Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Masters level work!! Break even analysis all work must be shown MSBA 5710 Breakeven Assignment 1 Questions 1. A producer is considering the addition of

Masters level work!! Break even analysis all work must be shown

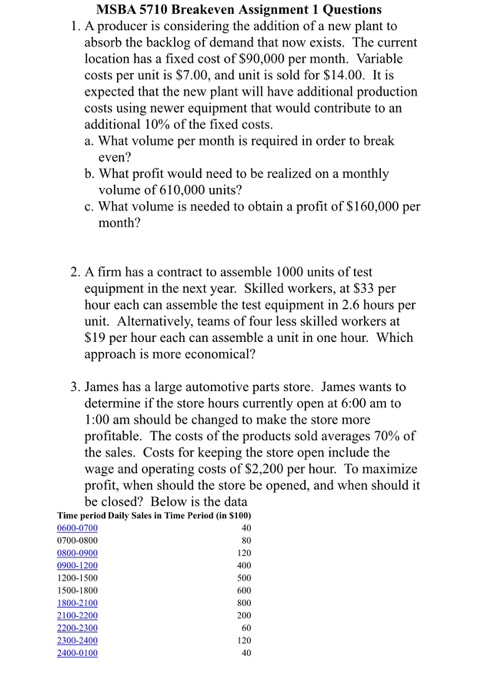

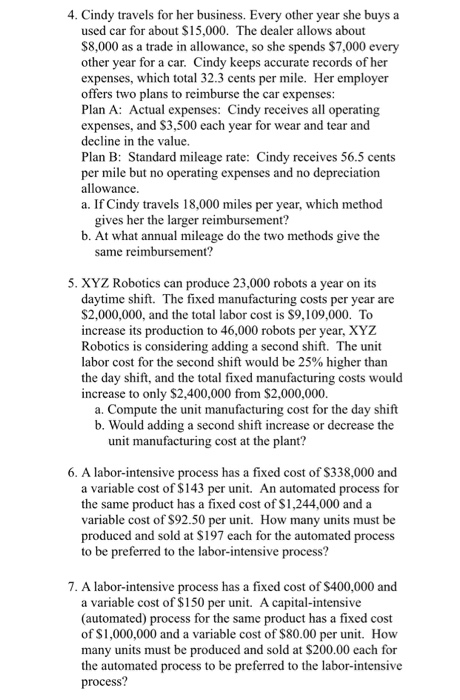

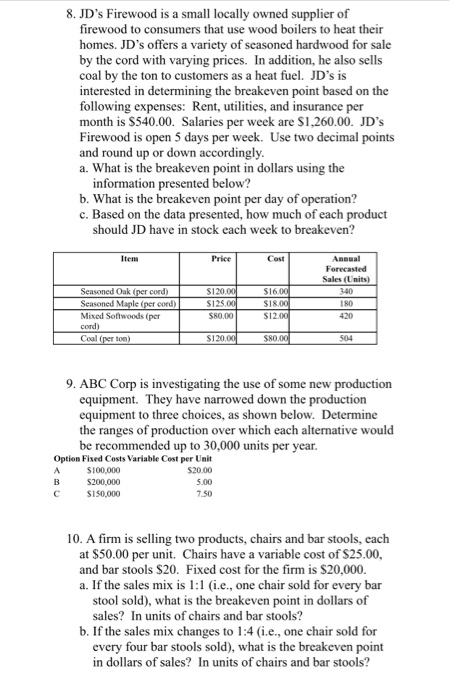

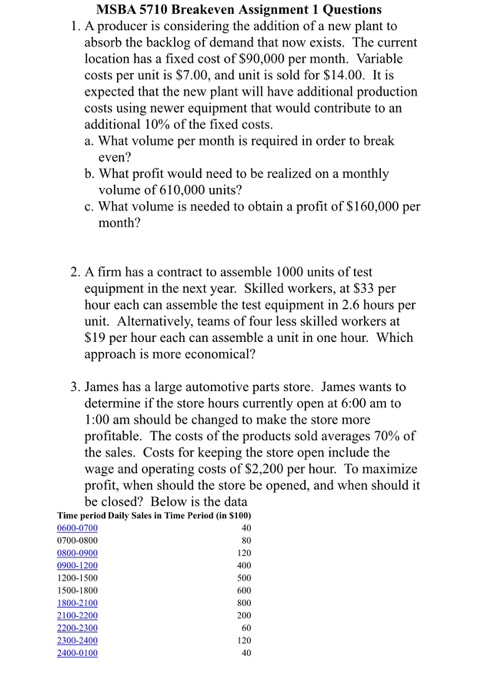

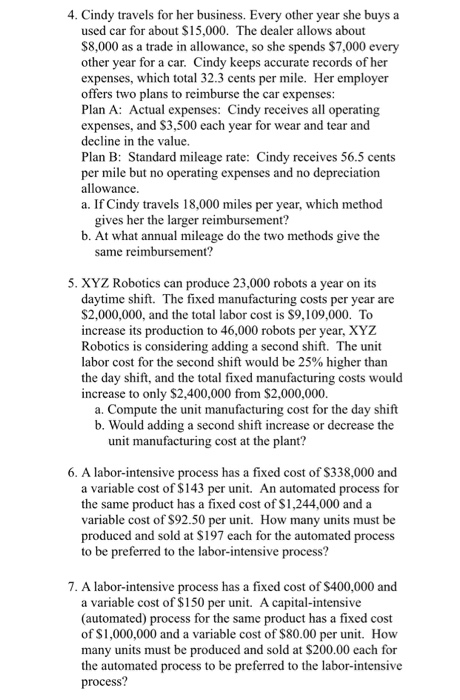

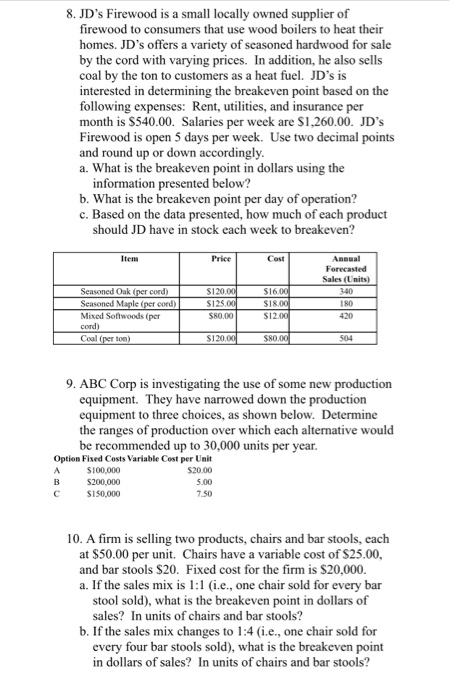

MSBA 5710 Breakeven Assignment 1 Questions 1. A producer is considering the addition of a new plant to absorb the backlog of demand that now exists. The current location has a fixed cost of $90,000 per month. Variable costs per unit is $7.00, and unit is sold for $14.00. It is expected that the new plant will have additional production costs using newer equipment that would contribute to an additional 10% of the fixed costs. a. What volume per month is required in order to break even b. What profit would need to be realized on a monthly volume of 610,000 units? c. What volume is needed to obtain a profit of $160,000 per month? 2. A firm has a contract to assemble 1000 units of test equipment in the next year. Skilled workers, at $33 per hour each can assemble the test equipment in 2.6 hours per unit. Alternatively, teams of four less skilled workers at $19 per hour each can assemble a unit in one hour. Which approach is more economical? 3. James has a large automotive parts store. James wants to determine if the store hours currently open at 6:00 am t 1:00 am should be changed to make the store more profitable. The costs of the products sold averages 70% of the sales. Costs for keeping the store open include the wage and operating costs of $2,200 per hour. To maximize profit, when should the store be opened, and when should it be closed? Below is the data Time period Daily Sales in Time Period (in S100) 40 80 120 400 500 600 800 200 60 120 40 1200-1500 1500-1800 2200-2300 4. Cindy travels for her business. Every other year she buys a used car for about $15,000. The dealer allows about $8,000 as a trade in allowance, so she spends $7,000 every other year for a car. Cindy keeps accurate records of her expenses, which total 32.3 cents per mile. Her employer offers two plans to reimburse the car expenses Plan A: Actual expenses: Cindy receives all operating expenses, and S3,500 each year for wear and tear and decline in the value Plan B: Standard mileage rate: Cindy receives 56.5 cents per mile but no operating expenses and no depreciation allowance a. If Cindy travels 18,000 miles per year, which methood gives her the larger reimbursement? b. At what annual mileage do the two methods give the me reimbursement? 