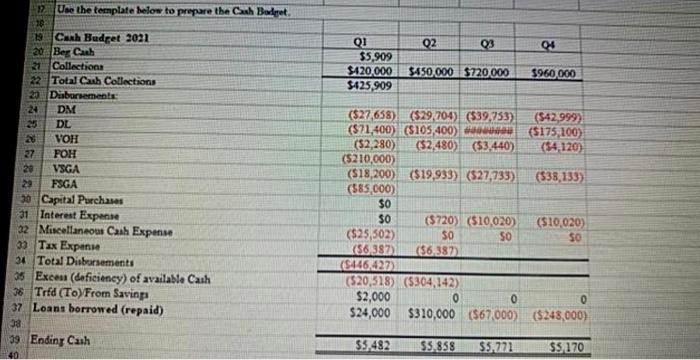

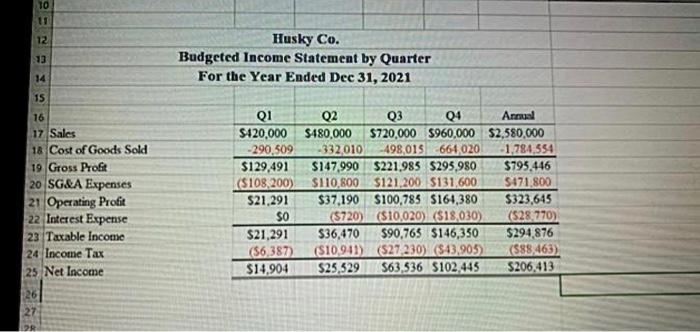

Use the following as inputs into the Cash Budget: Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of each quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100% in the quarter incurred. All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the buedgeted income statement from week 5 17. Use the template helow to prepare the Cuah Balpet. 2725 3827 Use the following as inputs into the Cash Budget: Capital Budget: Equipment costing $300,000 will be purchased at the end of Q2, paid in cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing. Other cash items: Tax Rate: 30% The beginning cash balance is $5,000 and the company intends to maintain this level of cash ($5,000$6,000) at the end of each quarter. If the cash balance exceeds $6,000, the surplus in moved to Savings in $1,000 increments at the end of the quarter. All components of cash COGS (DM, DL, VMOH) and cash SG\&A are paid 2/3 in the quarter incurred/purchased and 1/3 in the following quarter. Depreciation must be subtracted from the COGS to derive cash COGS. Fixed Overhead and Fixed SG\&A are paid 100% in the quarter incurred. All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Sales are collected 50% in the quarter of sale and the balance in the following quarter based on the budgeted income statement from week 5. Taxes are paid in the quarter following the quarter incurred based on the buedgeted income statement from week 5 17. Use the template helow to prepare the Cuah Balpet. 2725 3827