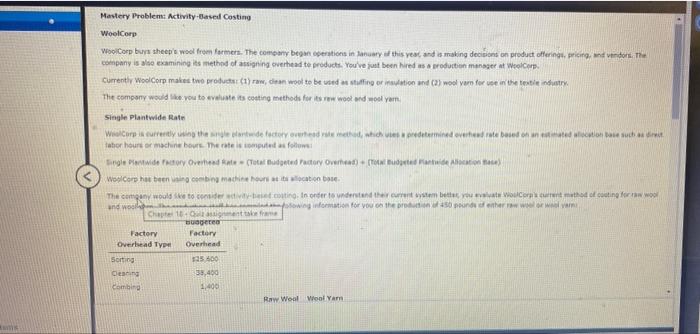

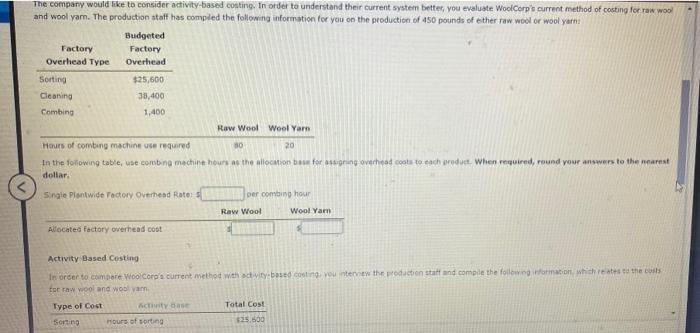

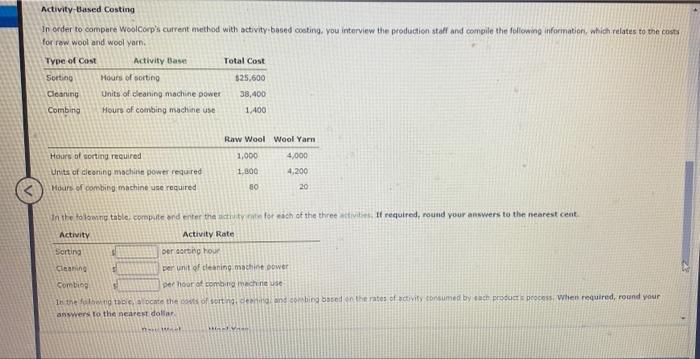

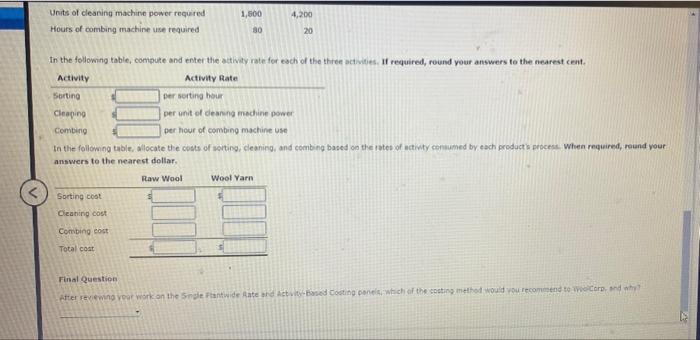

Mastery Problems Activity-Based Costing WooCorp WooCorp bu sheep's wool from formers. The comowy began operations in tary this year, and is making decisions on product offerings, pricing and vendors. The company is so examining its method of assigning overhead te products. You've just been hired as a production manager at Welcorp. Currently WooCorp makes two producer (1) raw, dan wood to be used willing or nation and (2) wool var for the textile industry The company would like you to sve its coating methods for its ww wool and wool yem Single Plantwide Rate Wil Corpi currently in the leaders who predetermined overate based on action besucht tabor hours or machine bout. There is muted for ingle tidery Overhead ate (Total Budgeted Factory Overhead) - foto Wolcorp has been in combing machine hour locations The company would keto comiderotino, in order to understand the current item better you wou Corn's current method of counting for wool and wool powing information for you to the proponenter www.loween Chaptent sugere Factory Factory Overhead Type Overhead Sorting 13500 Ceng 39,40 Combi Raw Weal Wool Yam 1.00 The company would like to consider activity-based costing. In order to understand their current system better, you evaluate WoolCorp's current method of costing for raw wool and wool yarn. The production staff has compled the following information for you on the production of 450 pounds of either raw wool or wool yarn Budgeted Factory Factory Overhead Type Overhead Sorting $25,600 Cleaning 33,400 Combing 1,400 Raw Wool Wool Yarn Hours of combing machine se required 30 20 In the following table, use combing machine hours as the allocation base for sagring overhead costs to each product. When required, round your answers to the nearest dollar Single Plontwide Factory Overhead Rates per coming hour Raw Wool Wool Yarn Allocated factory overhead cool Activity Based Costing In order to compare WooCorp's current method with activity based costing you interview the production staff and compile the following information which is to the cits for raw wool and wool van Type of Cost Activity Total Cost Sorting hours of sorting $35.600 Activity-Based Costing In order to compare WoolCorp's current method with activity based costing, you interview the production staff and compile the following information, which relates to the cost for raw wool and wool yarn. Type of cost Activity Base Total Cost Sorting Hours of sorting $25,600 Cleaning Units of deaning machine power 38,400 Combing Hours of combing machine use 1,400 Hours of sorting required Units of cleaning machine power required Hours of combing machine use required Raw Wool Wool Yarn 1,000 4,000 1 300 4,200 50 20 In the following table, compute and enter the activity for each of the three activities. If required, round your answers to the nearest cent. Activity Activity Rate Sorting per sorting hour Cleaning per unit of cleaning machine power Combi per hour of combing machine use in the latte, locate the cos of sorting, der and combina bored on the rates of activity consumed by each produce process when required, round your answers to the nearest dollar 1,500 4,200 Units of cleaning machine power required Hours of combing machine se required 80 20 In the following table, compute and enter the activity rate for each of the three activities. If required, round your answers to the nearest cent Activity Activity Rate Sorting per sorting hour Cleaping per unit of deaning machine power Combing per hour of combing machines In the following table, locate the costs of sorting, cleaning and coming based on the rates of activity consumed by each products process. When required, round your answers to the nearest dollar Raw Wool Wool Yarn Sorting cost Cleaning cost Combing cost Totalcoat Final Question After reviewing your work on the Single Patwie Rate and actvited Costin panel which of the costing method would you recommend to word why