Answered step by step

Verified Expert Solution

Question

1 Approved Answer

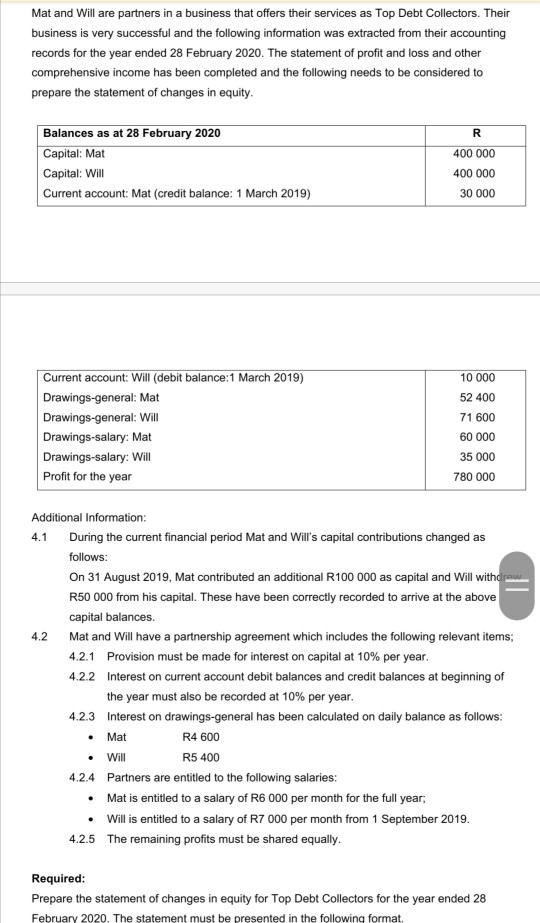

Mat and Will are partners in a business that offers their services as Top Debt Collectors. Their business is very successful and the following information

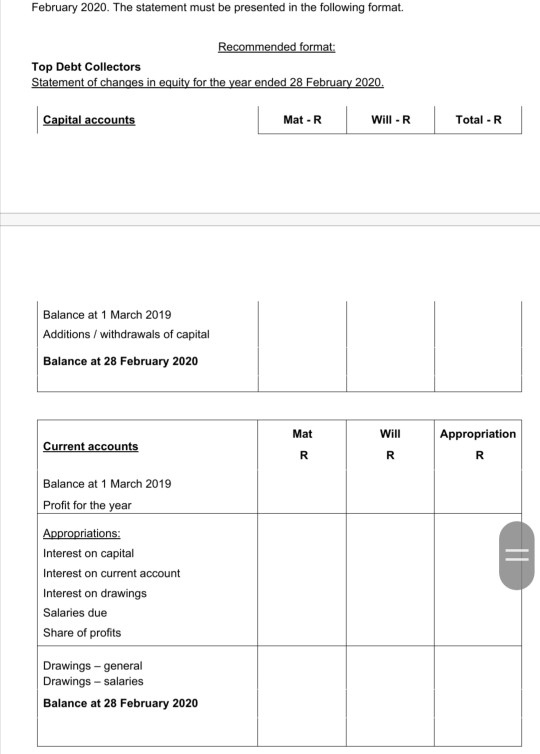

Mat and Will are partners in a business that offers their services as Top Debt Collectors. Their business is very successful and the following information was extracted from their accounting records for the year ended 28 February 2020. The statement of profit and loss and other comprehensive income has been completed and the following needs to be considered to prepare the statement of changes in equity. R 400 000 Balances as at 28 February 2020 Capital: Mat Capital: Will Current account: Mat (credit balance: 1 March 2019) 400 000 30 000 Current account: Will (debit balance:1 March 2019) Drawings-general: Mat Drawings-general: Will Drawings-salary: Mat Drawings-salary: Will Profit for the year 10 000 52 400 71 600 60 000 35 000 780 000 4.1 Additional Information: During the current financial period Mat and Will's capital contributions changed as follows: On 31 August 2019, Mat contributed an additional R100 000 as capital and will withdraw R50 000 from his capital. These have been correctly recorded to arrive at the above capital balances. 4.2 Mat and will have a partnership agreement which includes the following relevant items; 4.2.1 Provision must be made for interest on capital at 10% per year. 4.2.2 Interest on current account debit balances and credit balances at beginning of the year must also be recorded at 10% per year. 4.2.3 Interest on drawings-general has been calculated on daily balance as follows: R4 600 Will R5 400 4.2.4 Partners are entitled to the following salaries: Mat is entitled to a salary of R6 000 per month for the full year, Will is entitled to a salary of R7 000 per month from 1 September 2019. 4.2.5 The remaining profits must be shared equally. . Mat Required: Prepare the statement of changes in equity for Top Debt Collectors for the year ended 28 February 2020. The statement must be presented in the following format. February 2020. The statement must be presented in the following format. Recommended format: Top Debt Collectors Statement of changes in equity for the year ended 28 February 2020. Capital accounts Mat - R Will - R Total-R Balance at 1 March 2019 Additions / withdrawals of capital Balance at 28 February 2020 Mat Will Appropriation Current accounts R R R Balance at 1 March 2019 Profit for the year Appropriations: Interest on capital Interest on current account Interest on drawings Salaries due Share of profits = Drawings - general Drawings - salaries Balance at 28 February 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started