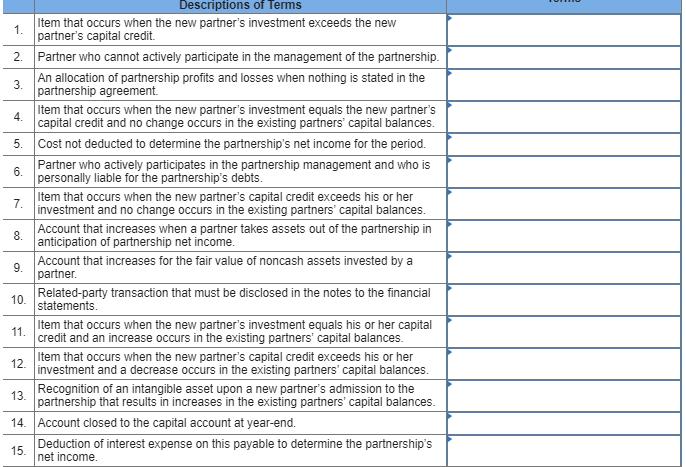

Match the descriptions on the left with the terms on the right. A term may be used once, more than once, or not at all.

Match the descriptions on the left with the terms on the right. A term may be used once, more than once, or not at all.

Descriptions of Terms 1. Item that occurs when the new partner's investment exceeds the new partner's capital credit. 2. Partner who cannot actively participate in the management of the partnership. 3. An allocation of partnership profits and losses when nothing is stated in the partnership agreement. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Item that occurs when the new partner's investment equals the new partner's capital credit and no change occurs in the existing partners' capital balances. Cost not deducted to determine the partnership's net income for the period. Partner who actively participates in the partnership management and who is personally liable for the partnership's debts. Item that occurs when the new partner's capital credit exceeds his or her investment and no change occurs in the existing partners' capital balances. Account that increases when a partner takes assets out of the partnership in anticipation of partnership net income. Account that increases for the fair value of noncash assets invested by a partner. Related-party transaction that must be disclosed in the notes to the financial statements. Item that occurs when the new partner's investment equals his or her capital credit and an increase occurs in the existing partners' capital balances. Item that occurs when the new partner's capital credit exceeds his or her investment and a decrease occurs in the existing partners' capital balances. Recognition of an intangible asset upon a new partner's admission to the partnership that results in increases in the existing partners' capital balances. Account closed to the capital account at year-end. Deduction of interest expense on this payable to determine the partnership's net income.

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Limited partner 4 3 Partnership income or loss shared equally Recognition of neith...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e18747d91a_181415.pdf

180 KBs PDF File

635e18747d91a_181415.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started