mastery problem liabilities: current installment note and contingencies

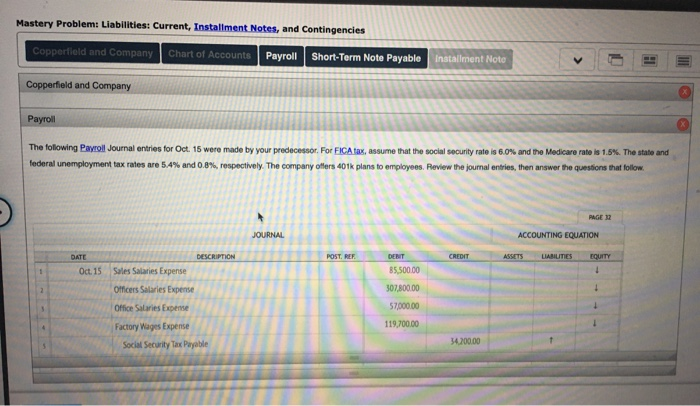

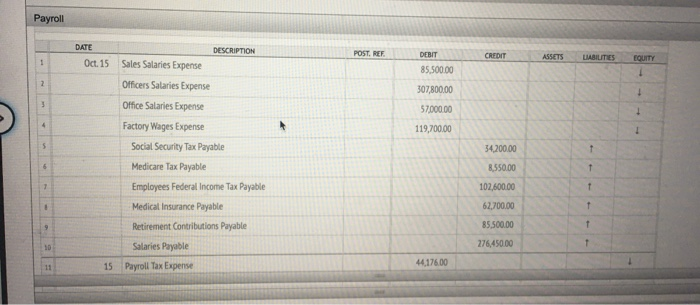

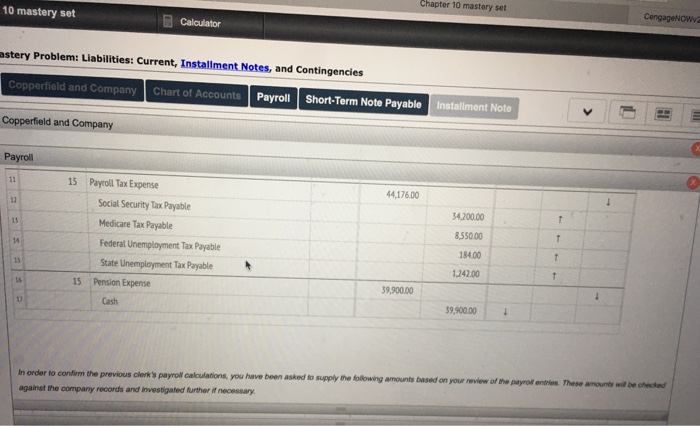

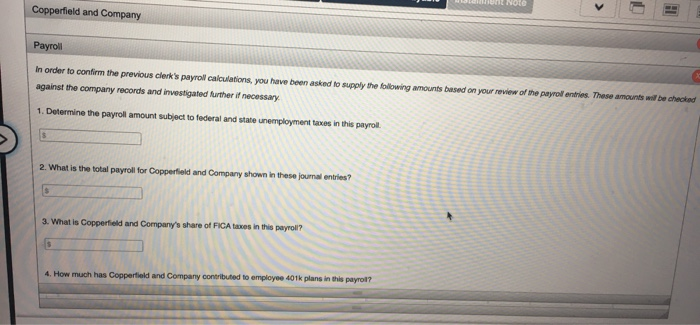

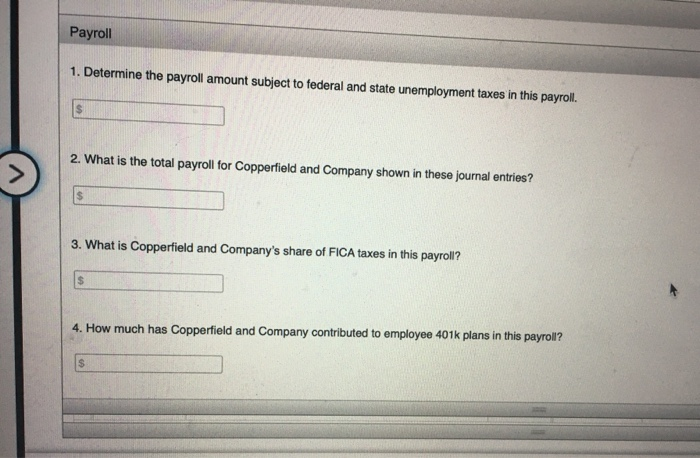

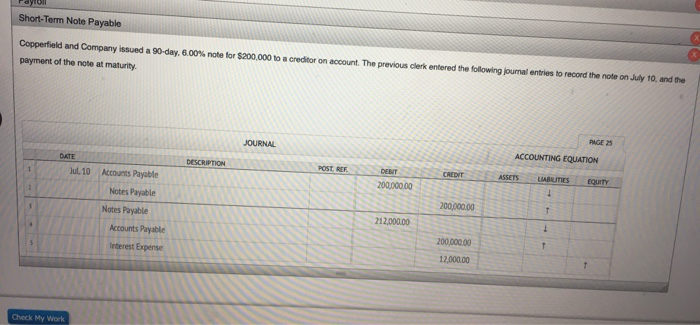

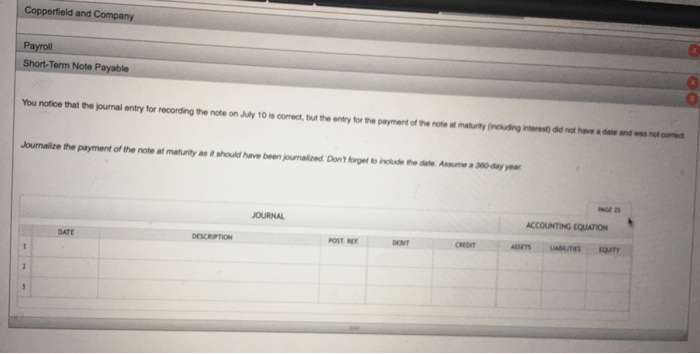

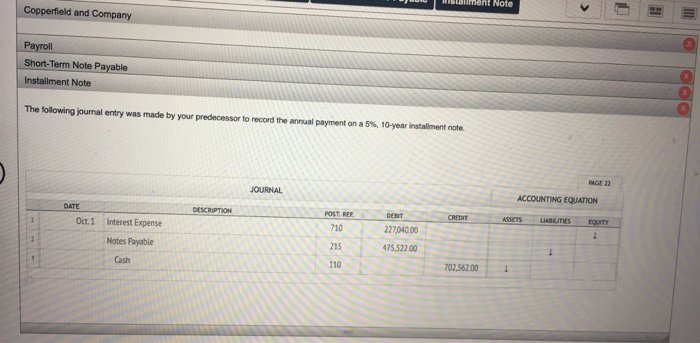

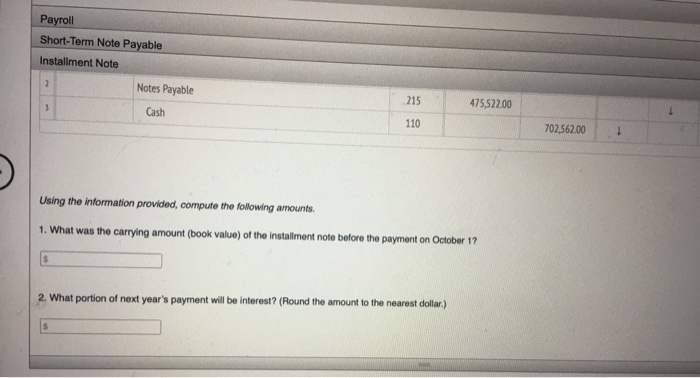

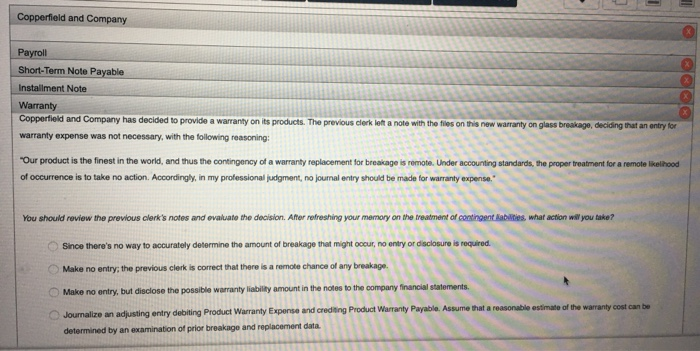

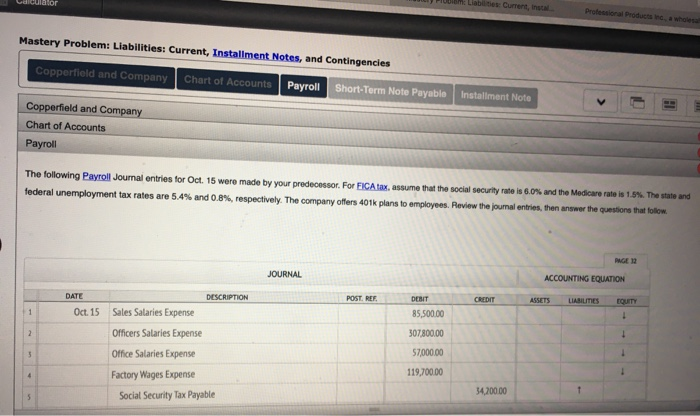

Mastery Problem: Liabilities: Current, Installment Notes, and Contingencies Copperfield and Company Chart of Accounts Payroll Short-Term Note Payable Installment Note Copperfield and Company Payroll The following Payroll Journal entries for Oct. 15 were made by your predecessor. For FICA tax, assume that the social security rate is 6.0 % and the Medicare rate is 1.5 % The state and federal unemployment tax rates are 5.4 % and 0.8 % , respectively. The company offers 401k plans to employees. Review the journal entries, then answer the questions that follow. PAGE 325 ACCOUNTING EQUATION JOURNAL DESCRIPTION CREDIT EQUITY POST. REF DEBIT ASSETS LIABILITIES DATE Oct. 15 85,500.00 Sales Salaries Expense Officers Salaries Expense 307,800.00 57,000.00 Office Salaries Expense 119,700.00 Factory Wages Expense 34,200.00 Social Security Tax Payable Payroll DATE DESCRIPTION POST. REF DEBIT CREDIT UABILITIES ASSETS EQUITY 1 Oct. 15 Sales Salaries Expense 85,500.00 Officers Salaries Expense 307800.00 Office Salaries Expense 3 57,000.00 1 Factory Wages Expense 4 119,70000 Social Security Tax Payable 34,200.00 T Medicare Tax Payable 6 8,550.00 T Employees Federal Income Tax Payable 102,60000 7 Medical Insurance Payable 62,700.00 85500.00 Retirement Contributions Payable 276,450.00 Salaries