Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Masterson Company has 420,000 shares of $10 par value common stock outstanding. During the year Masterson declared a 5% stock dividend when the

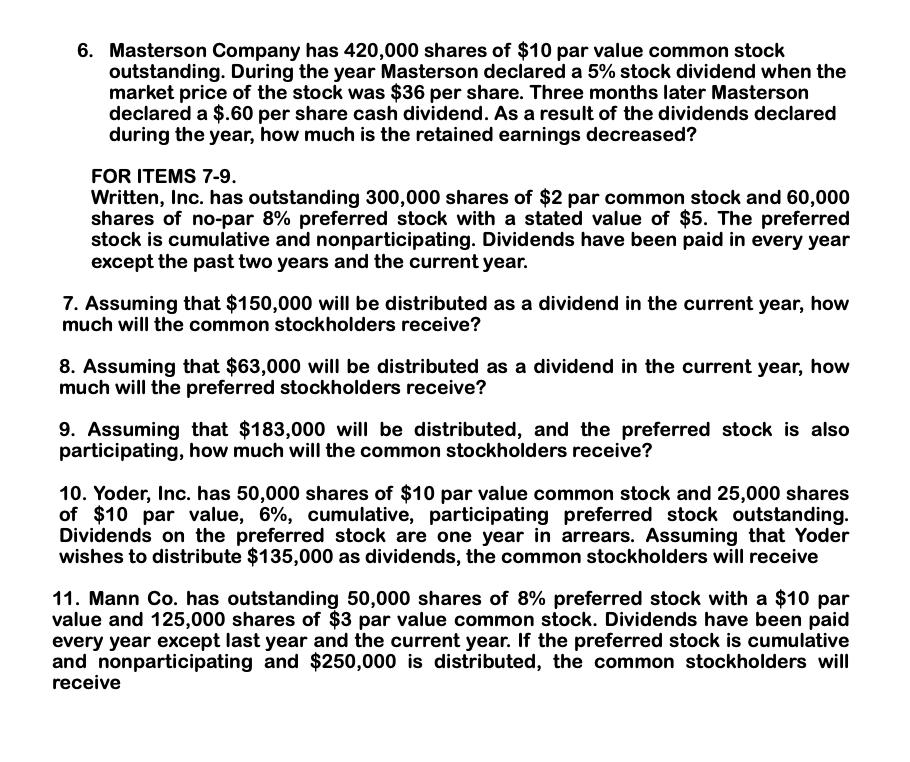

6. Masterson Company has 420,000 shares of $10 par value common stock outstanding. During the year Masterson declared a 5% stock dividend when the market price of the stock was $36 per share. Three months later Masterson declared a $.60 per share cash dividend. As a result of the dividends declared during the year, how much is the retained earnings decreased? FOR ITEMS 7-9. Written, Inc. has outstanding 300,000 shares of $2 par common stock and 60,000 shares of no-par 8% preferred stock with a stated value of $5. The preferred stock is cumulative and nonparticipating. Dividends have been paid in every year except the past two years and the current year. 7. Assuming that $150,000 will be distributed as a dividend in the current year, how much will the common stockholders receive? 8. Assuming that $63,000 will be distributed as a dividend in the current year, how much will the preferred stockholders receive? 9. Assuming that $183,000 will be distributed, and the preferred stock is also participating, how much will the common stockholders receive? 10. Yoder, Inc. has 50,000 shares of $10 par value common stock and 25,000 shares of $10 par value, 6%, cumulative, participating preferred stock outstanding. Dividends on the preferred stock are one year in arrears. Assuming that Yoder wishes to distribute $135,000 as dividends, the common stockholders will receive 11. Mann Co. has outstanding 50,000 shares of 8% preferred stock with a $10 par value and 125,000 shares of $3 par value common stock. Dividends have been paid every year except last year and the current year. If the preferred stock is cumulative and nonparticipating and $250,000 is distributed, the common stockholders will receive

Step by Step Solution

★★★★★

3.17 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started