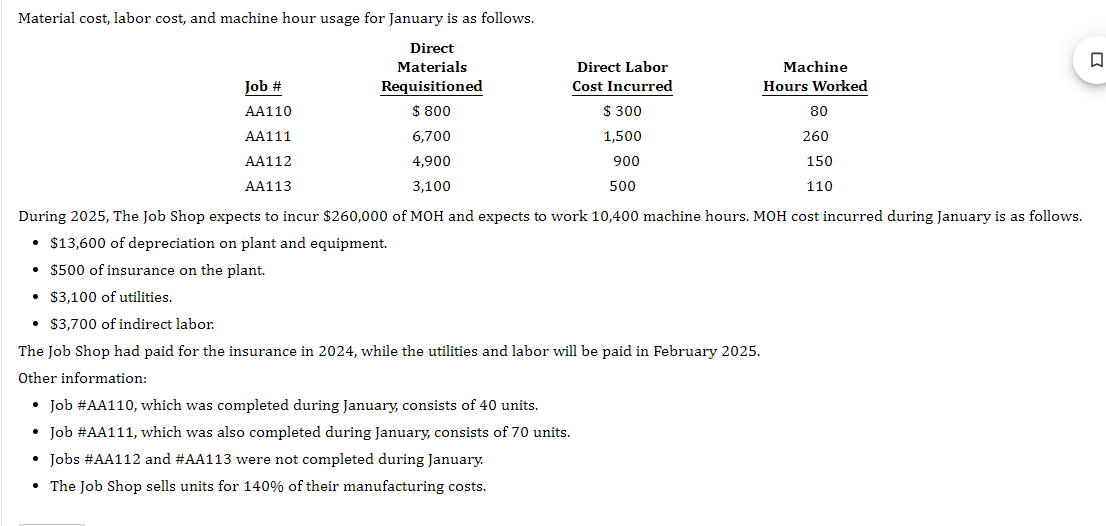

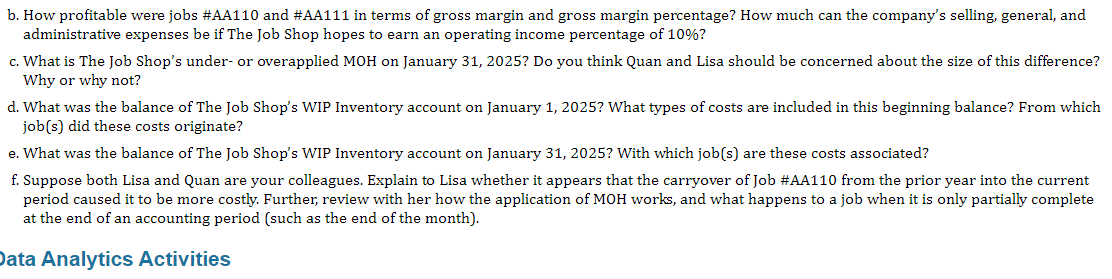

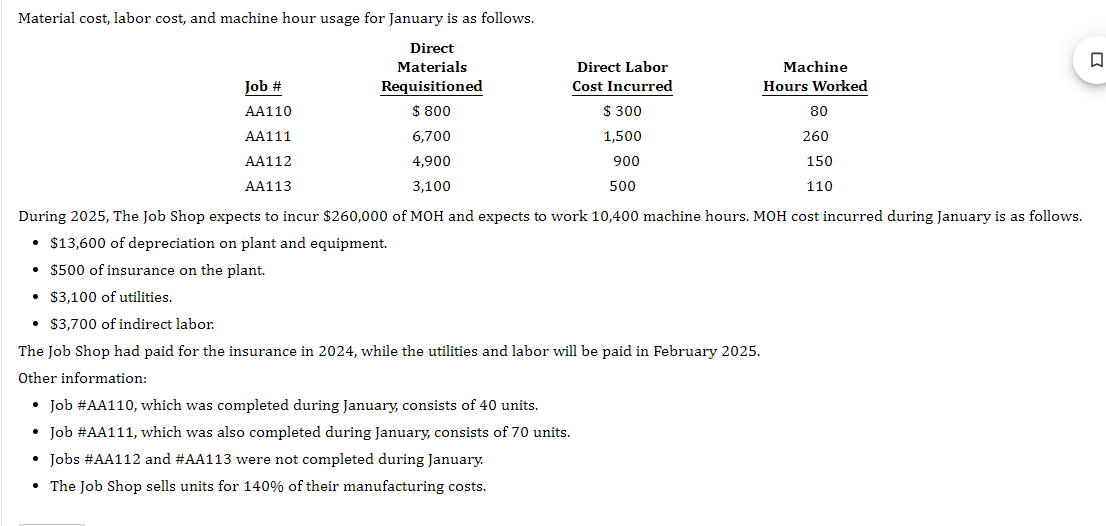

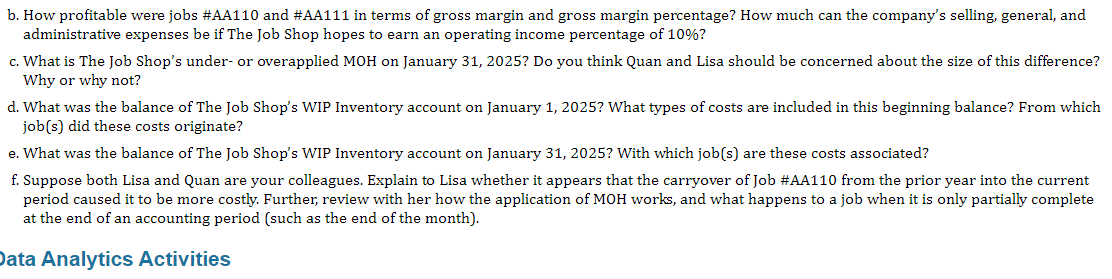

Material cost, labor cost, and machine hour usage for January is as follows. During 2025, The Job Shop expects to incur $260,000 of MOH and expects to work 10,400 machine hours. MOH cost incurred during January is as follows. - $13,600 of depreciation on plant and equipment. - $500 of insurance on the plant. - $3,100 of utilities. - $3,700 of indirect labor. The Job Shop had paid for the insurance in 2024, while the utilities and labor will be paid in February 2025. Other information: - Job #AA110, which was completed during January, consists of 40 units. - Job #AA111, which was also completed during January, consists of 70 units. - Jobs #AA112 and #AA113 were not completed during January. - The Job Shop sells units for 140% of their manufacturing costs. b. How profitable were jobs #AA110 and #AA111 in terms of gross margin and gross margin percentage? How much can the company's selling, general, and administrative expenses be if The Job Shop hopes to earn an operating income percentage of 10% ? c. What is The Job Shop's under- or overapplied MOH on January 31, 2025? Do you think Quan and Lisa should be concerned about the size of this difference? Why or why not? d. What was the balance of The Job Shop's WIP Inventory account on January 1, 2025? What types of costs are included in this beginning balance? From which job(s) did these costs originate? e. What was the balance of The Job Shop's WIP Inventory account on January 31, 2025? With which job(s) are these costs associated? f. Suppose both Lisa and Quan are your colleagues. Explain to Lisa whether it appears that the carryover of Job #AA110 from the prior year into the current period caused it to be more costly. Further, review with her how the application of MOH works, and what happens to a job when it is only partially complete at the