Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Master Budget Project Okay Company is preparing to build its master budget. The budget will detail each quarter's activity and the activity for the

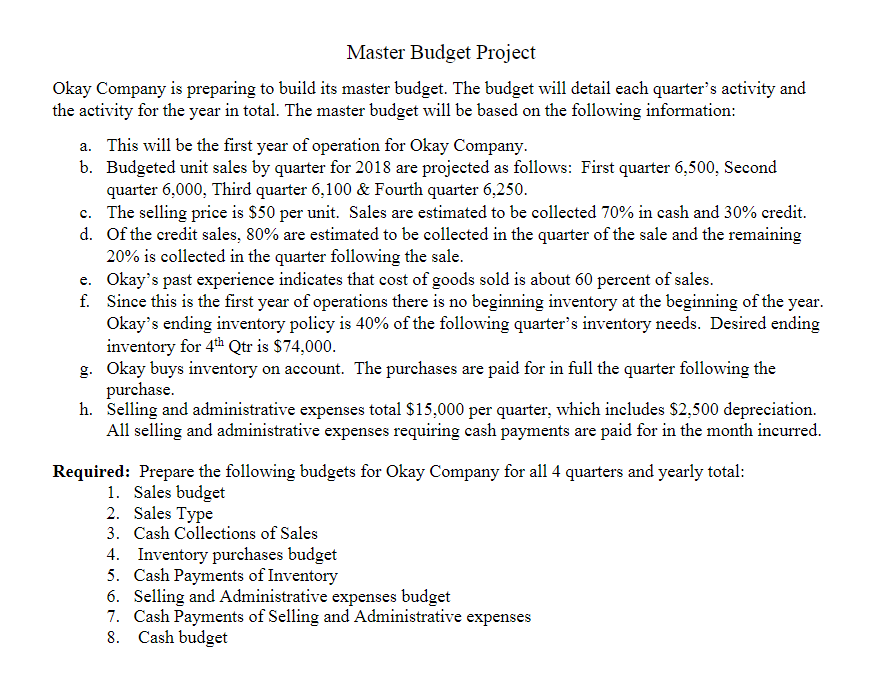

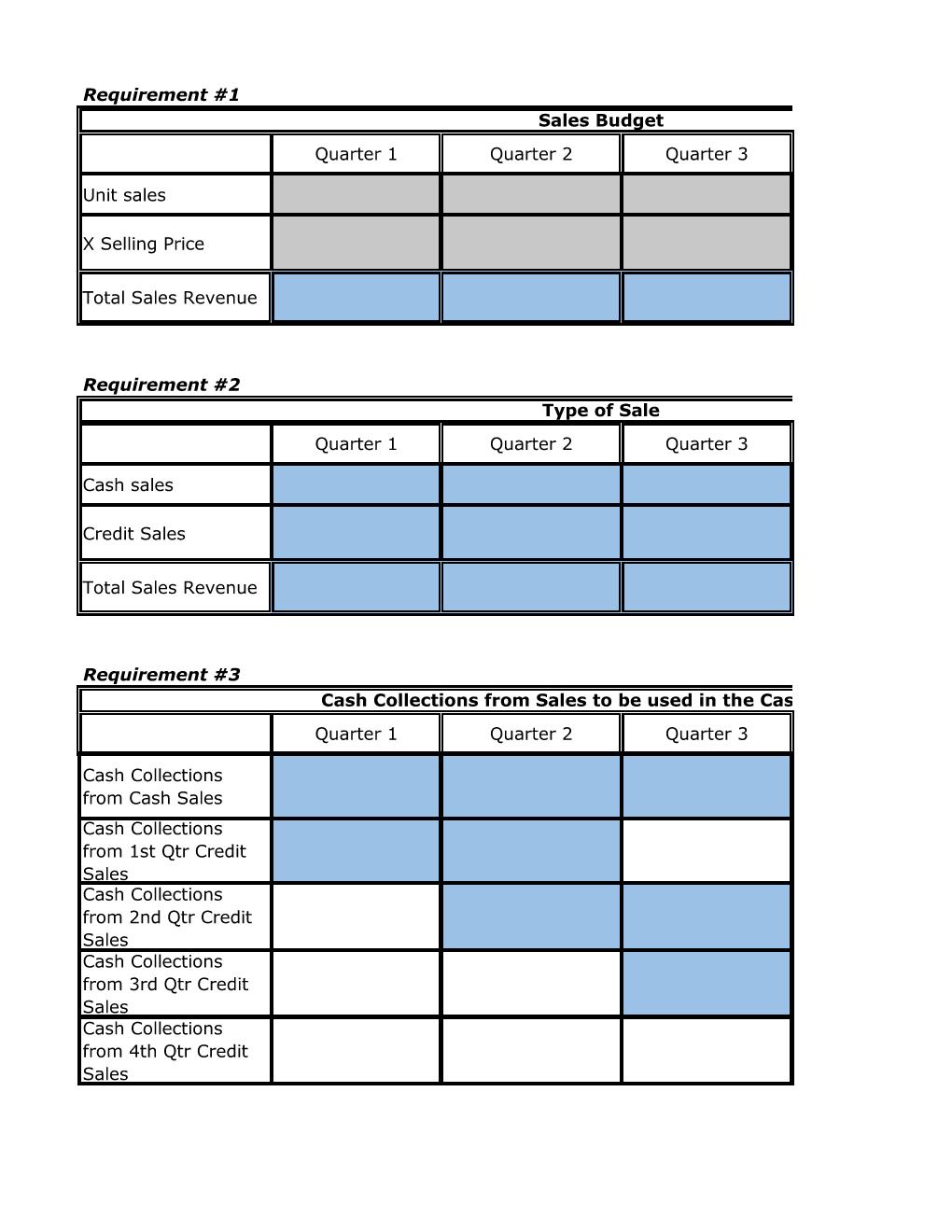

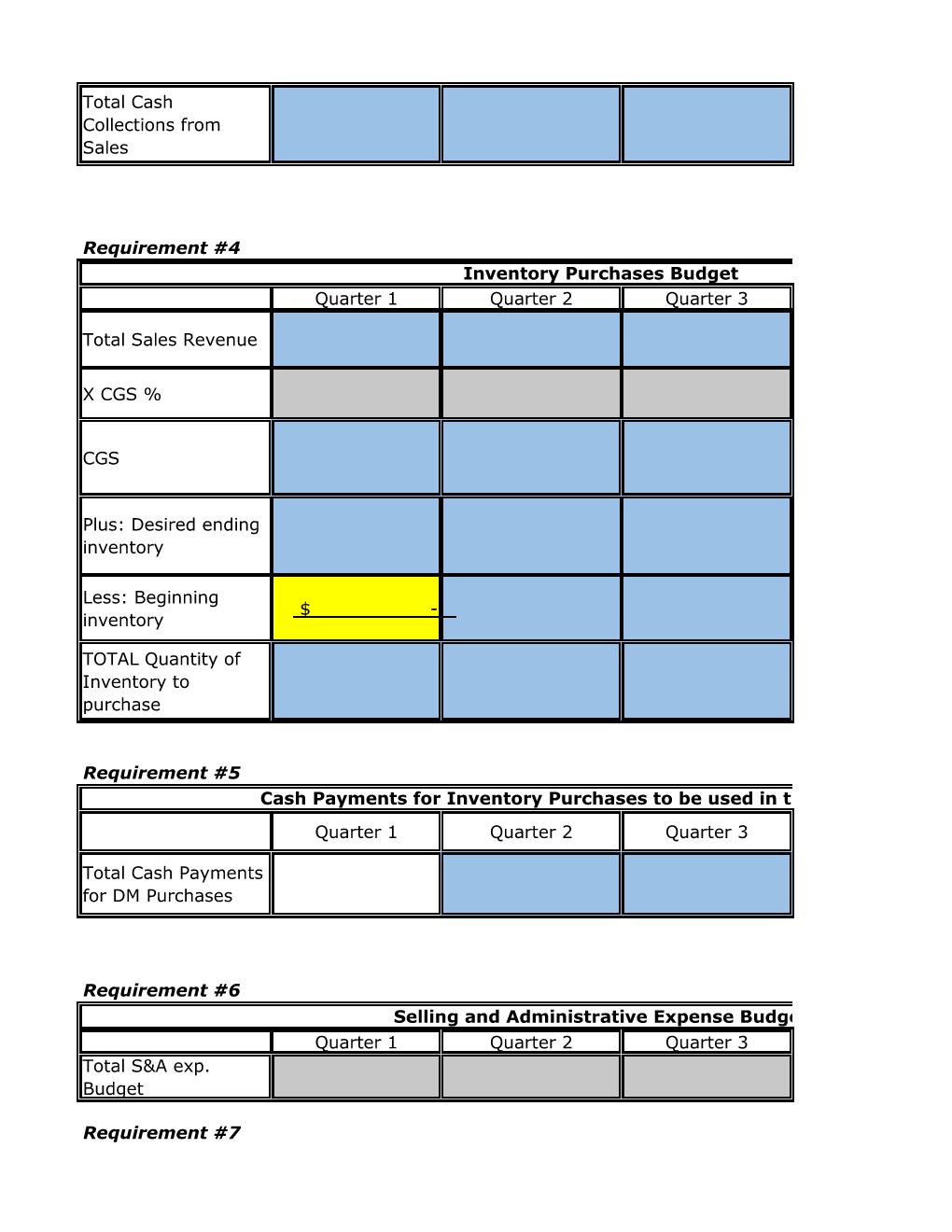

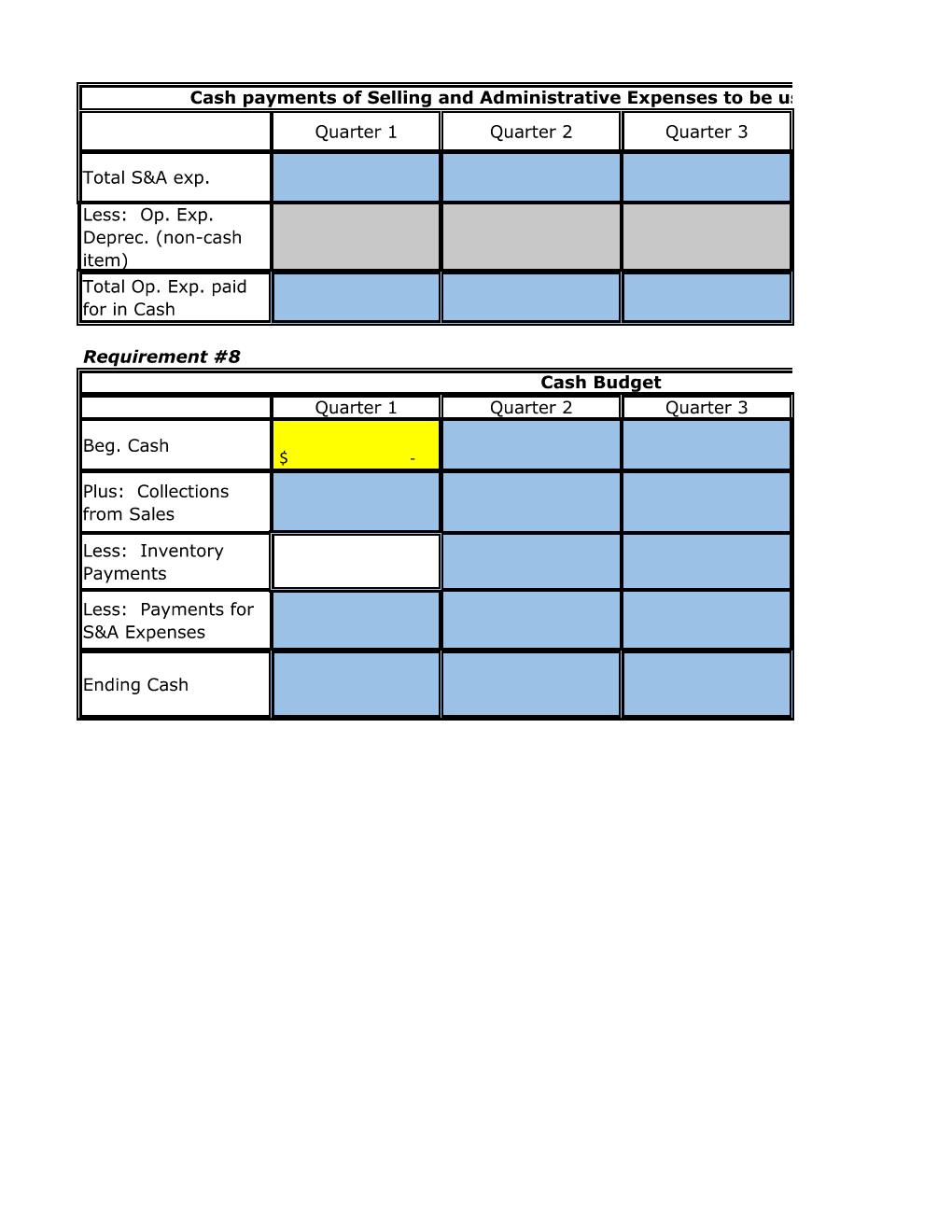

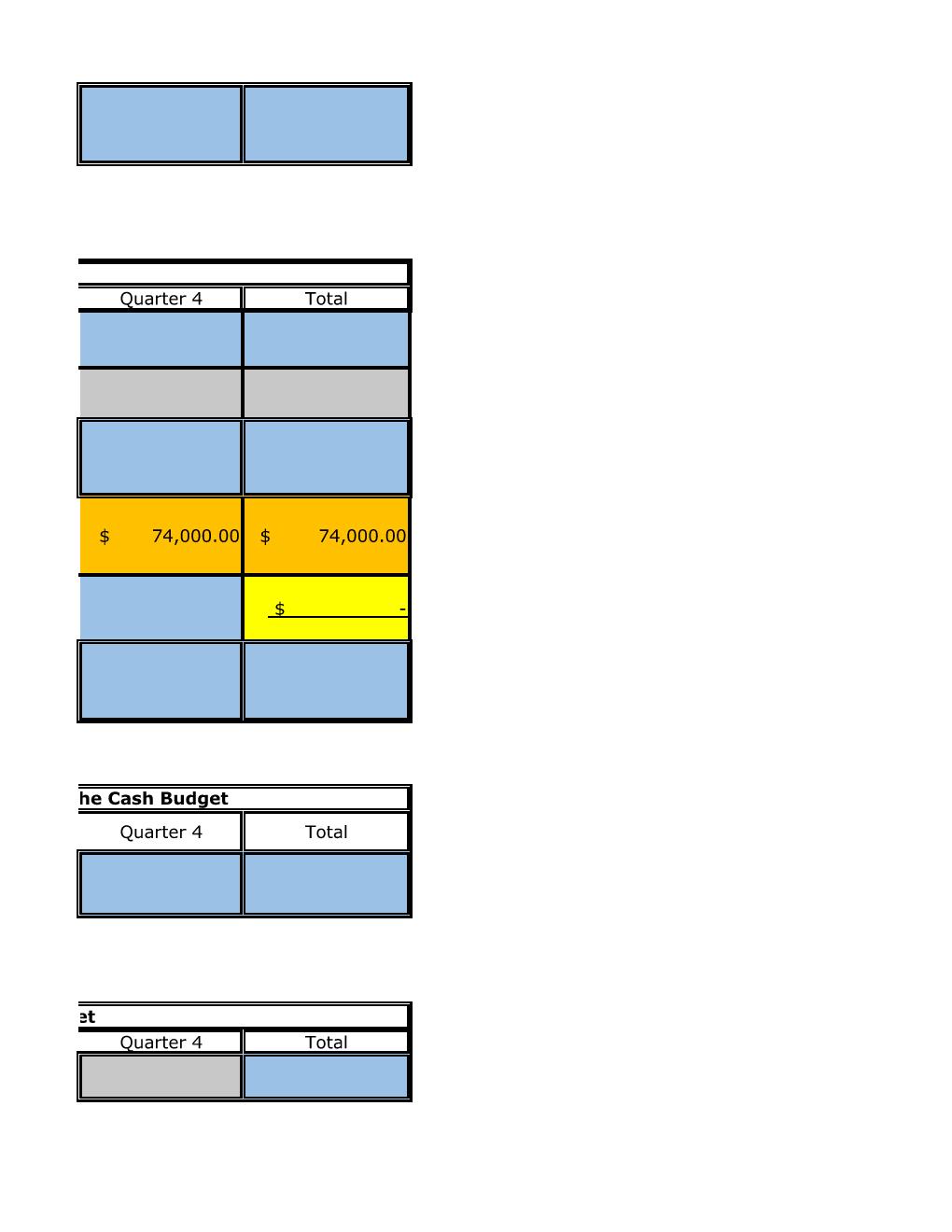

Master Budget Project Okay Company is preparing to build its master budget. The budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: a. This will be the first year of operation for Okay Company. b. Budgeted unit sales by quarter for 2018 are projected as follows: First quarter 6,500, Second quarter 