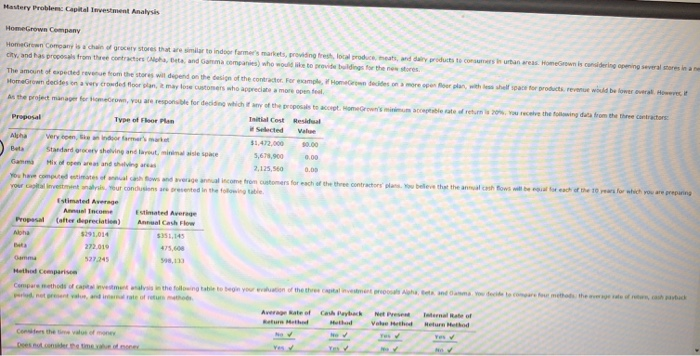

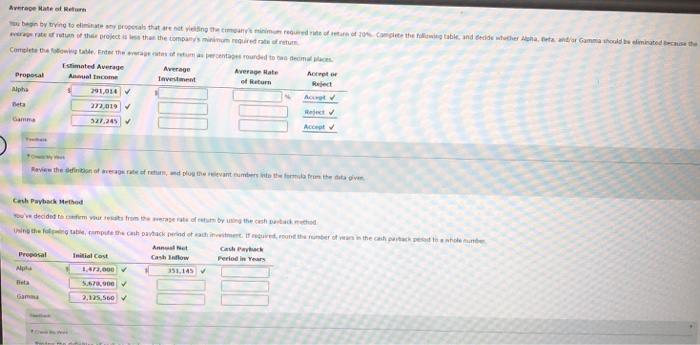

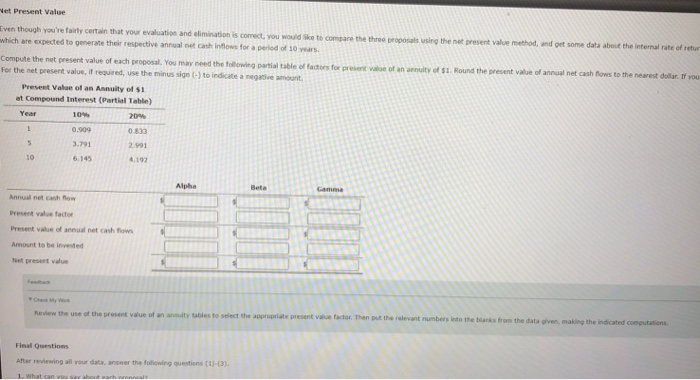

Mastery Problems. Capital Investment Analysis Home Grown Company Homegrown Company is a chain of grocery stores that are martindoor former's marketing locale, dar ducts to come an areas Homeown is considering opening several stores in an City, and has proposals from the contractors, Beta and Gommages) who would provide buildings for the new stores The amount of speed revenue from the stores will decent on the design of the contractor for commented on a more per for the well as for products, revent will be lower However, Homegrown decides on a very crowded floor plan, may lose customers who create more control As the project manager for home, you are responsible for deciding which of the protectorate of remove the wind from the three contractors Proposal Type of Floor Plan Tatial Cost Residual Selected Vale Alpha Very com, drama 51,472,000 Standard grocery shelving and routine sace 5,678,900 0.00 Mix of era and things 2,125,560 0.00 You have computed states of alcanhows and weagentul income from customers for each of the three contractors la believe that the annual cash flows will be for each of the 10 for which you are preparing Your cabinet analysis our conduses are presented in the following table Estimated Average Annual Income Estimated Average Proposal Cater depreciation) Annual Cash Flow Moha 5291,014 $351,145 272,019 527.245 598,113 Compare thods of cements in the following table to begin your vion of the three met het and a wow decide to come out to the web Average of Cash Pub Net Pres Varth Herhad Average Rate of Return You begin by trying to eliminate any rosals that are not yielding the company's minimum required rate of return of 20. Complete the following table, and decide whether Alpha, Beta, and/or Gamma should be eliminated because the were rate of return of the project is less than the company's minimum required rate of return Complete the following the Enter the werage rates of return as percentages rounded to two decimal places. Estimated Average Average Average Rate Accept Proposal Annual Income Investment of Return Alpha 291,014 Accept Beta 272,019 Reject Gamma 527,245 Acompt Review the definition of average rate of return, and plug the relevant numbers into the formula from the data given Cash Payback Method You've decided to confirm your res from the weape rate of return by using the cashback method Using the following compute the cash payback period of each investment. If red round the number of years in the cash payback perfod to a whole number Annet Cash Payak Proposal Initial Cost Cash Inflow Period in Years Alpha 1.472.000 351.145 5.673,900 Gama 2,125,560 Net Present Value Even though you're fairly certain that your evaluation and elimination is correct, you would like to compare the three proposals using the net present value method, and get some data about the internal rate of retur which are expected to generate their respective annual net cash inflows for a period of 10 years Compute the net present value of each proposal. You may need the following partial table of factors for prevent at of an annuity of $1. Round the present value of annual net cash flows to the nearest dollar. If you For the net present value if required, use the minus sign (-) to indicate a negative amount Present Value of an Annuity of $1 at Compound Interest (Partial Table) Year 10% 2016 1 0.909 0.833 3.791 2.991 10 6.145 4.192 5 Alpha Annet cash flow Precent value factor Present value of annual net cash flows Amount to be invested et present value Review the use of the present value of an any cables to select the appropriate present value factor. Then put the relevant numbers into the banks from the data oven, making the indicated computations Final Questions After reviewing all your data, answer the following questions (1-3). 1. What can houtarha