Payable 10 44176.00 15 Payroll Tax Expense 11 Chapter 10 mastery set CengageNOWv 10 mastery set Calculator astery Problem: Liabilities: Current, Installment Notes, and Contingencies Chart of Accounts Copperfield and Company Payroll Short-Term Note Payable Installment Note Copperfield and Company Payroll 11 Payroll Tax Expense 15 4417600 Social Security Tax Payable 12 34,200.00 Medicare Tax Payable 13 8550.00 Federal Unemployment Tax Payable 14 184.00 State Unemployment Tax Payable 15 1,242.00 Pension Expense 39,900.00 15 16 Cash 39,900.00 17 These amounts will be checked In order to confirm the previous clerk's payroll calculations, you have been asked to supply the folowing amounts based on your review of the payroll entries against the oompany records and investigated further if necessary 18rnt NOte Copperfield and Company Payroll In order to confirm the previous clerk's payroll calculations, you have been asked to supply the following amounts based on your review of the payroll entries. These amounts will be checked against the company records and investigated further if necessary 1. Determine the payroll amount subject to federal and state unemployment taxes in this payrol 2. What is the total payroll for Copperfield and Company shown in these jounal entries? 3. What is Copperfield and Company's share of FICA taxes in this payroll? 4. How much has Coppertield and Company contributed to employee 401k plans in this payrol? Payroll 1. Determine the payroll amount subject to federal and state unemployment taxes in this payrol. 2. What is the total payroll for Copperfield and Company shown in these journal entries? 