6,000, Third quarter 6,100 & Fourth quarter 6,250. c. The selling price is $50 per unit. Sales are estimated to be collected 70% in cash and 30% credit. d. Of the credit sales, 80% are estimated to be collected in the quarter of the sale and the remaining 20% is collected in the quarter following the sale. e. Okay's past experience indicates that cost of goods sold is about 60 percent of sales. f. Since this is the first year of operations there is no beginning inventory at the beginning of the year. Okay's ending inventory policy is 40% of the following quarter's inventory needs. Desired ending inventory for 4th Qtr is $74,000. g. Okay buys inventory on account. The purchases are paid for in full the quarter following the purchase. h. Selling and administrative expenses total $15,000 per quarter, which includes $2,500 depreciation. All selling and administrative expenses requiring cash payments are paid for in the month incurred. Required: Prepare the following budgets for Okay Company for all 4 quarters and yearly total: 1. Sales budget 2. Sales Type 3. Cash Collections of Sales 4. Inventory purchases budget 5. Cash Payments of Inventory 6. Selling and Administrative expenses budget 7. Cash Payments of Selling and Administrative expenses 8. Cash budget Requirement #1 Unit sales X Selling Price Total Sales Revenue Requirement #2 Cash sales Credit Sales Total Sales Revenue Sales Budget Quarter 1 Quarter 2 Quarter 3 