5. XYZ Robotics can produce 23,000 robots a year on its daytime shift. The fixed manufacturing costs per year ane $2,000,000, and the total labor cost is S9,109,000. To increase its production to 46,000 robots per year, XY2 Robotics is considering adding a second shift. The unit labor cost for the second shift would be 25% higher than the day shift, and the total fixed manufacturing costs would increase to only $2,400,000 from $2,000,000 a. Compute the unit manufacturing cost for the day shift b. Would adding a second shift increase or decrease the unit manufacturing cost at the plant? 6. A labor-intensive process has a fixed cost of $338,000 and a variable cost of $143 per unit. An automated process for the same product has a fixed cost of S1,244,000 and a variable cost of $92.50 per u. How many units must be produced and sold at $197 each for the automated process to be preferred to the labor-intensive process? 7. A labor-intensive process has a fixed cost of $400,000 and a variable cost of $150 per unit. A capital-intensive (automated) process for the same product has a fixed cost of S1,000,000 and a variable cost of $80.00 per unit. How many units must be produced and sold at $200.00 each for the automated process to be preferred to the labor-intensive process? 8. JD's Firewood is a small locally owned supplier of firewood to consumers that use wood boilers to heat their homes. JD's offers a variety of seasoned hardwood for sale by the co coal by the ton to customers as a heat fuel. JD's is interested in determining the breakeven point based on the following expenses: Rent, uties, and insurance per month is S540.00. Salaries per week are S1,260.00. JD's rd with varying prices. In addition, he also sells is open 5 days per week. Use two decimal points and round up or down accordingly a. What is the breakeven point in dollars using the information presented below? b. What is the breakeven point per day of operation? c. Based on the data presented, how much of each product should JD have in stock each week to breakeven? Itema Price Sales (Units) Seasoned Oak (per cord) cord) 180 Mixed Softwoods (per cord) $80.00 420 Coal (per ton 80.0 504 9. ABC Corp is investigating the use of some new production equipment. They have narrowed down the production equipment to three choices, as shown below. Determine the ranges of production over which each alternative would be recommended up to 30,000 units per year Option Fixed Costs Variable Cost per Unit $20.00 S100,000 $200,000 S150,000 7.50 10. A firm is selling two products, chairs and bar stools, each at $50.00 per unit. Chairs have a variable cost of $25.00, and bar stools $20. Fixed cost for the firm is $20,000 a. If the sales mix is :1 (i.e., one chair sold for every bar stool sold), what is the breakeven point in dollars of b. If the sales mix changes to 1 :4 (i.e., one chair sold for in dollars of sales? In units of chairs and bar stools? sales? In units of chairs and bar stools? every four bar stools sold), what is the breakeven point

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started