Question

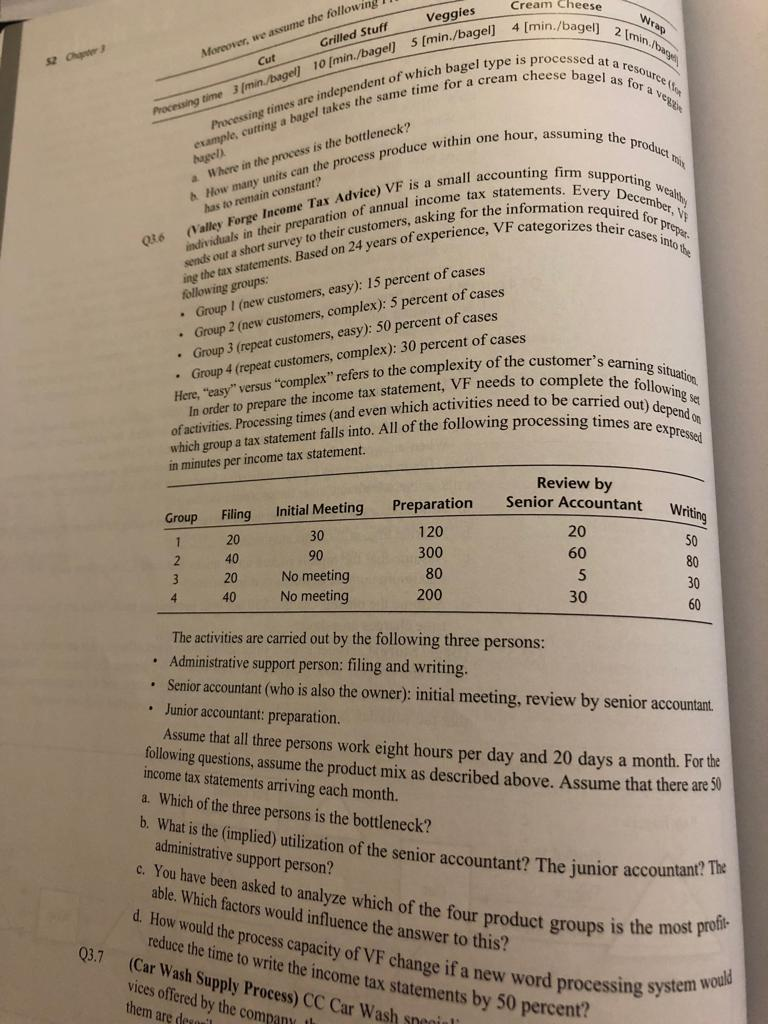

Matching Supply With Demand. 3.6 (Valley Forge Income Tax Advice; page 53). 2.1 Suppose that the demand was for 100 preparations per month (not 50

Matching Supply With Demand. 3.6 (Valley Forge Income Tax Advice; page 53). 2.1 Suppose that the demand was for 100 preparations per month (not 50 as stated in the question). What are the implied utilizations of the three resources (senior accountant, the junior accountant, and the administrative assistant)? 2.2 What is the process capacity, in terms of tax preparations per month? (Assume the proportion of preparations remains exactly consistent with the percentages given in the question; i.e., 15% Group 1, etc.). 2.3 If the process works at its maximal capacity, what are the utilizations of the three resources? 2.4 Under the conditions of the previous question, what is the bottleneck in the process? 2.5 How would the process capacity change if a new word processing system would reduce the time to write income tax statements by 20%? 2.6 Suppose that the senior accountant could help the junior accountant by taking care of some of the preparation work. Suppose that the preparation times will not change (in other words, the senior accountant is neither faster nor slower than the junior accountant). Suppose also, that the senior accountant would like to keep his utilization no larger than 50%. Under these conditions, what would the process capacity be? 2.7 Continuing with the previous question, suppose that you also needed to keep the junior accountants utilization no larger than 85%. What would the process capacity be?

Matching Supply With Demand. 3.6 (Valley Forge Income Tax Advice; page 53). 2.1 Suppose that the demand was for 100 preparations per month (not 50 as stated in the question). What are the implied utilizations of the three resources (senior accountant, the junior accountant, and the administrative assistant)? 2.2 What is the process capacity, in terms of tax preparations per month? (Assume the proportion of preparations remains exactly consistent with the percentages given in the question; i.e., 15% Group 1, etc.). 2.3 If the process works at its maximal capacity, what are the utilizations of the three resources? 2.4 Under the conditions of the previous question, what is the bottleneck in the process? 2.5 How would the process capacity change if a new word processing system would reduce the time to write income tax statements by 20%? 2.6 Suppose that the senior accountant could help the junior accountant by taking care of some of the preparation work. Suppose that the preparation times will not change (in other words, the senior accountant is neither faster nor slower than the junior accountant). Suppose also, that the senior accountant would like to keep his utilization no larger than 50%. Under these conditions, what would the process capacity be? 2.7 Continuing with the previous question, suppose that you also needed to keep the junior accountants utilization no larger than 85%. What would the process capacity be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started