Answered step by step

Verified Expert Solution

Question

1 Approved Answer

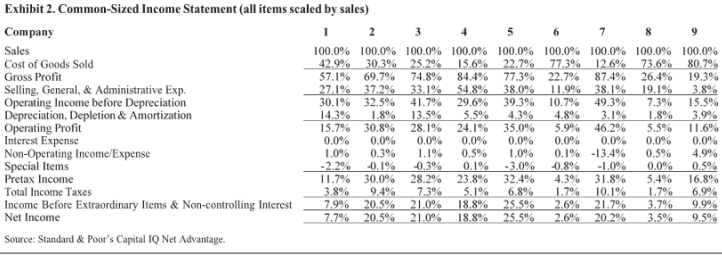

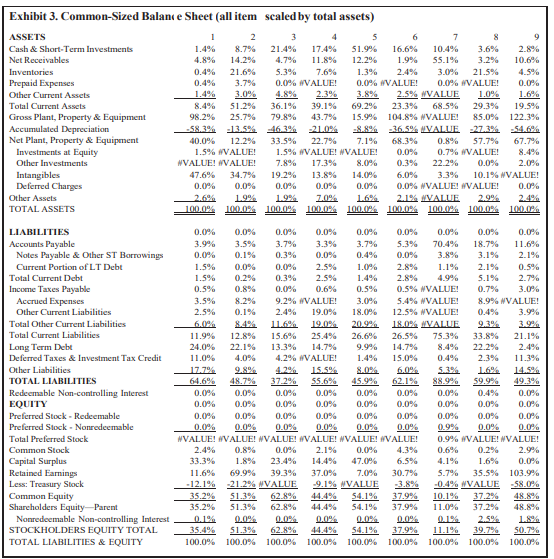

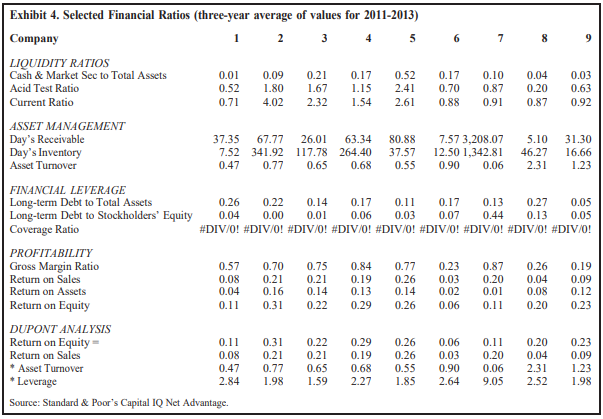

Match the companies in the table below with their industry using the financial statement data provided in Exhibits 2, 3, and 4.? Broader Classification Industry

Match the companies in the table below with their industry using the financial statement data provided in Exhibits 2, 3, and 4.?

| Broader Classification | Industry | Characteristics | Company No. | Reason |

| Service Industry | Mobile phone service operator | Mobile phone service operators would be expected to have high receivables, low inventories, and high property, plant, and equipment | ? | ? |

| Capital-Intensive Industry | Liquor producer and distributor | A liquor company would have high inventories, high day's inventory (spirits must age with time), and high selling, general administrative expenses because the product is heavily advertised and branded | ? | ? |

| Large integrated oil and gas company | An oil and gas company would be expected to have proportionately more inventories than an airline. An?airline might be more capital intensive | ? | ? | |

| Discount airline | ? | ? | ||

| High-Tech Industry | R&D-based semiconductor manufacturer | High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, brand value). They may also have low debt ratios because of the low collateral value of intangibles or growth opportunities. | ? | ? |

| R&D-based pharmaceutical manufacturer | High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, brand value). They may also have low debt ratios because of the low collateral value of intangibles or growth opportunities. A pharmaceutical manufacturer would be expected to have the high gross profit margin and high inventories, and a high day's inventory. | ? | ? | |

| Computer software company | High technology industries would be expected to have high research and development intensity (ratio of R&D expenses to sales), and high return on sales (patent protection, brand value). They may also have low debt ratios because of the low collateral value of intangibles or growth opportunities. A software company would be expected to have proportionately lower inventories and plant, property, and equipment | ? | ? | |

| Financial Industry | Commercial bank (items fitted into the same categories as the non-financial firms) | Firms in the financial industry could be expected to have high receivables (loans) and payables (deposits, other loans), a large ratio of assets to stockholders' equity (Dupont leverage), and little inventory. Financial firms would also be expected to have low asset turnover ratios. They might also have a high gross profit percentage, i.e., net interest margin (interest revenue less interest income). | ? | ? |

| Retail Industry | Retail grocery company | Retail firms would be expected to have lots of inventory, relatively low gross profit percentage, and low returns on sales (less than 4%), and high asset turnover | ? | ? |

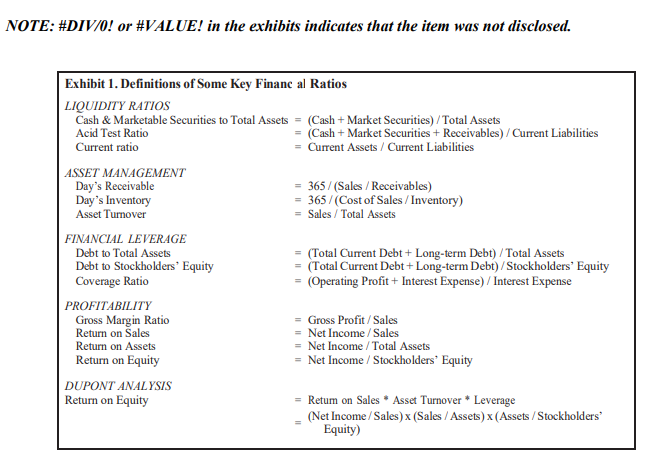

NOTE:#DIV/0! or #VALUE! in the exhibits indicates that the item was not disclosed. Exhibit 1. Definitions of Some Key Financ al Ratios LIQUIDITY RATIOS Cash & Marketable Securities to Total Assets = (Cash + Market Securities)/Total Assets Acid Test Ratio Current ratio ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Turnover FINANCIAL LEVERAGE Debt to Total Assets Debt to Stockholders' Equity Coverage Ratio PROFITABILITY Gross Margin Ratio Return on Sales Return on Assets Return on Equity DUPONT ANALYSIS Return on Equity = (Cash + Market Securities + Receivables) / Current Liabilities = Current Assets / Current Liabilities = 365/(Sales / Receivables) = 365/(Cost of Sales/Inventory) = Sales/Total Assets = (Total Current Debt +Long-term Debt)/Total Assets = (Total Current Debt +Long-term Debt)/Stockholders' Equity = (Operating Profit + Interest Expense) / Interest Expense = Gross Profit/Sales = Net Income / Sales = Net Income / Total Assets = Net Income / Stockholders' Equity = Retum on Sales * Asset Turnover * Leverage (Net Income/Sales) x (Sales / Assets) x (Assets/Stockholders' Equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To match the provided companies with their respective industries based on the financial statement da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started