Type of Sale Quarter 1 Quarter 2 Quarter 3 Requirement #3 Cash Collections from Sales to be used in the Cas Quarter 1 Quarter 2 Quarter 3 Cash Collections from Cash Sales Cash Collections from 1st Qtr Credit Sales Cash Collections from 2nd Qtr Credit Sales Cash Collections from 3rd Qtr Credit Sales Cash Collections from 4th Qtr Credit Sales Total Cash Collections from Sales Requirement #4 Quarter 1 Inventory Purchases Budget Quarter 2 Quarter 3 Total Sales Revenue X CGS % CGS Plus: Desired ending inventory Less: Beginning inventory TOTAL Quantity of Inventory to purchase Requirement #5 Cash Payments for Inventory Purchases to be used in t Total Cash Payments for DM Purchases Quarter 1 Requirement #6 Quarter 1 Total S&A exp. Budget Requirement #7 Quarter 2 Quarter 3 Selling and Administrative Expense Budg Quarter 2 Quarter 3 Cash payments of Selling and Administrative Expenses to be u Total S&A exp. Less: Op. Exp. Deprec. (non-cash item) Total Op. Exp. paid for in Cash Requirement #8 Beg. Cash Plus: Collections from Sales Less: Inventory Payments Less: Payments for S&A Expenses Ending Cash Quarter 1 Quarter 2 Quarter 3 Cash Budget Quarter 1 Quarter 2 Quarter 3 $ Quarter 4 Total Quarter 4 Total h Budget Quarter 4 Total $ Quarter 4 Total 74,000.00 $ 74,000.00 he Cash Budget $ Quarter 4 Total et Quarter 4 Total sed in the Cash Budget Quarter 4 Total Quarter 4 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started