3. What is Copperfield and Company's share of FICA taxes in this payroll? $ 4. How much has Copperfield and Company contributed to employee 401k plans in this payroll? $ Short-Term Note Payable Copperfield and Company issued a 90-day, 6.00 % note for $200,000 to a creditor on account. The previous clerk entered the following journal entries to record the note on July 10, and the payment of the note at maturity PAGE 25 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST REF CREDIT ASSETS UABILITIES DEBIT EQUITY Accounts Payable Jul. 10 200.00000 Nctes Payable 200,000.00 2 Nates Payable 212.000.00 Accounts Payable 200,000.00 Interest Expense 12,000.00 Check My Work Copperfield and Company Payroll Short-Term Note Payable You notice that the journal entry for recording the note on July 10 is comect, but the entry for the payment of the note at maturity including interest) did not have a date and was not comect Journalize the payment of the note at maturity as t should have been joumalized Don't forget to include the date Assume a 380-day year NGE 25 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION DEBIT ASSETS POST RE CREDIT LABUTIES equTY 2 Payroll Short-Term Note Payable Installment Note Notes Payable 2 215 475,522.00 3 Cash 110 702.562.00 Using the information provided, compute the following amounts 1. What was the carrying amount (book value) of the installment note before the payment on October 1? 2. What portion of next year's payment will be interest? (Round the amount to the nearest dollar.) Copperfield and Company Payroll Short-Term Note Payable Installment Note Warranty Copperfield and Company has decided to provide a warranty on its products. The previous clerk left a note with the files on this new warranty on glass breakage, deciding that an entry for warranty expense was not necessary, with the following reasoning "Our product is the finest in the world, and thus the contingency of a warranty replacement for breakage is remote. Under accounting standards, the proper