Answered step by step

Verified Expert Solution

Question

1 Approved Answer

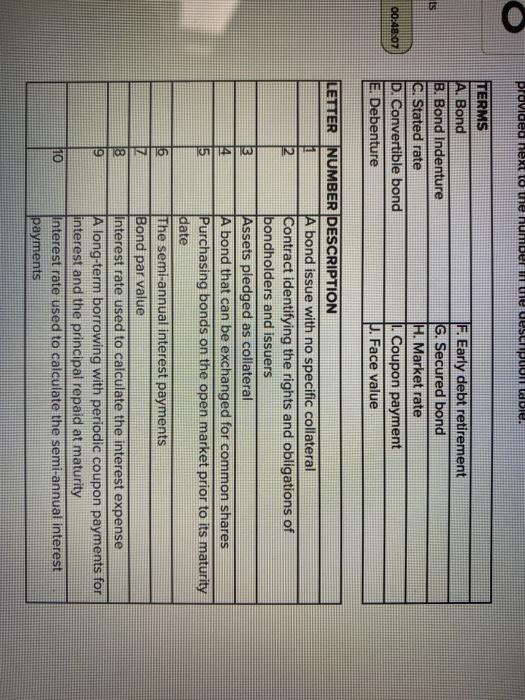

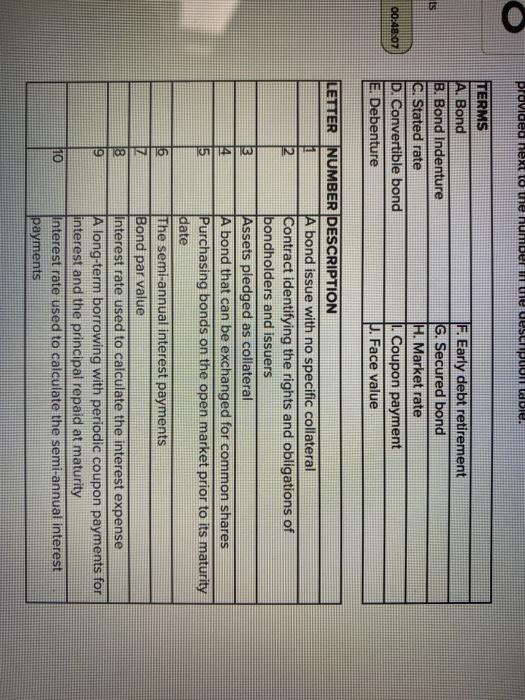

match terms to their definition Provided next to une number we ues poble. TERMS A. Bond B. Bond Indenture CI Stated rate D. Convertible bond

match terms to their definition

Provided next to une number we ues poble. TERMS A. Bond B. Bond Indenture CI Stated rate D. Convertible bond E. Debenture F. Early debt retirement G. Secured bond H. Market rate 1. Coupon payment U. Face value 00:48:02 IN LETTER NUMBER DESCRIPTION A bond issue with no specific collateral Contract identifying the rights and obligations of bondholders and issuers Assets pledged as collateral A bond that can be exchanged for common shares Purchasing bonds on the open market prior to its maturity Idate 6 The semi-annual interest payments 7 Bond par value Interest rate used to calculate the interest expense 9 A long-term borrowing with periodic coupon payments for interest and the principal repaid at maturity 110 Interest rate used to calculate the semi-annual interest payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started