Question

Match the breach to the CFA Institute Standard that would govern it. One (1) match only for each Standard. (you can just match the answer!

Match the breach to the CFA Institute Standard that would govern it. One (1) match only for each Standard.

(you can just match the answer! the answer can not be repeated!! You can use only 1,2,3,4,5,6,7 at one time. You can only use the number once. For example, ll.A. and ll.B. are both from number 2. So this counts as a repeated answer. Be careful!

a) A member Analyst leaves an asset management firm to go work for another, bringing all their valuation models and research reports.

b) Performance has been dismal over the last few quarters, and a member Portfolio Manager decides to only present to clients returns from those time frames that make their team look good.

c )During a promotional event, a member boasts that Portfolio Managers with a CFA designation generate better returns than those without such a designation.

d)During an interview, a Candidate in the CFA Program mentions that they are a CFA Level 1

f)Every time a member Portfolio Manager creates a new client report, they use the template from another review, not making sure to save previous client reviews. Furthermore, they regularly forget to take notes when meeting their clients.

g) A member Analyst works for a large asset management firm and learns that the Portfolio Manager is about to initiate a position in a company which will most probably boost the stock price. They decide to buy ahead of the firm to benefit from this gain without notifying their compliance department.

h) At a family gathering during Thanksgiving, a member learns that a company is about to be acquired and, based on this insider information, takes a position in that company as soon as the market opens on Tuesday morning

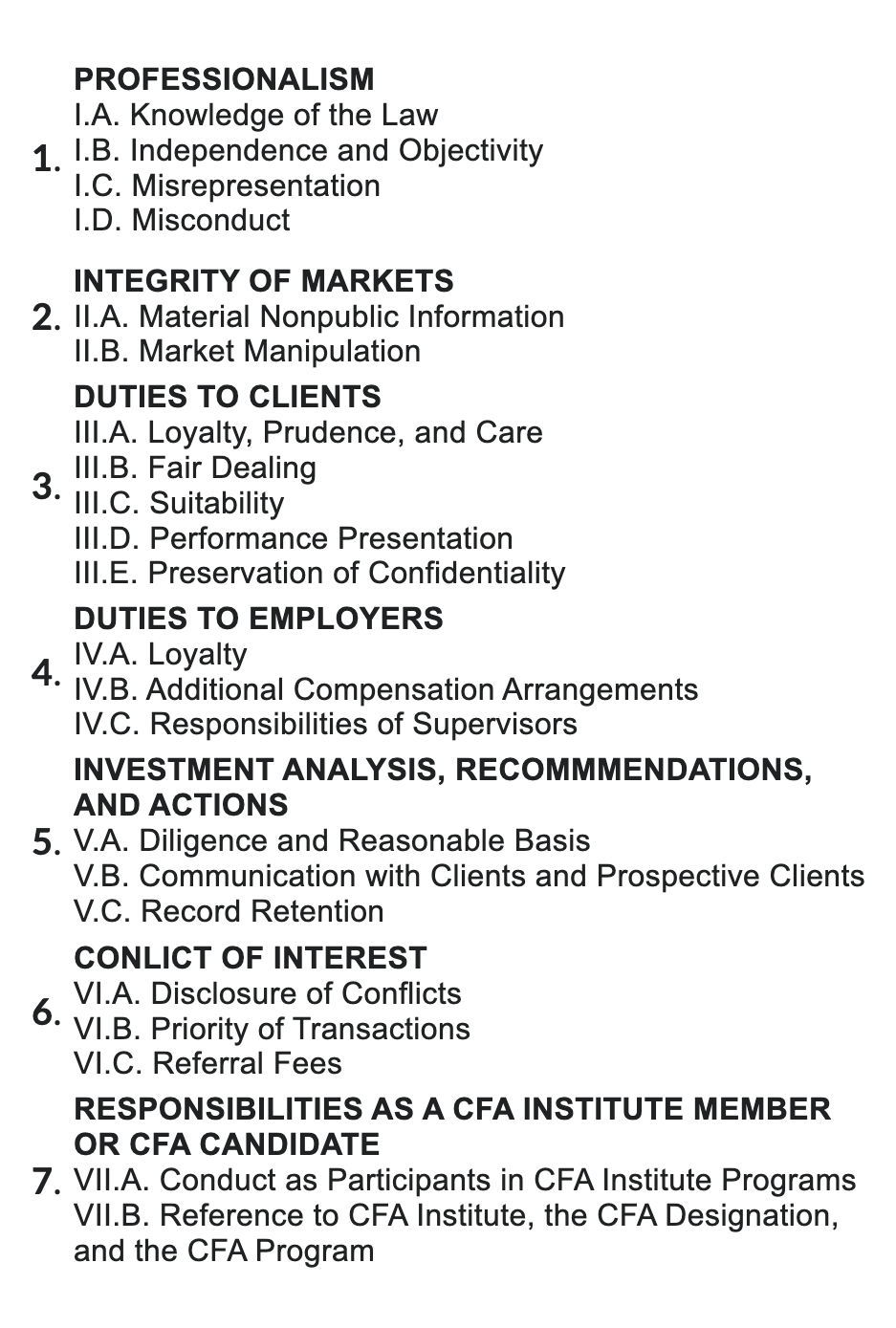

PROFESSIONALISM I.A. Knowledge of the Law 1. I.B. Independence and Objectivity I.C. Misrepresentation I.D. Misconduct INTEGRITY OF MARKETS 2. II.A. Material Nonpublic Information II.B. Market Manipulation DUTIES TO CLIENTS III.A. Loyalty, Prudence, and Care 3. III.B. Fair Dealing III.C. Suitability III.D. Performance Presentation III.E. Preservation of Confidentiality DUTIES TO EMPLOYERS 4. IV.A. Loyalty IV.B. Additional Compensation Arrangements IV.C. Responsibilities of Supervisors INVESTMENT ANALYSIS, RECOMMMENDATIONS, AND ACTIONS 5. V.A. Diligence and Reasonable Basis V.B. Communication with Clients and Prospective Clients V.C. Record Retention CONLICT OF INTEREST 6. VI.A. Disclosure of Conflicts VI.B. Priority of Transactions VI.C. Referral Fees RESPONSIBILITIES AS A CFA INSTITUTE MEMBER OR CFA CANDIDATE 7. VII.A. Conduct as Participants in CFA Institute Programs VII.B. Reference to CFA Institute, the CFA Designation, and the CFA Program

PROFESSIONALISM I.A. Knowledge of the Law 1. I.B. Independence and Objectivity I.C. Misrepresentation I.D. Misconduct INTEGRITY OF MARKETS 2. II.A. Material Nonpublic Information II.B. Market Manipulation DUTIES TO CLIENTS III.A. Loyalty, Prudence, and Care 3. III.B. Fair Dealing III.C. Suitability III.D. Performance Presentation III.E. Preservation of Confidentiality DUTIES TO EMPLOYERS 4. IV.A. Loyalty IV.B. Additional Compensation Arrangements IV.C. Responsibilities of Supervisors INVESTMENT ANALYSIS, RECOMMMENDATIONS, AND ACTIONS 5. V.A. Diligence and Reasonable Basis V.B. Communication with Clients and Prospective Clients V.C. Record Retention CONLICT OF INTEREST 6. VI.A. Disclosure of Conflicts VI.B. Priority of Transactions VI.C. Referral Fees RESPONSIBILITIES AS A CFA INSTITUTE MEMBER OR CFA CANDIDATE 7. VII.A. Conduct as Participants in CFA Institute Programs VII.B. Reference to CFA Institute, the CFA Designation, and the CFA Program Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started