treatment for a remote likelhood of occurrence is to take no action. Accordingly, in my professional judgment, no jounal entry should be made for warranty expense. You should review the previous clerk's notes and evaluate the docision. After refreshing your memory on the treatment of contingent Babilities what action wil you take? Since there's no way to accurately determine the amount of breakage that might occur, no entry or disclosure is required Make no entry; the previous clerk is correct that there is a remote chance of any breakage. O Make no entry, but disclose the possible warranty liability amount in the notes to the oompany financial statements. O Journalize an adjusting entry debiting Product Warranty Expense and crediting Product Warranty Payable. Assume that a reasonable estimate of the warranty cost can be determined by an examination of prior breakage and replacement data. O000 Liabilities: Cument, Instal Professional Products Inc, a wholesal Mastery Problem: Liabilities: Current, Installment Notes, and Contingencies Copperfield and Company Chart of Accounts Payroll Short-Term Note Payable Installment Note Copperfield and Company Chart of Accounts ayrol The following Payroll Journal entries for Oct. 15 were made by your predecessor. For FICA tax, assume that the social security rate is 6.0 % and the Medicare rate is 1.5 %. The state and federal unemployment tax rates are 5.4 % and 0.8 % , respectively. The company offers 401k plans to employees. Review the jounal entries, then answer the questions that follow PAGE 12 ACCOUNTING EQUATION JOURNAL CREDIT LIABILITIES EQUITY DEBIT ASSETS DESCRIPTION POST. REF DATE 85,50000 Sales Salaries Expense Oct. 15 1 307,800.00 Officers Salaries Expense 2 57,00000 Office Salaries Expense 119,700.00 Factory Wages Expense 4 34,20000 Social Security Tax Payable