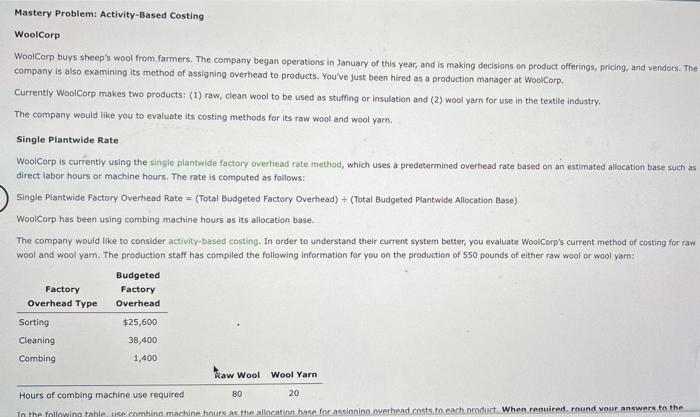

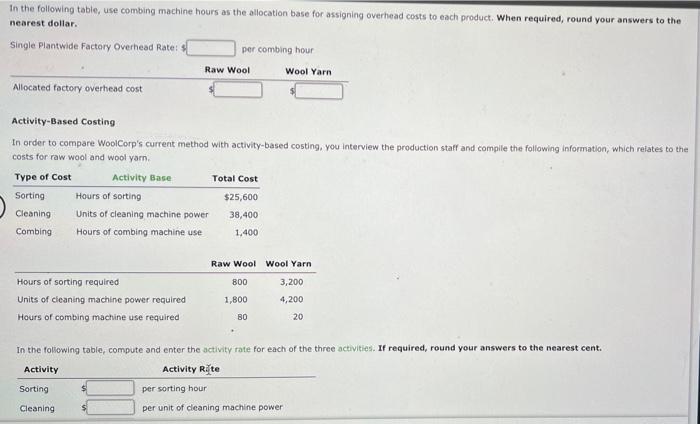

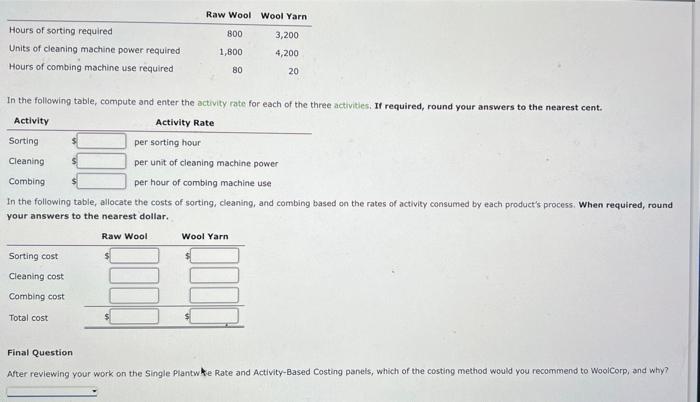

Mastery Problem: Activity-Based Costing WoolCorp WoolCorp buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product offerings, pricing, and vendors. The company is also examining its method of assigning overhead to products. You've just been hired as a production manager at WoolCorp. Currently WoolCorp makes two products: (1) raw, clean wool to be used as stuffing or insulation and (2) wool yarn for use in the textile industry, The company would like you to evaluate its costing methods for its raw wool and wool yarn. Single Plantwide Rate WoolCorp is currently using the single plantwide factory overhead rate method, which uses a predetermined overhead rate based on an estimated allocation base such as direct labor hours or machine hours. The rate is computed as follows: Single Plantwide Factory Overhead Rate = (Total Budgeted Factory Overhead) + (Total Budgeted Plantwide Allocation Base) WoolCorp has been using combing machine hours as its allocation base, The company would like to consider activity-based costing. In order to understand their current system better, you evaluate Wool Corp's current method of costing for raw wool and wool yarn. The production staff has complled the following information for you on the production of 550 pounds of either raw wool or wool yarn: Budgeted Factory Factory Overhead Type Overhead Sorting $25,600 Cleaning 38,400 Combing 1,400 Raw Wool wool Yarn Hours of combing machine use required 80 20 In the following table de combing machine hours as the allocation hase for accioning wwerhead costs to each nmdurt when required. round your answers to the In the following table, use combing machine hours as the allocation base for assigning overhead costs to each product. When required, round your answers to the nearest dollar. Single Plantwide Factory Overhead Rate: per combing hour Raw Wool Wool Yarn Allocated factory overhead cost Activity-Based Costing In order to compare WoolCorp's current method with activity-based costing, you interview the production staff and compile the following Information, which relates to the costs for raw wool and wool yarn Type of Cost Activity Base Total Cost Sorting Hours of sorting $25,600 Cleaning Units of cleaning machine power 38,400 Combing Hours of combing machine use 1.400 Raw Wool Wool Yarn 800 Hours of sorting required Units of cleaning machine power required Hours of combing machine use required 1,800 3,200 4,200 20 BO In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent. Activity Activity Rite Sorting per sorting hour Cleaning per unit of cleaning machine power Hours of sorting required Units of cleaning machine power required Hours of combing machine use required Raw Wool Wool Yarn 800 3,200 1,800 4,200 80 20 In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent. Activity Activity Rate Sorting per sorting hour Cleaning per unit of cleaning machine power Combing per hour of combing machine use In the following table, allocate the costs of sorting, cleaning, and combing based on the rates of activity consumed by each product's process. When required, round your answers to the nearest dollar. Raw Wool Wool Yarn Sorting cost Cleaning cost Combing cost Total cost Final Question After reviewing your work on the Single Plantwe Rate and Activity-Based Costing panels, which of the costing method would you recommend to WoolCorp, and why