Answered step by step

Verified Expert Solution

Question

1 Approved Answer

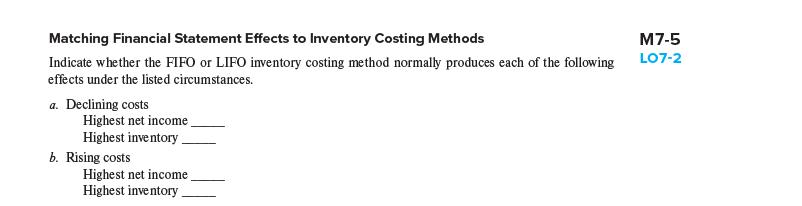

Matching Financial Statement Effects to Inventory Costing Methods Indicate whether the FIFO or LIFO inventory costing method normally produces each of the following effects

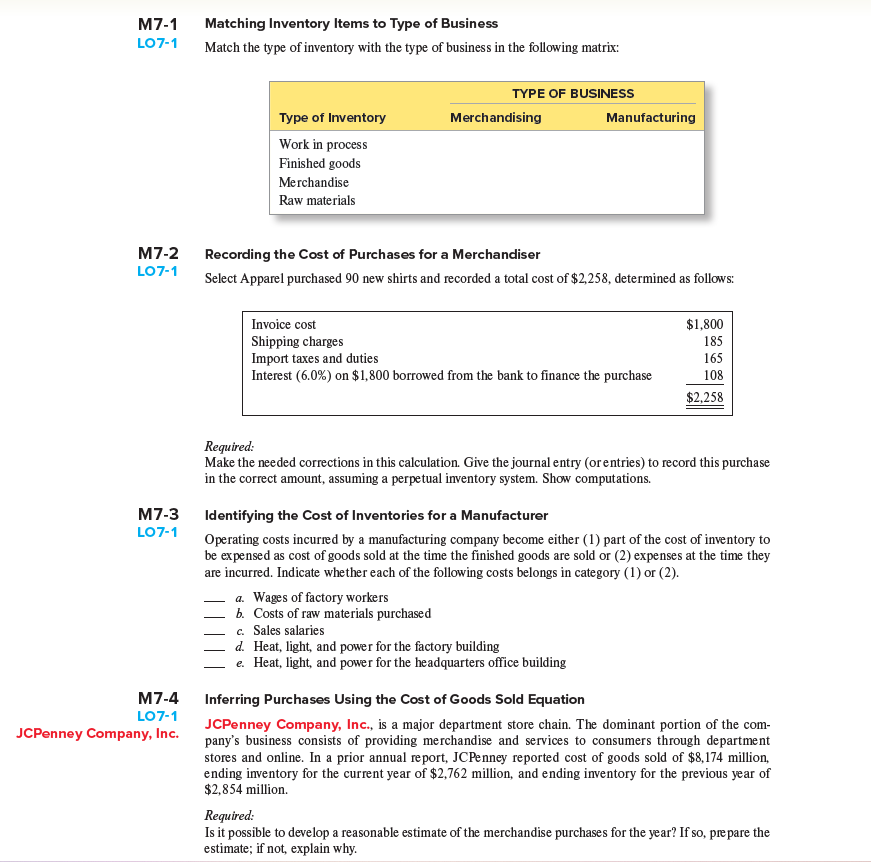

Matching Financial Statement Effects to Inventory Costing Methods Indicate whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. a. Declining costs M7-5 L07-2 Highest net income Highest inventory. b. Rising costs Highest net income Highest inventory. M7-1 LO7-1 Matching Inventory Items to Type of Business Match the type of inventory with the type of business in the following matrix: TYPE OF BUSINESS Type of Inventory Merchandising Manufacturing Work in process Finished goods Merchandise Raw materials M7-2 LO7-1 Recording the Cost of Purchases for a Merchandiser Select Apparel purchased 90 new shirts and recorded a total cost of $2,258, determined as follows: Invoice cost Shipping charges Import taxes and duties Interest (6.0%) on $1,800 borrowed from the bank to finance the purchase $1,800 185 165 108 $2,258 M7-3 LO7-1 M7-4 LO7-1 JCPenney Company, Inc. Required: Make the needed corrections in this calculation. Give the journal entry (or entries) to record this purchase in the correct amount, assuming a perpetual inventory system. Show computations. Identifying the Cost of Inventories for a Manufacturer Operating costs incurred by a manufacturing company become either (1) part of the cost of inventory to be expensed as cost of goods sold at the time the finished goods are sold or (2) expenses at the time they are incurred. Indicate whether each of the following costs belongs in category (1) or (2). a. Wages of factory workers b. Costs of raw materials purchased c. Sales salaries d. Heat, light, and power for the factory building e. Heat, light, and power for the headquarters office building Inferring Purchases Using the Cost of Goods Sold Equation JCPenney Company, Inc., is a major department store chain. The dominant portion of the com- pany's business consists of providing merchandise and services to consumers through department stores and online. In a prior annual report, JCPenney reported cost of goods sold of $8,174 million, ending inventory for the current year of $2,762 million, and ending inventory for the previous year of $2,854 million. Required: Is it possible to develop a reasonable estimate of the merchandise purchases for the year? If so, prepare the estimate; if not, explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started