Answered step by step

Verified Expert Solution

Question

1 Approved Answer

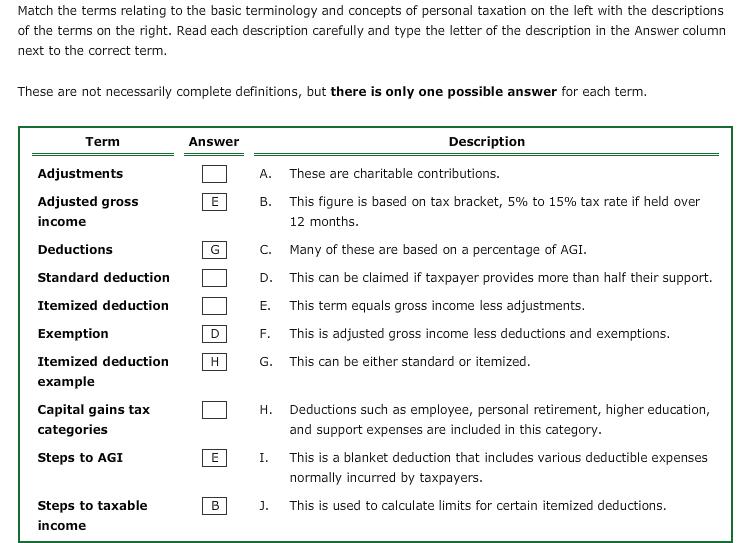

Match the terms relating to the basic terminology and concepts of personal taxation on the left with the descriptions of the terms on the

Match the terms relating to the basic terminology and concepts of personal taxation on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description Adjustments A. These are charitable contributions. Adjusted gross . This figure is based on tax bracket, 5% to 15% tax rate if held over income 12 months. Deductions C. Many of these are based on a percentage of AGI. Standard deduction D. This can be claimed if taxpayer provides more than half their support. Itemized deduction . This term equals gross income less adjustments. F. This is adjusted gross income less deductions and exemptions. G. This can be either standard or itemized. Exemption Itemized deduction H. example Capital gains tax H. Deductions such as employee, personal retirement, higher education, categories and support expenses are included in this category. Steps to AGI E I. This is a blanket deduction that includes various deductible expenses normally incurred by taxpayers. Steps to taxable B J. This is used to calculate limits for certain itemized deductions. income

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Adjustments J Adjusted Gross Income H ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started