end of an accounting period (such as the end of the month). Data Analytics Activities Material cost, labor cost, and machine hour usage for January is as follows. During 2025, The Job Shop expects to incur $260,000 of MOH and expects to work 10,400 machine hours. MOH cost incurred during January is as follows. - $13,600 of depreciation on plant and equipment. - $500 of insurance on the plant. - $3,100 of utilities. - $3,700 of indirect labor. The Job Shop had paid for the insurance in 2024, while the utilities and labor will be paid in February 2025. Other information: - Job #AA110, which was completed during January, consists of 40 units. - Job #AA111, which was also completed during January, consists of 70 units. - Jobs #AA112 and #AA113 were not completed during January. - The Job Shop sells units for 140% of their manufacturing costs. b. How profitable were jobs #AA110 and #AA111 in terms of gross margin and gross margin percentage? How much can the company's selling, general, and administrative expenses be if The Job Shop hopes to earn an operating income percentage of 10% ? c. What is The Job Shop's under- or overapplied MOH on January 31, 2025? Do you think Quan and Lisa should be concerned about the size of this difference? Why or why not? d. What was the balance of The Job Shop's WIP Inventory account on January 1, 2025? What types of costs are included in this beginning balance? From which job(s) did these costs originate? e. What was the balance of The Job Shop's WIP Inventory account on January 31, 2025? With which job(s) are these costs associated? f. Suppose both Lisa and Quan are your colleagues. Explain to Lisa whether it appears that the carryover of Job #AA110 from the prior year into the current period caused it to be more costly. Further, review with her how the application of MOH works, and what happens to a job when it is only partially complete at the end of an accounting period (such as the end of the month). Data Analytics Activities