Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block (upper) case letter of your choice

under column "A" and match the definitions in column "B" with the meanings or examples or real world applications in column "C"by writing the

small (lower) case letter of your choice under column "B". I need only questions #1, 3, 5, 7 and 9. Thank you.

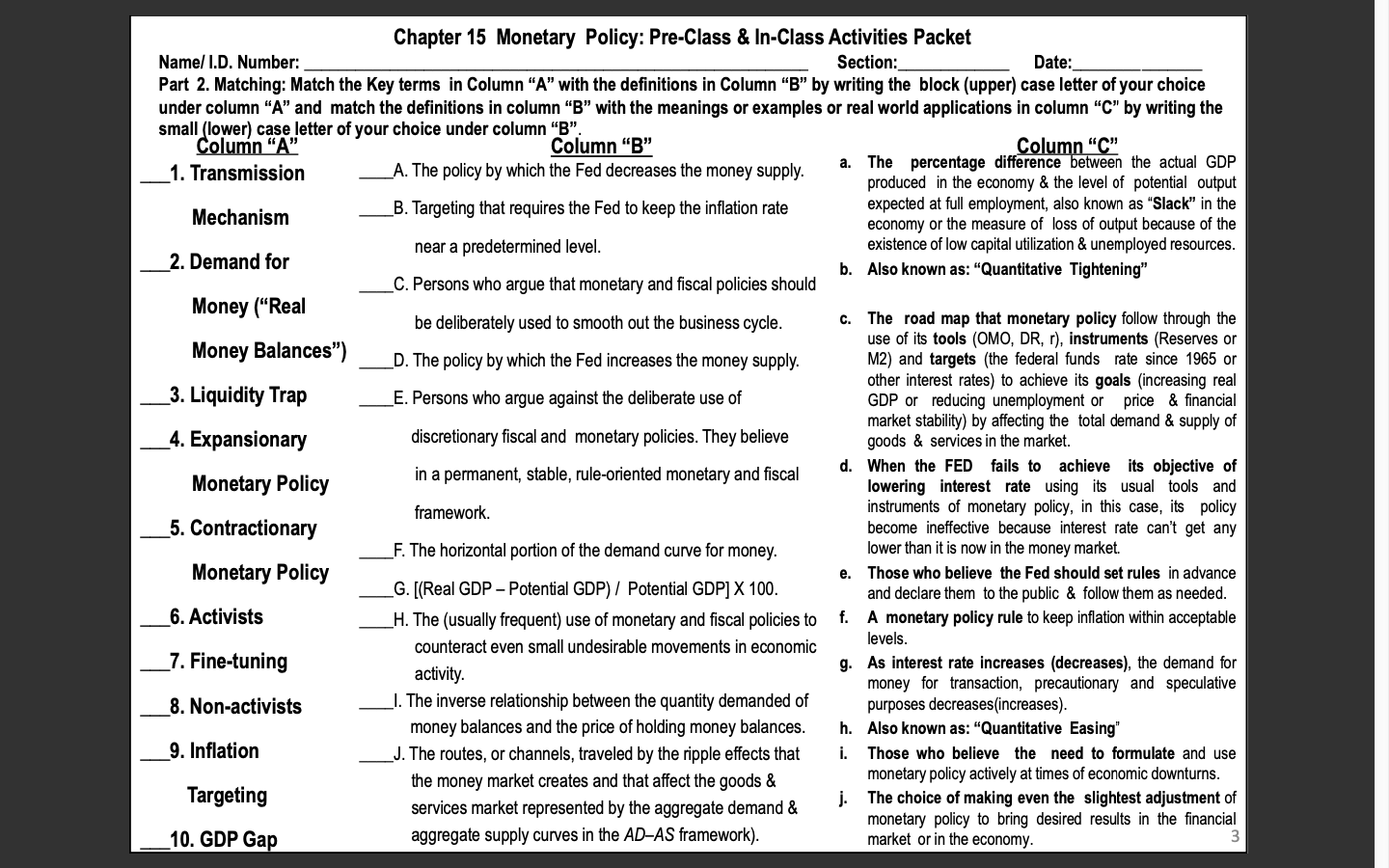

Chapter 15 Monetary Policy: Pre-Class & In-Class Activities Packet Name/ I.D. Number: Section: Date: Part 2. Matching: Match the Key terms in Column "A" with the definitions in Column "B" by writing the block (upper) case letter of your choice under column "A" and match the definitions in column "B" with the meanings or examples or real world applications in column "C" by writing the small (lower) case letter of your choice under column "B". Column "A' Column "B" Column "C" 1. Transmission A. The policy by which the Fed decreases the money supply. a. The percentage difference between the actual GDP produced in the economy & the level of potential output Mechanism B. Targeting that requires the Fed to keep the inflation rate expected at full employment, also known as "Slack" in the economy or the measure of loss of output because of the 2. Demand for near a predetermined level. existence of low capital utilization & unemployed resources. b. Also known as: "Quantitative Tightening" C. Persons who argue that monetary and fiscal policies should Money ("Real be deliberately used to smooth out the business cycle. c. The road map that monetary policy follow through the Money Balances") use of its tools (OMO, DR, r), instruments (Reserves or D. The policy by which the Fed increases the money supply. M2) and targets (the federal funds rate since 1965 or other interest rates) to achieve its goals (increasing real 3. Liquidity Trap E. Persons who argue against the deliberate use of GDP or reducing unemployment or price & financial market stability) by affecting the total demand & supply of 4. Expansionary discretionary fiscal and monetary policies. They believe goods & services in the market. in a permanent, stable, rule-oriented monetary and fiscal d. When the FED fails to achieve its objective of Monetary Policy lowering interest rate using its usual tools and framework. instruments of monetary policy, in this case, its policy 5. Contractionary become ineffective because interest rate can't get any F. The horizontal portion of the demand curve for money. lower than it is now in the money market. Monetary Policy e. Those who believe the Fed should set rules in advance G. [(Real GDP - Potential GDP) / Potential GDP] X 100. and declare them to the public & follow them as needed. 6. Activists H. The (usually frequent) use of monetary and fiscal policies to f. A monetary policy rule to keep inflation within acceptable counteract even small undesirable movements in economic levels. 7. Fine-tuning g. As interest rate increases (decreases), the demand for activity. money for transaction, precautionary and speculative 8. Non-activists 1. The inverse relationship between the quantity demanded of purposes decreases(increases). money balances and the price of holding money balances. h. Also known as: "Quantitative Easing" 9. Inflation J. The routes, or channels, traveled by the ripple effects that i. Those who believe the need to formulate and use the money market creates and that affect the goods & monetary policy actively at times of economic downturns. Targeting services market represented by the aggregate demand & J. The choice of making even the slightest adjustment of monetary policy to bring desired results in the financial 10. GDP Gap aggregate supply curves in the AD-AS framework). market or in the economy. 3