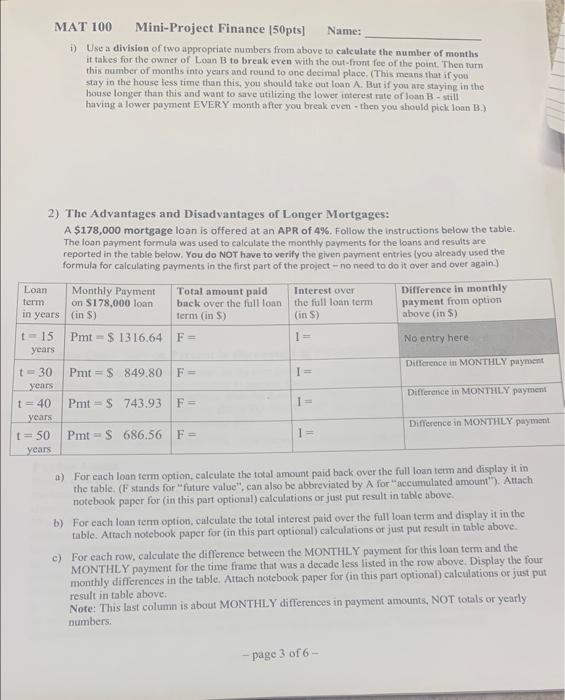

MAT 100 Mini-Project Finance (50pts] Name: 1) Use a division of two appropriate numbers from above to calculate the number of months it takes for the owner of Loan B to break even with the out-front fee of the point. Then turn this number of months into years and round to one decimal place. This means that if you stay in the house less time than this, you should take outloan A. But if you are staying in the house longer than this and want to save utilizing the lower interest rate of loan B-still having a lower payment EVERY month after you break even - then you should pick loan B.) 2) The Advantages and Disadvantages of Longer Mortgages: A $178,000 mortgage loan is offered at an APR of 4%. Follow the instructions below the table. The loan payment formula was used to calculate the monthly payments for the loans and results are reported in the table below. You do NOT have to verify the given payment entries (you already used the formula for calculating payments in the first part of the project - no need to do it over and over again.) Loan Monthly Payment Total amount paid Interest over Difference in monthly term on S178,000 loan back over the full loan the full loan term payment from option in years in S) term (in) (in ) above (in ) -15 Pmt = $ 1316.64 F= 1= No entry here years Diference in MONTHLY payment t = 30 Pmt=$ 849.80 F = years Difference in MONTHLY payment t = 40 Pmt = $ 743,93 F = 1 years Difference in MONTHLY payment t = 50 Pmt - $686.56 F = 1 = years a) For each loan term option, calculate the total amount paid back over the full loan term and display it in the table. (F stands for future value", can also be abbreviated by A for "accumulated amount"). Attach notebook paper for (in this part optional) calculations or just put result in table above. b) For cach loan term option, calculate the total interest paid over the full loan term and display it in the table. Attach notebook paper for (in this part optional) calcuintions or just put result in table above. c) For each row, calculate the difference between the MONTHLY payment for this loan term and the MONTHLY payment for the time frame that was a decade less listed in the row above. Display the four monthly differences in the table. Attach notebook paper for (in this part optional) calculations or just put result in table above. Note: This last column is about MONTHLY differences in payment amounts, NOT totals or yearly numbers - page 3 of 6