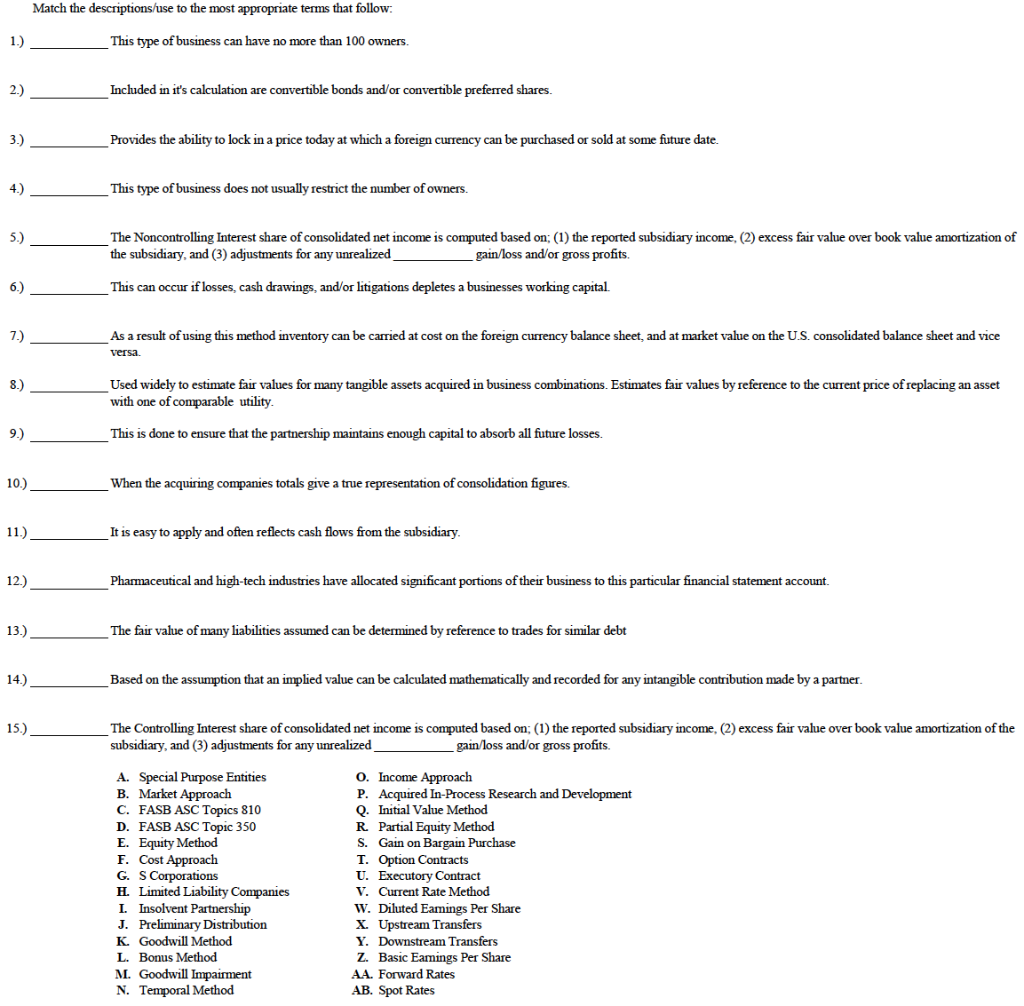

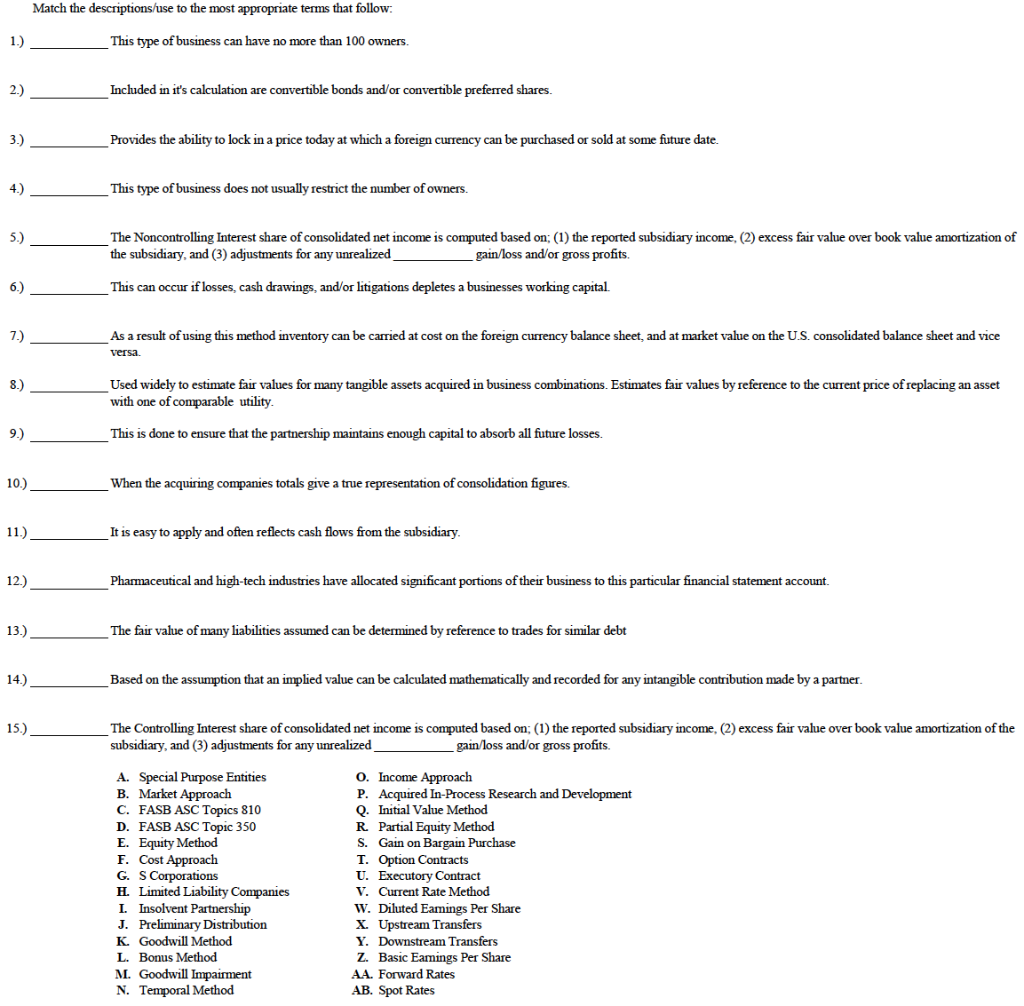

Match the descriptions/use to the most appropriate terms that follow: 1.) This type of business can have no more than 100 owners. 2.) Inchided in it's calculation are convertible bonds and/or convertible preferred shares. 3.) Provides the ability to lock in a price today at which a foreign currency can be purchased or sold some future date 4.) This type of business does not usually restrict the number of owners. 5.) The Noncontrolling Interest share of consolidated net income is computed based on: (1) the reported subsidiary income, (2) excess fair value over book value amortization of the subsidiary, and (3) adjustments for any unrealized gain/loss and/or gross profits. 6.) This can occur if losses, cash drawings, and/or litigations depletes a businesses working capital. 7.) As a result of using this method inventory can be carried at cost on the foreign currency balance sheet, and at market value on the U.S. consolidated balance sheet and vice versa 8.) Used widely to estimate fair values for many tangible assets acquired in business combinations. Estimates fair values by reference to the current price of replacing an asset with one of comparable utility. 9.) This is done to ensure that the partnership maintains enough capital to absorb all future losses. 10.) When the acquiring companies totals give a true representation of consolidation figures. 