Answered step by step

Verified Expert Solution

Question

1 Approved Answer

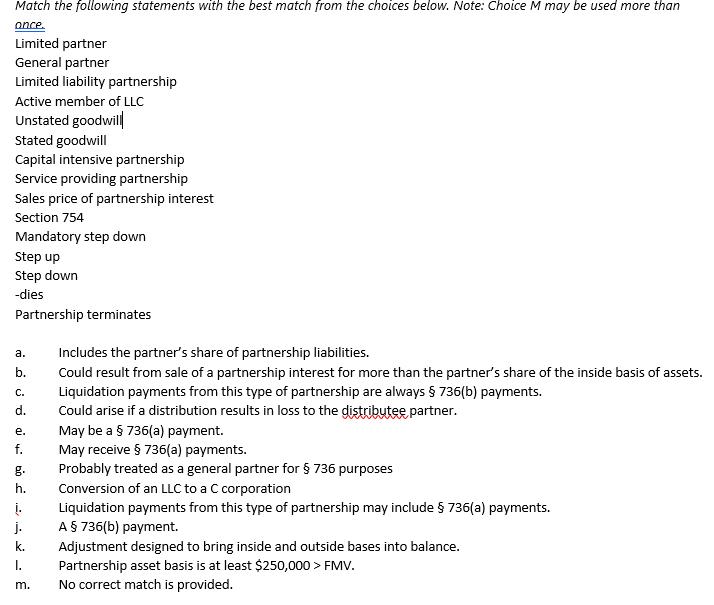

Match the following statements with the best match from the choices below. Note: Choice M may be used more than ance. Limited partner General

Match the following statements with the best match from the choices below. Note: Choice M may be used more than ance. Limited partner General partner Limited liability partnership Active member of LLC Unstated goodwill Stated goodwill Capital intensive partnership Service providing partnership Sales price of partnership interest Section 754 Mandatory step down Step up Step down -dies Partnership terminates a. b. C. d. e. f. g. h. . j. k. I. m. Includes the partner's share of partnership liabilities. Could result from sale of a partnership interest for more than the partner's share of the inside basis of assets. Liquidation payments from this type of partnership are always 736(b) payments. Could arise if a distribution results in loss to the distributee partner. May be a 736(a) payment. May receive 736(a) payments. Probably treated as a general partner for 736 purposes Conversion of an LLC to a C corporation Liquidation payments from this type of partnership may include 736(a) payments. A 736(b) payment. Adjustment designed to bring inside and outside bases into balance. Partnership asset basis is at least $250,000 > FMV. No correct match is provided.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Limited Partner Include the partners share of partnership liabilities General p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started