11.) It is easy to apply and often reflects cash flows from the subsidiary. 12.) Pharmaceutical and high-tech industries have allocated significant portions of their business to this particular financial statement account. 13.) The fair value of many liabilities assumed can be determined by reference to trades for similar debt 14.) Based on the assumption that an implied value can be calculated mathematically and recorded for any intangible contribution made by a partner. 15.) The Controlling Interest share of consolidated net income is computed based on: (1) the reported subsidiary income, (2) excess fair value over book value amortization of the subsidiary, and (3) adjustments for any unrealized gain loss and/or gross profits. A. Special Purpose Entities B. Market Approach C. FASB ASC Topics 810 D. FASB ASC Topic 350 E. Equity Method F. Cost Approach G. S Corporations H Limited Liability Companies I. Insolvent Partnership J. Preliminary Distribution K. Goodwill Method L. Bonus Method M. Goodwill Impairment N. Temporal Method 0. Income Approach P. Acquired In-Process Research and Development Q. Initial Value Method R Partial Equity Method S. Gain on Bargain Purchase T. Option Contracts U. Executory Contract V. Current Rate Method W. Diluted Eamings Per Share X. Upstream Transfers Y. Downstream Transfers Z. Basic Eamings Per Share AA. Forward Rates AB. Spot Rates